Washington, D.C. (PPD) — The Small Business Optimism Index dipped 1.8 points in July to 98.8 from 100.6, less than expected though near the historic average. Four of the 10 index components in the NFIB index improved, 5 declined and 1 was unchanged.

Forecasts ranged from a low of 97.0 to a high of 101.8. The consensus forecast was 100.0.

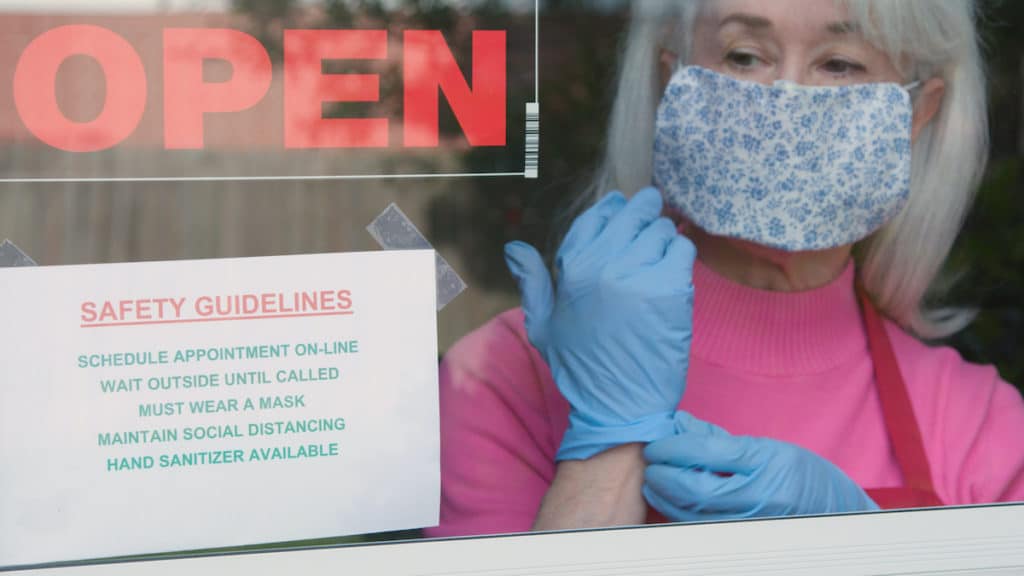

Small business owners lowered their six month outlook amid concerns the economy is not fully reopening quickly enough. The percentage expecting better business conditions in the next six months declined 14 points to a net 25%.

“This summer has been challenging for many small business owners who are working hard to keep their doors open and remain in business,” said NFIB’s Chief Economist Bill Dunkelberg. “Small business represents nearly half of the GDP and this month we saw a dip in optimism. There is still plenty of work to be done to get businesses back to pre-crisis numbers.”

The net for hiring plans over the next 3 months came in at a seasonally adjusted 18%, up 2 points from June and 17 percentage points higher than in April. However, too many workers have not yet returned to work.

The generous unemployment benefits provided by the CAREs Act only expired in July. Further, 21% cited “finding qualified labor” as their top business problem, with 37% being in construction.

The percentage of small business owners reporting capital outlays in the last six months rose 1 point to 49%. Of those, 33% reported spending on new equipment, 21% acquired vehicles, and 13% improved or expanded facilities. Another 5% acquired new buildings or land for expansion and 10% spent money for new fixtures and furniture. Twenty-six percent (26%) of owners are planning capital outlays in the next few months.

Only 3% of small business owners say their borrowing needs were not met and 35% reported all their credit needs were met. Fifty-one (51%) have no interest in a loan, while just 2% net reported it was harder to obtain a loan than previously.

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.