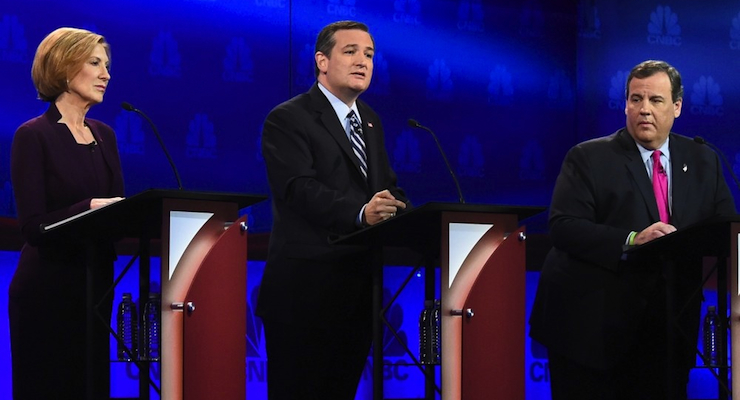

Texas Sen. Ted Cruz, center, delivers talking points on his new tax plan as Carly Fiorina, left, and Chris Christie, right, listen and participate in the Oct. 28, 2015, GOP debate hosted by CNBC in Boulder, Colo. (Photo: Robyn Beck, AFP/Getty Images)

Some honest statists understand and acknowledge that you can’t have bigger government unless you target middle-income taxpayers.

- The New York Times endorsed higher taxes on the middle class in 2010.

- The then-House Majority Leader Steny Hoyer also gave a green light that year to higher taxes on the middle class.

In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.

In 2012, MIT professor and former IMF official Simon Johnson argued that the middle class should pay more tax.- The Washington Post also called for higher taxes on the middle class a few years ago, as did Vice President Joe Biden’s former economist.

- A New York Times columnist also called for broad-based tax hikes on the middle class in 2012.

- A Senior Fellow from Demos also argued for higher taxes on all Americansthat year, specifically targeting the middle class.

- In 2013, the New York Times again (!) editorialized in favor of higher tax burdens on the middle class.

And why do all these statists want higher taxes on ordinary people?

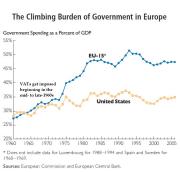

The answer is that they understand you can’t finance a giant welfare state unless there’s a huge increase in the tax burden on lower-income and middle-income taxpayers. Which is exactly what’s happened in Europe.

Of course, you don’t need to favor that outcome to predict (of fear) that it will happen. My opposition to tax hikes, for instance, is precisely because I don’t want America to have a Greek-style fiscal future.

It’s a simple matter of math. The income tax simply isn’t capable of generating enough revenue to fulfill the fantasies of folks like Hillary Clinton and Bernie Sanders.

Robert Samuelson, writing in the Washington Post, explains that the middle class will need to be targeted if politicians actually want to finance an ever-expanding welfare state.

Democrats retort that raising taxes on the rich will provide needed revenues to expand progressive government. …They obviate the need for middle-class tax increases to pay for government. …of Democrats’ faith in soaking the rich. …The trouble is that the math doesn’t match the rhetoric, as a new Brookings Institution study shows. In it, economists William Gale, Melissa Kearney and Peter Orszag asked this question: What would happen if the top income tax rate were increased from 39.6 percent to 50 percent? The answer — less than you think. …it would raise about $100 billion in tax revenues…, but it’s actually slightly less than a quarter of the $439 billion budget deficit for fiscal 2015. …Even if the $100 billion were directly distributed to the poorest fifth of Americans (an average $2,650 per household), the effect on overall inequality would be “exceedingly modest,” the authors say. …tax policies don’t come close to covering the real costs of government.

In other words, there aren’t enough rich people to finance big government, even if you somehow assume that huge tax hikes don’t have negative effects on taxable income (and the evidence from the 1980s shows that upper-income taxpayers have very strong responses to changes in tax rates).

So, given all this evidence, what’s Samuelson’s bottom line?

If middle-class Americans need or want bigger government, they will have to pay for it. Sooner or later, a tax increase is coming their way.

And he’s right.

Which makes it all the more puzzling that some good lawmakers want to give the other side a value-added tax. One of my colleagues at the Cato Institute, Chris Edwards, wrote a column on this topic for National Review. Here are some key excerpts.

Senators Ted Cruz and Rand Paul are strong advocates of limited government. …That is why their embrace of the value-added tax (VAT) in their presidential campaigns is so baffling. VATs are the revenue engine of big-government welfare states, not a proper funding source for the small federal government that both senators favor for America. …the candidates hide behind innocuous names — “business flat tax” for Cruz and “business transfer tax” for Paul.

But calling something a “business tax” doesn’t mean the burden is borne by businesses.

The tab for taxes collected from businesses is ultimately passed through to individuals in the form of lower wages, reduced dividends, or higher prices. …VATs have huge bases. That’s because — unlike income taxes — they do not allow businesses to deduct employee compensation when calculating the taxable amount. …The result would be that tax revenues from businesses under the Cruz and Paul VATs would be enormous.

In other words, the VAT is – among other things – a withholding tax on labor income. And that’s why this levy generates a huge amount of revenue. To make matters worse, this giant tax is hidden from voters.

Because Cruz and Paul shift much of the collection to businesses, more of the tax burden gets hidden from citizens and voters. …If the government is going to take our money, it should mug us on the street in broad daylight, rather than sneak into our homes at night and burglarize us unnoticed. The VAT would encourage more burglary.

And this hidden tax also will give statists an easy method of financing an ever-expanding burden of government spending

And this hidden tax also will give statists an easy method of financing an ever-expanding burden of government spending

Cruz and Paul want smaller government, but down the road, other politicians looking to shore up entitlement programs will say, “They could be financed with just a small tax increase on businesses.” But each “small” increase in the VAT rate would transfer huge amounts of additional cash from the private economy to the government.

Amen.

When I wrote about Sen. Cruz’s plan and Sen. Paul’s plan, I specifically pointed out that the VATs needed to be jettisoned.

But Chris makes an even stronger case. And he’s correct. Adopting a VAT would be a cataclysmic error for advocates of limited government. It would be a truly perverse tragedy if the other side eventually gets a VAT because well-meaning (but misguided) conservatives paved the way.

P.S. The left also is salivating for a broad-based energy tax.