Obtaining a student loan hasn’t been a real problem for students pursuing higher education, according to a new report from the Consumer Financial Protection Bureau. In fact, the most recent data suggest the U.S. economy is suffering from a saturation of the labor market by PhD-holders that are not — well — very productive, or cannot repay their debts.

The Dodd-Frank Wall Street Reform and Consumer Protection Act required the CFPB to submit an annual report that analyzes complaints submitted by consumers, most recently from October 1, 2013, through September 30, 2014. In that timeframe, the Bureau handled approximately 5,300 private student loan complaints, which represented an increase of approximately 38 percent compared to that of the previous year. Just 2 percent of those complainants cited “getting a loan” as their problem.

However, 57 percent cited “repaying my loan/dealing with my lender” and 41 percent said “problems when you are unable to pay/can’t repay my loan” in the report. That’s a frightening finding, considering the class of 2014 graduated with an average student loan debt of $33,000. Even if we adjusted for inflation using the government’s bogus numbers and methods, that’s still nearly double the amount borrowers had to pay back 20 years ago.

According to the CFPB, student loan debt has ballooned to nearly $1.5 trillion. With the U.S. national debt rapidly approaching $18 trillion, student loan debt now represents 6 percent of the wet debt-blanket over the economy. The amount of consumer debt from student loans is second only to mortgages, and the vast majority of student loans are backed by the U.S. government through banks like Sallie Mae, or since 2010, by the Department of Education.

Unfortunately, they are also representative of the majority of loans that debts holders say they cannot pay back, by far.

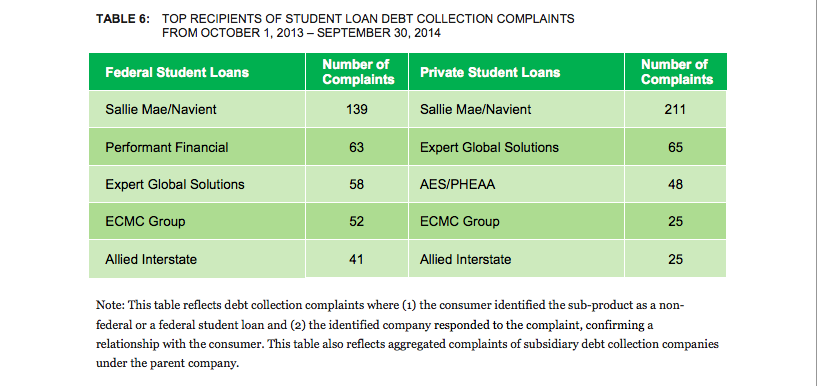

Source: CONSUMER FINANCIAL PROTECTION BUREAU

Defaults on such an enormous amount of student loan debt along with current levels of national debt would no doubt have grave consequences on the U.S. economy, including slower if any economic growth — hence fewer jobs — and rising interest rates that will ultimately make repayment on those debts very difficult and very expensive. As interest rates increase, as they are inevitably destined to do, particularly now that the Federal Reserve has decided to end its bond-buying, money-printing scheme known as QE3, the cost of that debt will increase to unknown levels.

Due to a bipartisan bill signed by President Obama last year, increases in interest rates will have a limited impact on student loans, though the overall impact is unclear and the bill obviously does nothing about the total debt. As the market climbs, most student loan rates will climb until they reach a cap of 8.25 percent. Still, under such pressure in a bad case scenario, liquidity will not be readily available and financial markets will once again freeze up.

What, exactly, is the return for the American taxpayer in terms of economic productivity and growth?

It has long been a cultural belief that advanced degrees lead to more opportunity. But, recently, it isn’t holding up to scrutiny. While it certainly doesn’t represent all college graduates, a recent paper published in the Journal of Economic Perspectives found PhD research conducted by some of those with the most expensive degrees is grossly lagging in productivity.

“If the objective of graduate training in top-ranked departments is to produce successful research economists, then these graduate programmes are largely failing,” says John P. Conley and Ali Sina Önder, the authors of the new report. “Our evidence shows that only the top 10–20 percent of a typical graduating class of economics PhD students are likely to accumulate a research record that might lead to tenure at a medium-level research university.”

“Perhaps the most striking finding from our data is that graduating from a top department is neither necessary nor sufficient for becoming a successful research economist.”

In other words, more money doesn’t necessarily translate into more opportunity, and there is little wonder why even those who possess advanced degrees are having a hard time paying back loans. Though the study focused solely on economists, the saturation of the U.S. labor market with expensive, advanced degrees is certainly not confined to PhD economists.

In America, as a result of a private-public partnership between unionized universities and the government, there are way too many PhDs produced each year juxtaposed to the lack of job openings. More than 100,000 doctoral degrees were shelled out in the United States between 2005 and 2009, but in the same period there were just 16,000 new professorships.

“What’s the point in killing yourself to be a productive researcher when finding an academic job is so hard?” the Economist asked.

That’s a good question, one which policy-makers should be asking. It’s also a question that I nor anyone else, including proponents of government-sponsored higher education-for-all, can answer in a positive manner that actually benefits the economy.

DebtNEUTRALITYPetition.com / November 12, 2014

This is why I started the Debt Neutrality Petition on Change dot org. http://www.debtneutralitypetition.com

/

Simon / May 18, 2015

Not all education is a good investment and the government pushing student loans has been unproductive. The tough question a student must ask will this degree get me a better paying job that justified the investment (in both time and money) and prevent me from the constant need to apply to 24/7 payday loans UK direct lenders. I suspect in many cases it does not, particularly for the non STEM fields. The real scandal is that student loan debt now exceeds millions dollars and now exceeds the total credit card debt. A failed public policy to push more debt on students and to make bad investments which do not help our country.

/