Every so often, I’ll assert that some statists are so consumed by envy and spite that they favor high tax rates on the “rich” even if the net effect (because of diminished economic output) is less revenue for government.

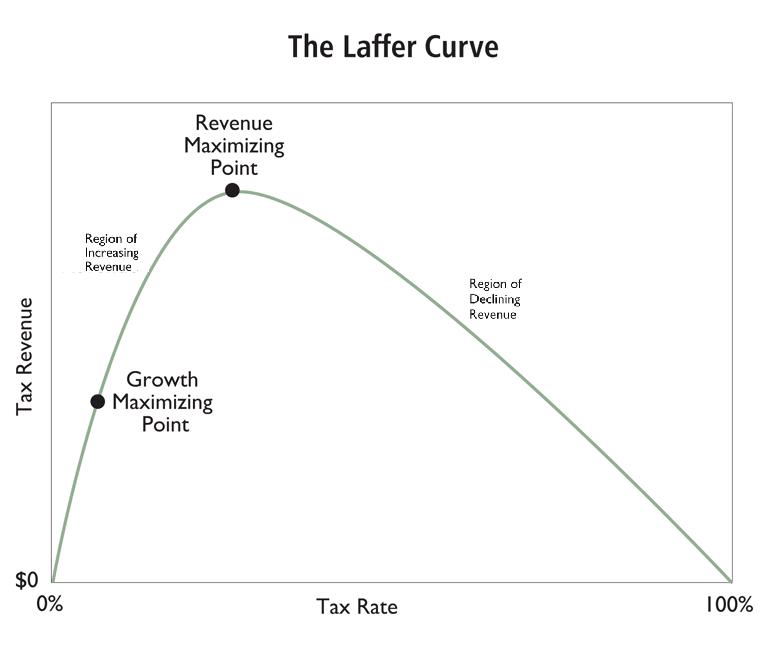

In other words, they deliberately and openly want to be on the right side (which is definitely the wrong side) of the Laffer Curve.

Critics sometimes accuse me of misrepresenting the left’s ideology, to which I respond by pointing to a poll of left-wing voters who strongly favored soak-the-rich tax hikes even if there was no extra tax collected.

But now I have an even better example.

Writing for Vox, Matthew Yglesias openly argues that we should be on the downward-sloping portion of the Laffer Curve. Just in case you think I’m exaggerating, “the case for confiscatory taxation” is part of the title for his article.

Here’s some of what he wrote.

Maybe at least some taxes should be really high. Maybe even really really high. So high as to make them useless for revenue-raising purposes — but powerful for achieving other ends. We already accept this principle for tobacco taxes. If all we wanted to do was raise revenue, we might want to slightly cut cigarette taxes. …But we don’t do that because we care about public health. We tax tobacco not to make money but to discourage smoking.

The tobacco tax analogy is very appropriate.

Indeed, one of my favorite arguments is to point out that we have high taxes on cigarettes precisely because politicians want to discourage smoking.

As a good libertarian, I then point out that government shouldn’t be trying to control our private lives, but my bigger point is that the economic arguments about taxes and smoking are the same as those involving taxes on work, saving, investment.

Needless to say, I want people to understand that high tax rates are a penalty, and it’s particularly foolish to impose penalties on productive behavior.

But not according to Matt. He specifically argues for ultra-high tax rates as a “deterrence” to high levels of income.

If we take seriously the idea that endlessly growing inequality can have a cancerous effect on our democracy, we should consider it for top incomes as well. …apply the same principle of taxation-as-deterrence to very high levels of income. …Imagine a world in which we…imposed a 90 percent marginal tax rate on salaries above $10 million. This seems unlikely to raise substantial amounts of revenue.

I suppose we should give him credit for admitting that high tax rates won’t generate revenue. Which means he’s more honest than some of his fellow statistswho want us to believe confiscatory tax rates will produce more money.

