US Democratic presidential hopeful Hillary Clinton speaks outlining economic vision at the New School in New York on July 13, 2015. (Photo: JEWEL SAMAD/AFP/Getty Images)

We can learn a lot of economic lessons from Europe.

- Never adopt a VAT unless you want much bigger government.

- Bigger government means lower living standards.

- Don’t believe Bernie Sanders about the Nordic nations.

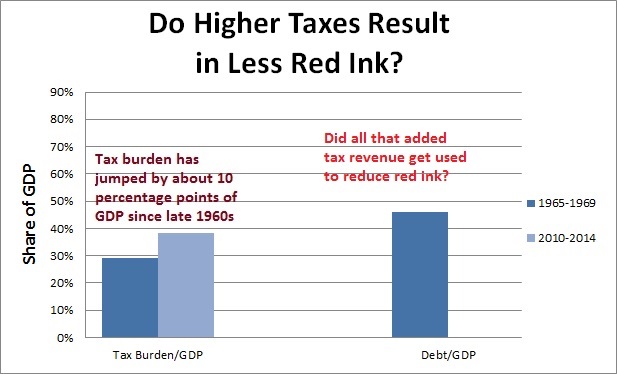

Today, we’re going to focus on another lesson, which is that higher taxes lead to more red ink. And let’s hope Hillary Clinton is paying attention.

I’ve already made the argument, using European fiscal data to show that big increases in the tax burden over the past several decades have resulted in much higher levels of government debt.

But let’s now augment that argument by considering what’s happened in recent years. There’s been a big fiscal crisis in Europe, which has forced governments to engage in austerity. But the type of austerity matters. A lot.

But let’s now augment that argument by considering what’s happened in recent years. There’s been a big fiscal crisis in Europe, which has forced governments to engage in austerity. But the type of austerity matters. A lot.

Here’s some of what I wrote back in 2014.

…austerity is a catch-all phrase that includes bad policy (higher taxes) and good policy (spending restraint). But with a few notable exceptions, European nations have been choosing the wrong kind of austerity (even though Paul Krugman doesn’t seem to know the difference).

And when I claim politicians in Europe have chosen the wrong kind of austerity, that’s not hyperbole.

As of 2012, there were €9 of tax hikes for every €1 of supposed spending cuts according to one estimate. That’s even worse than some of the terrible budget deals we’ve seen in Washington.

At this point, a clever statist will accuse me of sour grapes and state that I’m simply unhappy that politicians opted for policies I don’t like.

I’ll admit to being unhappy, but my real complaint is that higher tax burdens don’t work.

And you don’t have to believe me. We have some new evidence from an international bureaucracy based in Europe.

In a working paper for the European Central Bank, Maria Grazia Attinasi and Luca Metelli crunch the numbers to determine if and when “austerity” works in Europe.

…many Euro area countries have adopted fiscal consolidation measures in an attempt to reduce fiscal imbalances…in most cases, fiscal consolidation did not result, at least in the short run, in a reduction in the debt-to-GDP ratio…calls for a more temperate approach to fiscal consolidation have increased on the ground that the drag of fiscal restraint on economic growth could lead to an increase rather than a decrease in the debt-to-GDP ratio, as such fiscal consolidation may turn out to be self-defeating. …The aim of this paper is to investigate the effects of fiscal consolidation on the general government debt-to-GDP ratio in order to assess whether and under which conditions self defeating effects are likely to materialise and whether they tend to be short-lived or more persistent over time.

Now let’s look at the results of their research.

It turns out that austerity does work, but only if it’s the right kind. The authors find that spending cuts are successful and higher tax burdens backfire.

The main finding of our analysis is that…In the case of revenue-based consolidations the increase in the debt-to-GDP ratio tends to be larger and to last longer than in the case of spending-based consolidations. The composition also matters for the long term effects of fiscal consolidations. Spending-based consolidations tend to generate a durable reduction of the debt-to-GDP ratio compared to the pre-shock level, whereas revenue-based consolidations do not produce any lasting improvement in the sustainability prospects as the debt-to-GDP ratio tends to revert to the pre-shock level. …strategy is more likely to succeed when the consolidation strategy relies on a durable reduction of spending, whereas revenue-based consolidations do not appear to bring about a durable improvement in debt sustainability.

Unfortunately, European politicians generally have chosen the wrong approach.

This is an important policy lesson also in view of the fact that revenue-based consolidations tend to be the preferred form of austerity, at least in the short run, given also the political costs that a durable reduction in government spending entail.

Here are a few important observations from the study’s conclusion.

…the findings of our analysis are in line with those of the literature on successful consolidation, namely that the composition of fiscal consolidation matters and that a durable reduction in the debt-to-GDP ratio is more likely to be achieved if consolidation is implemented on the expenditure side, rather than on the revenue side. In particular, when fiscal consolidation is implemented via an increase in taxation, the debt-to-GDP ratio reverts back to its pre-shock level only in the long run, thus failing to generate an improvement in the debt ratio, and producing what we call a self-defeating fiscal consolidation. …fiscally stressed countries benefit from an immediate reduction in the level of debt when reducing spending.

In other words, restraining the growth of spending is the best way to reduce red ink. Heck, it’s the only way.

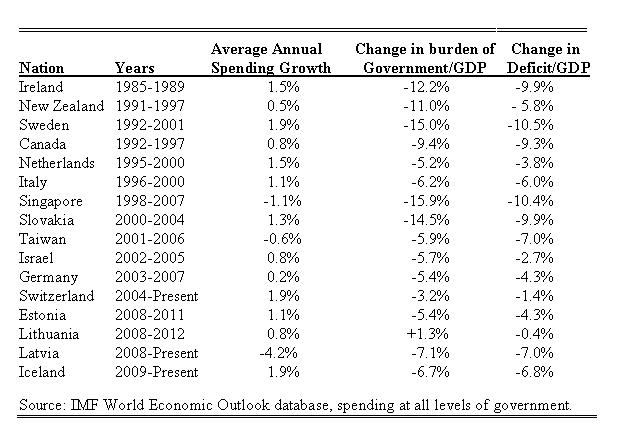

When debating my leftists friends, I frequently share this table showing nations that have obtained very good results with multi-year periods of spending restraint.

Source: IMF World Economic Outlook database.

My examples are from all over the world and cover all sorts of economic conditions. And the results repetitively show that when you deal with the underlying problem of too much government, you automatically improve the symptom of red ink.

I then ask my statist pals to show me a similar table of data for countries that have achieved good results with higher taxes.

I’m still waiting for an answer.

Which is why the only good austerity is spending restraint.

P.S. Paul Krugman is remarkably sloppy and inaccurate when writing about austerity. Check out his errors when commenting on the United Kingdom, Germany, and Estonia.