Following the latest unilateral move to delay ObamaCare, Republicans ramped up their calls to delay or repeal ObamaCare. The Obama administration announced Monday the ObamaCare employer mandate delay will only apply to some businesses, giving some employers a reprieve next year, while arbitrarily phasing in the mandate for others.

The administration had already delayed the implementation of the so-called employer mandate by a year, initially pushing the requirements off until 2015, suspiciously past the midterm elections. Now, the Treasury Department announced Monday that the administration would not enforce the rules across the board next year.

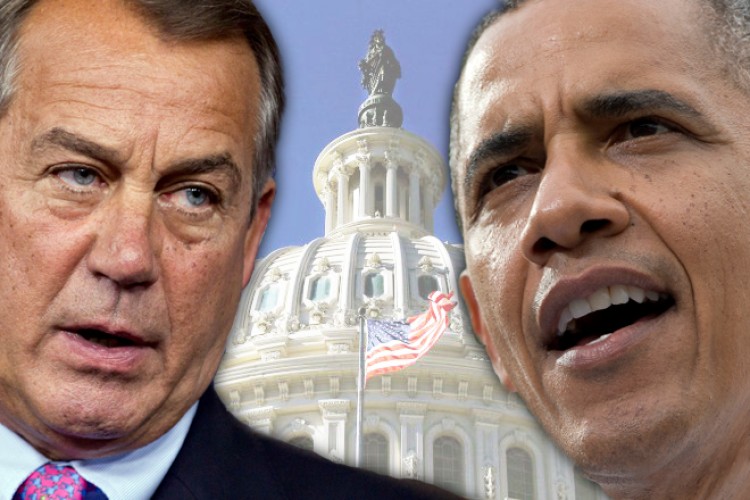

“Once again, the president is giving a break to corporations while individuals and families are still stuck under the mandates of his health care law. And, once again, the president is rewriting law on a whim,” House Speaker John Boehner said in a statement. “If the administration doesn’t believe employers can manage the burden of the law, how can struggling families be expected to?”

Senator and physician John Barrasso (R-WY), said the announcement Monday provides “further evidence that the health care law is hurting the economy.”

Because of the delay the administration has decided to — once again — unilaterally change the law to allow employers with 50 to 99 employees avoid the ObamaCare employer mandate requirement in 2015. They will still be required to report on how many workers are covered, but will have until 2016 — after the midterm elections — before being required to cover full-time staff or pay a penalty. Americans, however, would still be required to obtain health insurance through the individual mandate, or the rule that forces each citizen to purchase health insurance.

Under the new changes to the law, employers with 100 or more workers will be required to provide health insurance to full-time staff next year. But the new rules will only require them to immediately cover 70 percent of workers, and then 95 percent the following year and all those thereafter.

Per the prior delay, companies with fewer than 50 employees will not be required to provide health coverage.

The administration claims they are suddenly reversing their stance on businesses who have been voicing their concerns over the damage ObamaCare rules will have on the economy. However, the change is another example of the flawed implementation and, in fact, the design of the law. Fewer workers getting insurance through their employers could mean more individuals on the ObamaCare exchanges seeking subsidized coverage, increasing the cost to taxpayers.

Further, as shown by the latest Congressional Budget Office, will destroy over 2.3 million jobs by incentivizing millions not to work, a grim economic policy reality, which has forced Democrats to create a new word “job-lock” to explain.

But what the administration cannot seem to grasp, however, which is what lawmakers have been saying all along, the mere threat of the employer mandate is causing many companies to cut full-time workers in the hope of keeping their staff size below 50 to avoid being subject to the requirement.

Administration officials can claim that this is not happening on a large-scale, but the jobs reports over the last three years suggest otherwise, with the latest claiming it will take 6 years to return to pre-recession job market levels.

Treasury officials said Monday that businesses will be told to “certify” that they are not cutting full-time workers simply to avoid the mandate. Employers will be told to sign a “self-attestation” on their tax forms affirming this, under penalty of perjury.

Officials stressed that the latest ObamaCare employer mandate delay only applies to a relatively small percentage of employers, an echo of a tactic that includes minimizing the lives’ of Americans, though these companies employ millions of workers. It’s all relative to the administration.

Barrasso joined Sen. Tom Coburn (R-OK), and other Republican lawmakers in writing a letter to IRS Commissioner John Koskinen on Monday asking about the enforcement of the individual mandate, addressing all the other changes to the law’s implementation.

“Given a number of last-minute administrative ‘adjustments’ made by the Administration, there is some understandable confusion and concern about the enforcement of the individual mandate tax,” they wrote. “With the Administration’s decision to waive, delay, or unilaterally alter some provisions of the law-including the employer mandate tax on businesses-taxpayers deserve clarification on how the agency intends to enforce the individual mandate tax.”

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.