But honesty isn’t the same as wisdom.

Let’s look at the economic consequences. Yglesias does admit that there might be some behavioral effects because upper-income taxpayers will be discouraged from earning and reporting income.

Maybe…we really would see a reduction of effort, or at least a relaxation of the intensity with which the performers pursue money. But would that be so bad? Imagine the very best hedge fund managers and law firm partners became inclined to quit the field a bit sooner and devote their time to hobbies. What would we lose, as a society? …some would presumably just move to Switzerland or the Cayman Islands to avoid taxes. That would be a real hit to local economies, but hardly a disaster. …Very high taxation of labor income would mean fewer huge compensation packages, not more revenue. Precisely as Laffer pointed out decades ago, imposing a 90 percent tax rate on something is not really a way to tax it at all — it’s a way to make sure it doesn’t happen.

While I suppose it’s good that Yglesias admits that high tax rates have behavioral effects, he clearly underestimates the damaging impact of such a policy.

He presumably doesn’t understand that rich people earn very large shares of their income from business and investment sources. As such, they have considerable ability to alter the timing, level, and composition of their earnings.

But my biggest problem with Yglesias’ proposals is that he seems to believe in the fixed-pie fallacy that public policy doesn’t have any meaningful impact of economic performance. This leads him to conclude that it’s okay to rape and pillage the “rich” since that will simply mean more income and wealth is available for the rest of us.

That’s utter nonsense. The economy is not a fixed pie and there is overwhelming evidence that nations with better policy grow faster and create more prosperity.

In other words, confiscatory taxation will have a negative effect on everyone, not just upper-income taxpayers.

There will be less saving and investment, which translates into lower wages and salaries for ordinary workers.

And as we saw in France, high tax rates drive out highly productive people, and we have good evidence that “super-entrepreneurs” and inventors are quite sensitive to tax policy.

To be fair, I imagine that Yglesias would try to argue that these negative effects are somehow offset by benefits that somehow materialize when there’s more equality of income.

But the only study I’ve seen that tries to make a connection between growth and equality was from the OECD and that report was justly ridiculed for horrible methodology (not to mention that it’s hard to take serious a study that lists France, Spain, and Ireland as success stories).

P.S. This is my favorite bit of real-world evidence showing why there should be low tax rates on the rich (in addition, of course, to low tax rates on the rest of us).

P.P.S. And don’t forget that leftists generally view higher taxes on the rich as a precursor to higher taxes on the rest of the population.

P.P.P.S. In the interests of full disclosure, Yglesias says I’m insane and irrational.

[mybooktable book=”global-tax-revolution-the-rise-of-tax-competition-and-the-battle-to-defend-it” display=”summary” buybutton_shadowbox=”true”]

JIm Huffman / June 10, 2015

This guy’s full of it. And you know what is.

/

Mark Curran / November 6, 2019

Didn’t Mitchell push Fairtax fraud for a time, too, or at least acted as if it was rational.

His supposed Flat tax is as goofy if not more so.

At least Fairtax has fine print and math equations — tricky as hell, meant do deceive, and it does that.

But Fairtax hustlers at least put it out, and you can see it, and find the fraud if you can read carefully and decode the hilarious math equations.

But the flat tax won’t even put out those kinds of details, false or not, no actual legislation to pick apart.

The flat tax is about as flat as pike peak. The real focus of this flat tax hustle is to COMPLETELY get rid of taxes on capital gains, unearned income, etc To have absolutely zero tax on trillions of dollars of income over a few years — while suckers (who get ordinary income) are told they taxed the same rate. Never mind that a whole group of very rich would pay zero, and many others would pay zero tax on much of their income.

This will never end – these bullship slogans like Fairtax and Flat tax — because it works. Even when the fraud does not get passed, folks still assume the slogans (the names especially) have something to do with whats in the legislation.

Go see the word games Fairtax hustlers use –Flat tax does not dare to be that “honest”

/