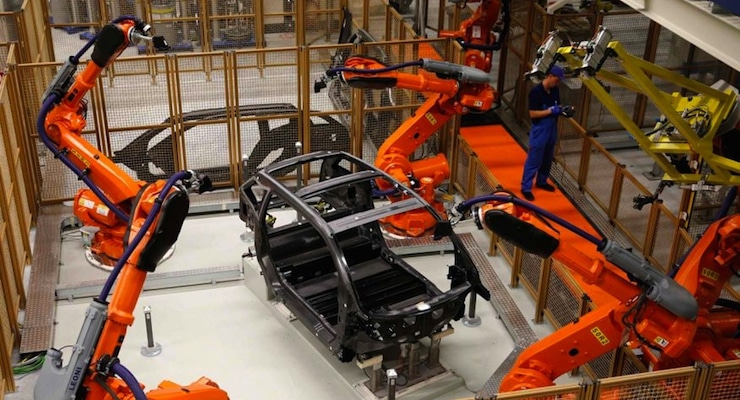

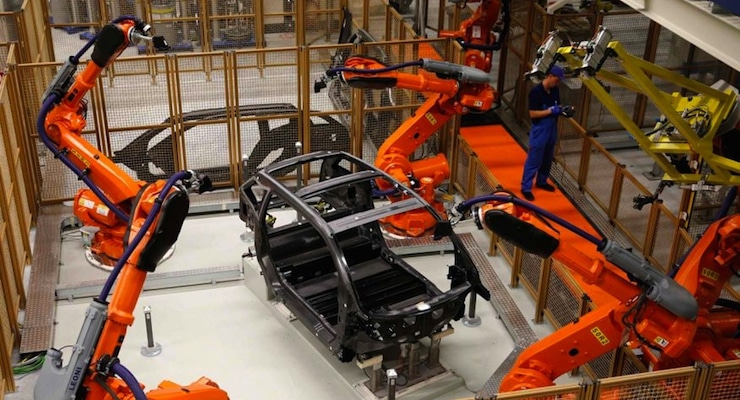

Auto manufacturing plant and worker in Midwest. (Photo: Reuters)

The Chicago Business Barometer, the Chicago PMI gauge of Midwest manufacturing activity, unexpectedly increased to 56.2 from 48.7 in September. The survey conducted by the Institute for Supply Management-Chicago came in at its highest level since January, though economists polled by The Wall Street Journal forecast a modest gain to 49.0.

Readings above 50 indicate expansion and readings below indicate contraction, which is where the Chicago PMI has been five times already this year. It also unexpectedly dropped below 50 last month.

“The disappointing September data look more like an aberration than the start of a trend, and the October results mark a good start to the final quarter of the year,” said Philip Uglow, Chief Economist of MNI Indicators. “Respondents were optimistic that orders will continue to pick-up, consistent with an acceleration in economic activity in Q4.“

However, the U.S. manufacturing sector as a whole has been struggling badly over the previous year. Recently reported regional and nationwide manufacturing data more than suggest manufacturing activity in the Midwest is the outlier, not the norm.

The New York Federal Reserve’s Empire State Manufacturing Survey remained stuck in contraction in October, declining for a third consecutive month, while the Philadelphia Federal Reserve said the Manufacturing Business Outlook Survey showed continued contraction in the mid-Atlantic region. The Commerce Department reported that durable goods orders fell 1.2% from the prior month, matching economists’ pessimistic estimates.

Business activity across the Midwest snapped back in October and rose to its best level since January after contracting last month, according to a report released Friday.

Production (+20 to 63.4) and new orders (+10 to 59.4) rebounded back into positive territory, but employment fell back to just above 50 in October, with demand for labor down significantly on a year-over-year basis. Some comments pointed to continued issues sourcing qualified workers. Firms also reported significant growth in inventories, which contributed in no small part to the bounce back in October. Order backlogs fell to 45.5, which is a bit concerning considering employment lags orders. Absent that result, there would be solid reason for optimism on future employment.