I have a very mixed view of the Committee for a Responsible Federal Budget, which is an organization representing self-styled deficit hawks in Washington. They do careful work and I always feel confident about citing their numbers.

Yet, I frequently get frustrated because they seem to think that tax increases have to be part of any budget deal, regardless of the evidence that such an approach will backfire. So, when CRFB published a “Fiscal FactChecker” to debunk 16 supposed budget myths that they expect during this campaign season, I knew I’d find lots of stuff I would like…and lots of stuff I wouldn’t like. Let’s look at what they said were myths, along with my two cents on CRFB’s analysis.

Myth #1: We Can Continue Borrowing without Consequences

Reality check: CRFB’s view is largely correct. If we leave policy on autopilot, demographic changes and poorly structured entitlement programs will lead to an ever-rising burden of government spending, which almost surely will mean ever-rising levels of government debt (as well as ever-rising tax burdens).  At some point, this will lead to serious consequences, presumably bad monetary policy (i.e., printing money to finance the budget) and/or Greek-style crisis (investors no longer buying bonds because they don’t trust the government will pay them back).

At some point, this will lead to serious consequences, presumably bad monetary policy (i.e., printing money to finance the budget) and/or Greek-style crisis (investors no longer buying bonds because they don’t trust the government will pay them back).

The only reason I don’t fully agree with CRFB is that we could permanently borrow without consequence if the debt grew 1 percent per year while the economy grew 3 percent per year. Unfortunately, given the “new normal” of weak growth, that’s not a realistic scenario.

Myth #2: With Deficits Falling, Our Debt Problems are Behind Us

Reality check: The folks at CRFB are right. Annual deficits have dropped to about $500 billion after peaking above $1 trillion during Obama’s first term, but that’s just the calm before the storm. As already noted, demographics and entitlements are a baked-into-the-cake recipe for a bigger burden of government and more red ink.

That being said, I think that CRFB’s focus is misplaced. They fixate on debt, which is the symptom, when they should be more concerned with reducing excessive government, which is the underlying disease.

Myth #3: There is No Harm in Waiting to Solve Our Debt Problems

Reality check: We have a spending problem. Deficits and debt are merely symptoms of that problem. But other than this chronic mistake, CRFB is right that it is far better to address our fiscal challenges sooner rather than later.

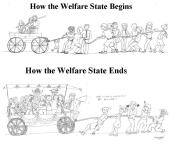

CRFB offers some good analysis of why it’s easier to solve the problem by acting quickly, but this isn’t just about math. It’s also important to impose some sort of spending restraint before a majority of the voting-age population has been lured into some form of government dependency. Once you get to the point when more people are riding in the wagon than pulling the wagon(think Greece), reform becomes almost impossible.

It’s also important to impose some sort of spending restraint before a majority of the voting-age population has been lured into some form of government dependency. Once you get to the point when more people are riding in the wagon than pulling the wagon(think Greece), reform becomes almost impossible.

Myth #4: Deficit Reduction is Code for Austerity, Which Will Harm the Economy

Reality check: The folks at CRFB list this as a myth, but they actually agree with the assertion, stating that deficit reduction policies “have damaged economic performance and increased unemployment.” They even seem sympathetic to “modest increases to near-term deficits by replacing short-term ‘sequester’ cuts”, which would gut this century’s biggest victory for good fiscal policy!

There are two reasons for CRFB’s confusion. First, they seem to accept the Keynesian argument about bigger government and red ink boosting growth, notwithstanding all the evidence to the contrary. Second, they fail to distinguish between good austerity and bad austerity. If austerity means higher taxes, as has been the case so often in Europe, then it is unambiguously bad for growth. But if it means spending restraint (or even actual spending cuts), then it is clearly good for growth. There may be some short-term disruption since resources don’t instantaneously get reallocated, but the long-term benefits are enormous because labor and capital are used more productively in the private economy.

Myth #5: Tax Cuts Pay For Themselves

Reality check: I agree with the folks at CRFB. As a general rule, tax cuts will reduce government revenue, even after measuring possible pro-growth effects that lead to higher levels of taxable income.

