In early 2013, a reader asked me the best place to go if America suffered a Greek-style economic collapse. I suggested Australia might be the best option, even if I would be too stubborn to take my own advice.

Perhaps because of an irrational form of patriotism, I’m fairly certain that I will always live in the United States and I will be fighting to preserve (or restore) liberty until my last breath.

But while I intend to stay in America, there is one thing that would make me very pessimistic about my country’s future. Simply stated, if politicians ever manage to impose a value-added tax on the United States, the statists will have won a giant victory and it will be much harder to restrain big government.

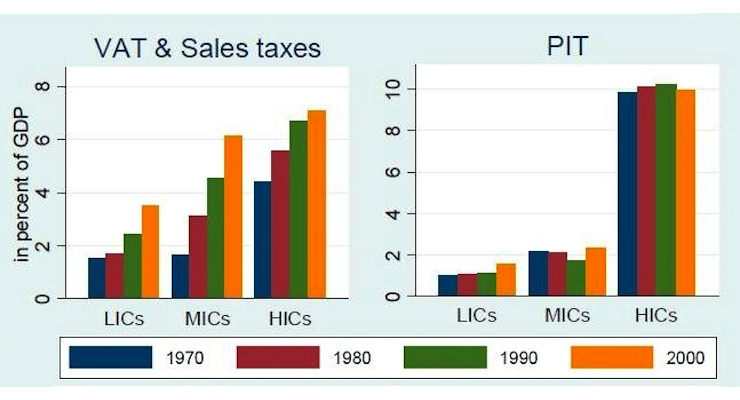

Source: International Monetary Fund

But you don’t have to believe me. Folks on the left openly admit that a VAT is necessary to make America more like Europe.

Check out these excerpts from an article in Foreign Affairs by Professor Lane Kenworthy of the University of Arizona. He explicitly wants bigger government and recognizes the VAT is the only way to finance a European-sized welfare state.

…modern social democracy means a commitment to the extensive use of government…U.S. policymakers will recognize the benefits of a larger government role… Americans will need to pay more in taxes. …The first and most important step would be to introduce a national consumption tax in the form of a value-added tax (VAT)… Washington…cannot realistically squeeze an additional ten percent of GDP in tax revenues solely from those at the top.

Pay special attention to the final sentence in that excerpt. Kenworthy is an honest statist. He knows that the Laffer Curve is real and that taxing the rich won’t generate the amount of revenue he wants.

That’s why the VAT is the key to financing bigger government. Heck, even the International Monetary Fund inadvertently provided very powerful evidence that a VAT is the recipe for bigger government.

Want more proof? Well, check out the recentNew York Times column by John Harwood (the same guy who was criticized for being a biased moderator of CNBC’s GOP debate).

He starts by pointing out that Senators Cruz and Paul are proposing European-type value-added taxes.

Senator Ted Cruz of Texas and Senator Rand Paul of Kentucky do it most explicitly by proposing variations on “value-added tax” systems used by European countries.

But here’s the part that should grab your attention. He cites some folks on the left who admit that there’s no way to finance big expansions of the welfare state without a VAT.

Democratic economists…say…income trends…complicate their ability to raise enough revenue to finance government programs without increasing burdens on the middle class as well as the affluent. “We’ve come close to maxing out the amount of progressivity we can get from the existing tax system,” said Peter Orszag, President Obama’s first budget director. …as looming baby boomer retirements promise to swell Social Security and Medicare expenses beyond the current tax system’s ability to finance them, is in new thinking that expands the scope of possible solutions. “There’s no way we can keep the promises we’ve made to senior citizens and others without a new revenue source,” said Mr. Burman of the Tax Policy Center.

So if the statists are salivating for a VAT to make government bigger, why on earth are some otherwise sensible people pushing for this pernicious new tax?!?

Some journalists have asked this same question. Here are some passages from aSlate report.

…conservative policy thinkers…worry that it might accidentally set the stage for much, much higher taxes in the future should Democrats ever take back control of Washington. …Cruz would impose a new, roughly 19 percent “business flat tax.” This is his campaign’s creative rebranding of what the rest of the world typically calls a “value-added tax,” or VAT. And…it scares the living hell out of some conservatives.

The article notes that Cruz and Paul have decent intentions.

…for Cruz—and for Rand Paul, who…would similarly like to combine a VAT and flat income tax—the main appeal is that it could theoretically raise a lot of money to finance tax cuts elsewhere.

But good intentions don’t necessarily mean good results.

And just like you don’t give matches to a child, you don’t give a giant new tax to Washington.

How much could Cruz’s proposal net the government? The conservative-leaning Tax Foundation thinks $25.4 trillion over 10 years. … in the hands of a Democratic president, it could become a hidden money-making machine for the government. Passing a national sales tax would be hard, they say. But once it’s in place, slowly ratcheting it up to pay for additional spending would be relatively easy. “To be blunt, unless there’s a magic guarantee that principled conservatives such as Rand Paul and Ted Cruz (and their philosophical clones) would always hold the presidency, a VAT would be a very risky gamble,” Daniel Mitchell, a senior fellow at the libertarian Cato Institute, wrote recently. …The ironic thing here is that Ted Cruz, anti-tax preacher, may be doing his best to craft a tax plan that leaves Americans in the dark about the actual cost of running their government. Simultaneously, he might be making political room for Democrats to start talking about a VAT tax of their own.

By the way, this isn’t the first time that a Republican has broached the idea of a VAT.

One of the worst Presidents in American history, Richard Nixon, wanted a VAT to finance bigger government. Here are some passages from an article in the 1972 archives of Congressional Quarterly.

President Nixon…asked both the Advisory Commission on Intergovernmental Relations and his Commission on School Finance, a group he appointed in 1970, to study and report on a proposal for a value added tax. …The tax had the advantages that…it yielded relatively large amounts of revenue. …Two major reasons were apparent for the Nixon administration’s consideration of a value added tax. The first was the condition of federal finances. …Projected costs of existing and proposed programs were expected to absorb all revenues from existing taxes and other sources. This meant that no new programs could be inaugurated without new taxes to finance them or reduction of existing programs to release funds. Though initially pledged for education, revenues from an expanding value added tax might provide future funding for other programs.

My colleague, Chris Edwards, deserves credit for unearthing this disturbing bit of fiscal history. Here’s some of what he wrote about Nixon’s sinister effort.

Richard Nixon appears to have been the first U.S. leader to push for a VAT, which is not surprising given that he was perhaps the most statist GOP president of the 20th century. …Thankfully, the Nixon proposal went nowhere in Congress, the ACIR came out against it, and it was dropped. America’s economy dodged a bullet. If Nixon had been successful, the rate would probably have soared over time from an initial 3 percent to maybe 20 percent today—just as rates in Europe have risen—and that would have fueled growth in new and expanded entitlement programs.

Amen. Chris hits the nail on the head.

It doesn’t really matter what the initial rate is. The VAT is an easy tax to raise because it’s so non-transparent.

Moreover adopting a VAT is a sure-fire way of enabling higher income tax rates because the statists will say it’s “unfair” to raise the VAT burden on lower-income and middle-income taxpayers unless there’s a concomitant increase in the income tax burden on the evil rich.

Which is exactly what happens in Europe. Look at how recent VAT hikes have been paired with higher income tax rates. But here’s the chart that should scare any sensible person. The bottom line is that the VAT is the Ebola Virus of big government.

VAT and government spending in the European Union.

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.