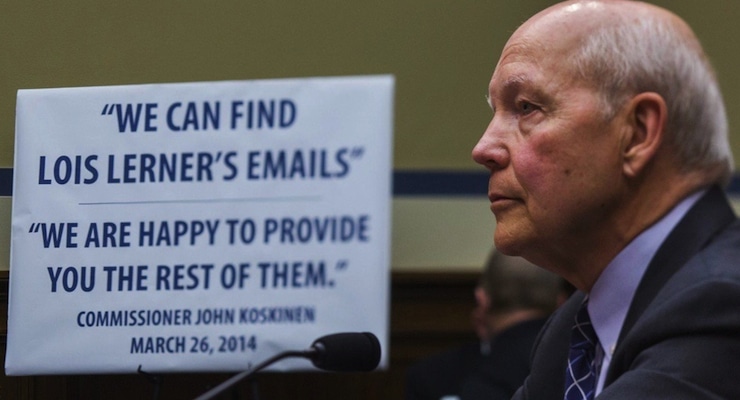

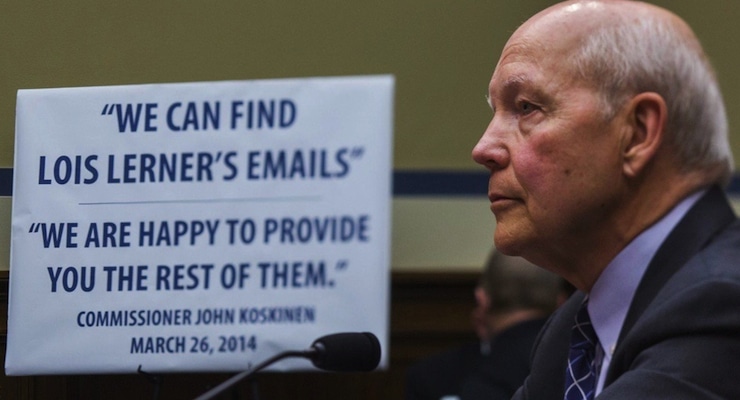

File Photo: IRS Commissioner John Koskinen testifies on Capitol Hill in June 2014 during what became a contentious hearing on the “lost” Lois Lerner emails.

When someone says “IRS,” my Pavlovian response is “flat tax.” That’s because I’m a policy wonk and I’d like to replace our punitive internal revenue code with something simple and fair that doesn’t do nearly as much damage to our economy.

And it’s a fringe benefit that real tax reform would substantially de-fang the IRS.

But I’m also a big believer in the rule of law and a big opponent of capricious government power, so I’m also interested in curtailing the power of the IRS even if we don’t get a chance to fix the tax code. I’ve previously commented on the unseemly and corrupt behavior of the IRS, and there’s no question the bureaucracy’s actions have been despicable.

But is it so bad that the IRS Commissioner deserves to be impeached? Let’s look at pro and con arguments. Here’s some of what Bloomberg’s Al Hunt wrote about the controversy. He’s obviously a defender of the current Commissioner.

The specifics of any supposed impeachable offenses are vague. Koskinen, 76, is a respected, successful business and government executive who, at the behest of the White House, took on the job of cleaning up the beleaguered tax agency in December 2013, after offenses had been committed. …The accusations stem from 2013, when the IRS’s tax-exempt division was found to have disproportionately targeted conservative groups for scrutiny. Although Koskinen was brought in after the damage had been done, …Some, rather recklessly, accuse him of lying. …The specific charges seem specious: There may have been miscommunication, but there is no evidence of wrongdoing by Koskinen. …The pre-Koskinen abuses by the IRS’s tax-exempt division have been the subject of three inquiries… All were critical of IRS mismanagement, but none found any evidence of illegal activities or political direction from on high.

George Will is not so sanguine about Koskinen’s role. Here are excerpts from his column in the Washington Post.

Federal officials can be impeached for dereliction of duty (as in Koskinen’s failure to disclose the disappearance of e-mails germane to a congressional investigation); for failure to comply (as in Koskinen’s noncompliance with a preservation order pertaining to an investigation); and for breach of trust (as in Koskinen’s refusal to testify accurately and keep promises made to Congress). …After Koskinen complained about the high cost in time and money involved in the search, employees at a West Virginia data center told a Treasury Department official that no one asked for backup tapes of Lerner’s e-mails. Subpoenaed documents, including 422 tapes potentially containing 24,000 Lerner e-mails, were destroyed. For four months, Koskinen kept from Congress information about Lerner’s elusive e-mails. He testified under oath that he had “confirmed” that none of the tapes could be recovered. …Koskinen’s obfuscating testimonies have impeded investigation of unsavory practices, including the IRS’s sharing, potentially in violation of tax privacy laws, up to 1.25 million pages of confidential tax documents. …Koskinen consistently mischaracterized the Government Accountability Office report on IRS practices pertaining to IRS audits of tax-exempt status to groups.

These charges don’t seem (as Hunt asserted) to be “specious.” That doesn’t mean, by the way, that there aren’t good (or at least adequate) responses to these accusations. And perhaps Koskinen didn’t technically commit perjury. Maybe he simply engaged in some Clintonian parsing and misdirection.

So I’ll be the first to admit that it’s unclear whether Koskinen deserves to be impeached. But I’ll also be the first to argue that the IRS is a rogue bureaucracy that needs to slapped down. That’s why it deserves budget cuts rather than the increases favored by the White House. And Lois Lerner almost certainly should be in jail. Beyond that, I’m open to ideas on how to discourage the tax collectors from engaging in rampant misbehavior.

Just in case you think I’m exaggerating, here’s a list.

- The IRS goes beyond the law to make the system worse, as we saw when it imposed a regulation that forced U.S. banks to put foreign tax law above American tax law.

- Bureaucrats at the IRS then decided to ignore the text of the FATCA legislation and make up a different enforcement mechanism in order to salvage an unworkable and destructive law.

- Moreover, the IRS disregarded legislative text and arbitrarily rewrote the Obamacare legislation to enable additional subsidies.

- This is the bureaucracy that – in an odious display of bias – interfered with the electoral process by targeting the President’s opponents. And then awarded bonuses to itself after this corrupt behavior!

- The IRS also is one of the worst offenders in the government’s asset-forfeiture racket, which arbitrarily steals money from law-abiding citizens.

- The tax-collection bureaucracy has violated its own rules as part of a discriminatory and arbitrary persecution of Microsoft.

- While the IRS slaps harsh penalties and interest payments on taxpayers who make inadvertent errors, the agency is seemingly incapable of preventing massive fraud against taxpayers, routinely sending checks to crooks and con artists milking the system for EITC payments and false refunds.

- And the IRS (with help from negligent courts) routinely violates legal protections and civil liberties of American citizens.

These horror stories provide plenty of evidence that the internal revenue service should have its wings clipped.