But it’s also important to recognize that not all tax cuts are created equal. Some tax cuts have very large “supply-side” effects, particularly once the economy has a chance to adjust in response to better policy.  So a lower capital gains tax or a repeal of the death tax, to cite a couple of examples, might increase revenue in the long run. And we definitely saw a huge response when Reagan lowered top tax rates in the 1980s. But other tax cuts, such as expanded child credits, presumably generate almost no pro-growth effects because there’s no change in the relative price of productive behavior.

So a lower capital gains tax or a repeal of the death tax, to cite a couple of examples, might increase revenue in the long run. And we definitely saw a huge response when Reagan lowered top tax rates in the 1980s. But other tax cuts, such as expanded child credits, presumably generate almost no pro-growth effects because there’s no change in the relative price of productive behavior.

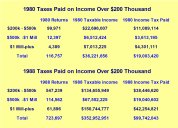

Myth #6: We Can Fix the Debt Solely by Taxing the Top 1%

Reality check: The CRFB report correctly points out that confiscatory tax rates on upper-income taxpayers would backfire for the simple reason that rich people would simply choose to earn and report less income. And they didn’t even include the indirect economic damage (and reductions in taxable income) caused by less saving, investment, and entrepreneurship.

Ironically, the CRFB folks seem to recognize that tax rates beyond a certain level would result in less revenue for government. Which implies, of course, that it is possible (notwithstanding what they said in Myth #5) for some tax cuts to pay for themselves.

Myth #7: We Can Lower Tax Rates by Closing a Few Egregious Loopholes

Reality check: It depends on the definition of “egregious.” In the CRFB report, they equate “egregious” with “unpopular” in order to justify their argument.

But if we define “egregious” to mean “economically foolish and misguided,” then there are lots of preferences in the tax code that could – and should – be abolished in order to finance much lower tax rates. Including the healthcare exclusion, the mortgage interest deduction, the charitable giving deduction, and (especially) the deduction for state and local taxes.

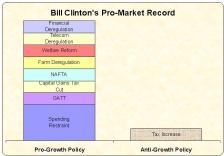

Myth #8: Any Tax Increases Will Cripple Economic Growth

Reality check: The CRFB folks are right. A small tax increase obviously won’t “cripple” economic growth. Indeed, it’s even possible that a tax increase might lead to more growth if it was combined with pro-growth policies in other areas.  Heck, that’s exactly what happened during the Clinton years. But now let’s inject some reality into the conversation. Any non-trivial tax increase on productive behavior will have some negative impact on economic performance and competitiveness. The evidence is overwhelming that higher tax rates hurt growth and the evidence is also overwhelming that more double taxation will harm the economy.

Heck, that’s exactly what happened during the Clinton years. But now let’s inject some reality into the conversation. Any non-trivial tax increase on productive behavior will have some negative impact on economic performance and competitiveness. The evidence is overwhelming that higher tax rates hurt growth and the evidence is also overwhelming that more double taxation will harm the economy.

The CRFB report suggests that the harm of tax hikes could be offset by the supposed pro-growth impact of a lower budget deficit, but the evidence for that proposition if very shaky. Moreover, there’s a substantial amount of real-world data showing that tax increases worsen fiscal balance. Simply stated, tax hikes don’t augment spending restraint, they undermine spending restraint. Which may be why the only “bipartisan” budget deal that actually led to a balanced budget was the one that lowered taxes instead of raising them.

Myth #9: Medicare and Social Security Are Earned Benefits and Should Not Be Touched

Reality check: CRFB is completely correct on this one. The theory of age-related “social insurance” programs such as Medicare and Social Security is that people pay into the programs while young and then get benefits when they are old. This is why they are called “earned benefits.”

The problem is that politicians don’t like asking people to pay and they do like giving people benefits, so the programs are poorly designed. The average Medicare recipient, for instance, costs taxpayers $3 for every $1 that recipient paid into the program. Social Security isn’t that lopsided, but the program desperately needs reform because of demographic change. But the reforms shouldn’t be driven solely by budget considerations, which could lead to trapping people in poorly designed entitlement schemes. We need genuine structural reform.

Myth #10: Repealing “Obamacare” Will Fix the Debt

Reality check: Obamacare is a very costly piece of legislation that increased the burden of government spending and made the tax system more onerous. Repealing the law would dramatically improve fiscal policy.

