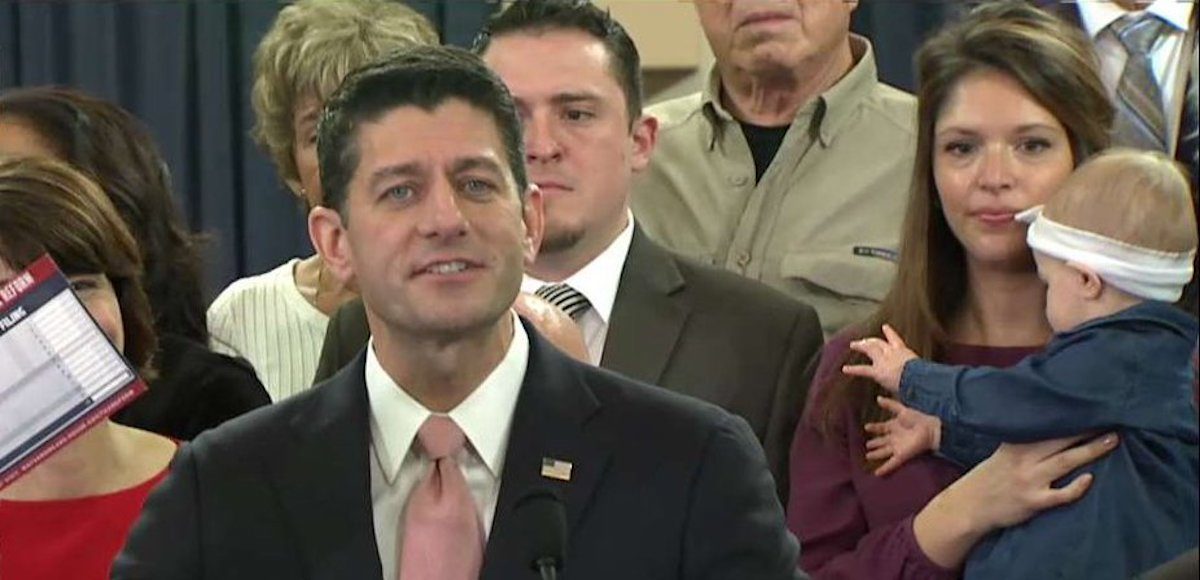

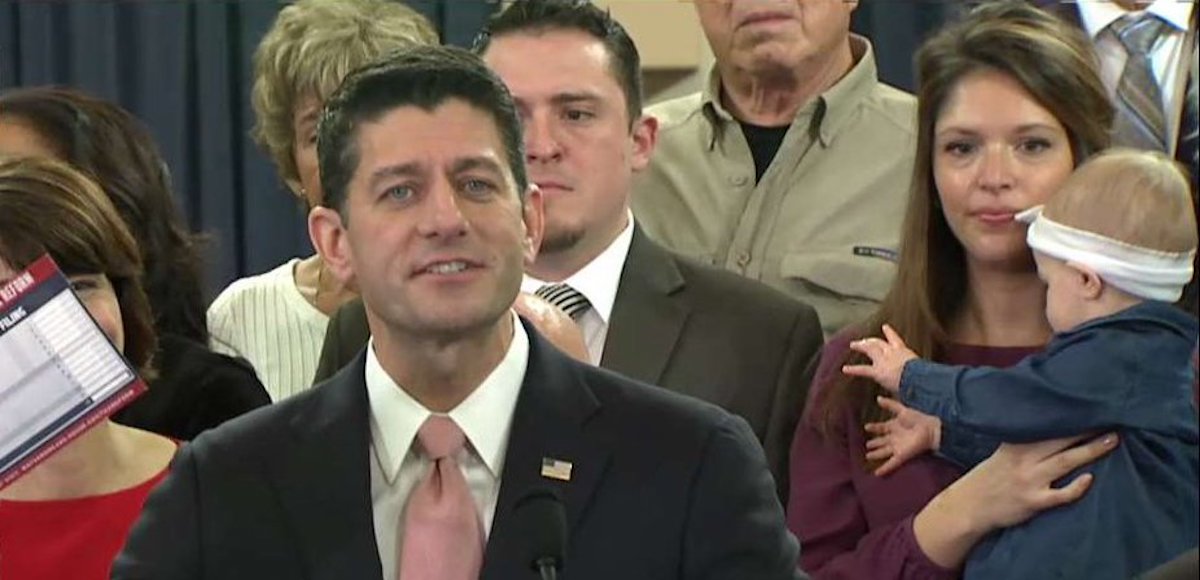

House Speaker Paul Ryan, R-Wis., holds up a post card form during the introduction of the Republican tax reform plan, dubbed the “Tax Cuts and Jobs Act,” on Thursday November 2, 2017.

House Republicans on Thursday introduced their highly-anticipated tax reform plan dubbed the Tax Cuts and Jobs Act, which will cut rates for working Americans, simplifies the tax code and preserves the popular 401K retirement account deduction.

“With this plan, the typical family of 4 will save $1182 a year on their taxes,” Speaker Ryan said. “It covers your family’s phone bill for the year, pay down your debt, put money away from college. With this plan, we are getting rid of loopholes for special interest and we are leveling the playing field. We’re making things so simple, that you can do your taxes on a form the size of a postcard.”

Roughly 90% of Americans will be able to take advantage of the post card filing Speaker Ryan mentioned, while the Tax Cuts and Jobs Act increases the child tax credit to $1,600 from $1,000. The $4,050 per child exemption would be repealed, while it limits the deductibility of local property taxes to $10,000 and eliminates the the deduction for state income taxes.

“That’s your money,” Rep. Kevin Brady, R-Calif., said. “You earned it. You deserve to keep it.”

It would also reduce the cap for the mortgages interest deduction to $500,000 for newly purchased homes, down from the current cap of $1 million. The unpopular death tax will also be repealed and the corporate tax rate will be cut to 20% to ensure American companies can compete in the global marketplace, and lowers individual rates to 0%, 12%, 25% and 35%.

The 39.6% rate for the highest earners is maintained.

“Repealing the death tax is incredibly important to me because it’s the most unfair tax in our tax code,” Rep. Kristi Noem, R-S.D., said.

The House Ways and Means Committee is slated to consider the Tax Cuts and Jobs Act next week.

“We are going to make our economy boom,” Rep. Kathy Morris, R-Wa., added. “Our plan is pro-family and it’s pro-economic growth.”

President Donald Trump has stressed to Republican leaders on Capitol Hill that he wants to see the bill on his desk to become law before Christmas.

“Every single American is going to keep more of what they earn,” House Majority Leader Kevin McCarthy, R-Calif., said. “Even before this tax reform plan goes into effect, I believe we are going to begin to see businesses start to come back. This is about America First and this is about the future.”

Republicans need a big legislative win in order to justify their majority before the 2018 midterm elections. Thus far, they’ve failed to make good on their 7-year promise to repeal ObamaCare and more than 200 bills that passed in the House have stalled in the U.S. Senate.

“We’re going to get this done – you know why?” Speaker Ryan asked. “Because the American people are counting on us.”