But CRFB, because of the aforementioned misplaced fixation on red ink, doesn’t have a big problem with Obamacare because the increase in taxes and the increase in spending are roughly equivalent. So the organization is technically correct that repealing the law won’t “fix the debt.” But it would help address America’s real fiscal problem, which is a bloated and costly public sector.

Myth #11: The Health Care Cost Problem is Solved

Reality check: CRFB’s analysis is correct, though it would have been nice to see some discussion of how third-party payer is the problem.

Myth #12: Social Security’s Shortfall Can be Closed Simply by Raising Taxes on or Means-Testing Benefits for the Wealthy

Reality check: To their credit, CRFB is basically arguing against President Obama’s scheme to impose Social Security payroll taxes on all labor income, which would turn the program from a social-insurance system into a pure income-redistribution scheme.

On paper, such a system actually could eliminate the vast majority of Social Security’s giant unfunded liability. In reality, this would mean a huge increase in marginal tax rates on investors, entrepreneurs, and small business owners, which would have a serious adverse economic impact.

Myth #13: We Can Solve Our Debt Situation by Cutting Waste, Fraud, Abuse, Earmarks, and/or Foreign Aid

Reality check: Earmarks (which have been substantially curtailed already) and foreign aid are a relatively small share of the budget, so CRFB is right that getting rid of that spending won’t have a big impact. But what about the larger question. Could our fiscal mess (which is a spending problem, not a “debt situation”) be fixed by eliminating waste, fraud, and abuse?

It depends on how one defines “waste, fraud, and abuse.” If one uses a very narrow definition, such as technical malfeasance, then waste, fraud, and abuse might “only” amount to a couple of hundred billions dollars per year. But from an economic perspective (i.e., grossly inefficient misallocation of resources), then entire federal departments such as HUD, Education,Transportation, Agriculture, etc, should be classified as waste, fraud, and abuse.

Myth #14: We Can Grow Our Way Out of Debt

Reality check: CRFB is correct that faster growth won’t solve all of our fiscal problems. Unless one makes an untenable assumption that economic growth will be faster than the projected growth of entitlement spending. And even that kind of heroic assumption would be untenable since faster growth generally obligates the government to pay higher benefits in the future.

Reality check: CRFB is correct that faster growth won’t solve all of our fiscal problems. Unless one makes an untenable assumption that economic growth will be faster than the projected growth of entitlement spending. And even that kind of heroic assumption would be untenable since faster growth generally obligates the government to pay higher benefits in the future.

Myth #15: A Balanced Budget Amendment is All We Need to Fix the Debt

Reality check: CRFB accurately explains that a BBA is simply an obstacle to additional debt. Politicians still would be obliged to change laws to fulfill that requirement. But that analysis misses the point. A BBA focuses on red ink, whereas the real problem is that government is too big and growing too fast. State balanced-budget requirement haven’t stopped states like California andIllinois from serious fiscal imbalances and eroding competitiveness. The so-called Maastricht anti-deficit and anti-debt rules in the European Union haven’t stopped nations such as France and Greece from fiscal chaos.

This is why the real solution is to have some sort of enforceable cap on government spending. That approach has worked well in jurisdictions such as Switzerland, Hong Kong, and Colorado. And even research from the IMF (a bureaucracy that shares CRFB’s misplaced fixation on debt) has concluded that expenditure limits are the only effective fiscal rules.

Myth #16: We Can Fix the Debt Solely by Cutting Welfare Spending

Reality check: The federal government is spending about $1 trillion this year on means-tested (i.e., anti-poverty) programs, which is about one-fourth of total outlays, so getting Washington out of the business of income redistribution would substantially lower the burden of federal spending (somewhat offset, to be sure, by increases in state and local spending). And for those who fixate on red ink, that would turn today’s $500 billion deficit into a $500 billion surplus.

That being said, there would still be a big long-run problem caused by other federal programs, most notably Social Security and Medicare. So CRFB is correct in that dealing with welfare-related spending doesn’t fully solve the long-run problem, regardless of whether you focus on the problem of spending or the symptom of borrowing.

This has been a lengthy post, so let’s have a very simple summary.

We know that modest spending restraint can quickly balance the budget. We also know lots of nations that have made rapid progress with modest amounts of spending restraint. And we know that the tax-hike option simply leads to more spending. So, the only question to answer is why the CRFB crowd can’t put two and two together and get four?