US national debt piles up next to the Capitol Building in Washington, D.C., where no one has the political courage to rise to the challenge of staving off the coming crisis.

It’s not a big day for normal people, but today is exciting for fiscal policy wonks because the Congressional Budget Office has released its new 10-year forecast of how much revenue Uncle Sam will collect based on current law and how much the burden of government spending will expand if policy is left on auto-pilot.

Most observers will probably focus on the fact that budget deficits are projected to grow rapidly in future years, reaching $1 trillion in 2024.

That’s not welcome news, though I think it’s far more important to focus on the disease of too much spending rather than the symptom of red ink.

But let’s temporarily set that issue aside because the really big news from the CBO report is that we have new evidence that it’s actually very simple to balance the budget without tax increases.

According to CBO’s new forecast, federal tax revenue is projected to grow by an average of 4.3 percent each year, which means receipts will jump from 3.28 trillion this year to $4.99 trillion in 2026.

And since federal spending this year is estimated to be $3.87 trillion, we can make some simple calculation about the amount of fiscal discipline needed to balance the budget.

A spending freeze would balance the budget by 2020. But for those who want to let government grow at 2 percent annually (equal to CBO’s projection for inflation), the budget is balanced by 2024.

So here’s the choice in front of the American people. Either allow spending to grow on autopilot, which would mean a return to trillion dollar-plus deficits within eight years. Or limit spending so it grows at the rate of inflation, which would balance the budget in eight years.

Seems like an obvious choice.

By the way, when I crunched the CBO numbers back in 2010, they showed that it would take 10 years to balance the budget if federal spending grew 2 percent per year.

So why, today, can we balance the budget faster if spending grows 2 percent annually?

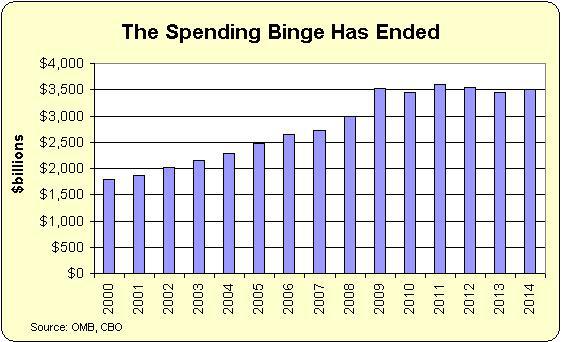

For the simple reason that all those fights earlier this decade about debt limits, government shutdowns, spending caps, and sequestration actually produced a meaningful victory for advocates of spending restraint. The net result of those budget battles was a five-year nominal spending freeze.

Federal Spending from 2000 to the present. (Source: Dan Mitchell)

In other words, Congress actually out-performed my hopes and expectations (probably the only time in my life I will write that sentence).*

Here’s a video I narrated on this topic of spending restraint and fiscal balance back in 2010.

Everything I said back then is still true, other than simply adjusting the numbers to reflect a new forecast.

The bottom line is that modest spending restraint is all that’s needed to balance the budget.

That being said, I can’t resist pointing out that eliminating the deficit should not be our primary goal. It’s not good to have red ink, to be sure, but the more important goal should be to reduce the burden of federal spending.

That’s why I keep promoting my Golden Rule. If government grows slower than the private sector, that means the burden of spending (measured as a share of GDP) will decline over time.

And it’s why I’m a monomaniacal advocate of spending caps rather than a conventional balanced budget amendment. If you directly address the underlying disease of excessive government, you’ll automatically eliminate the symptom of government borrowing.

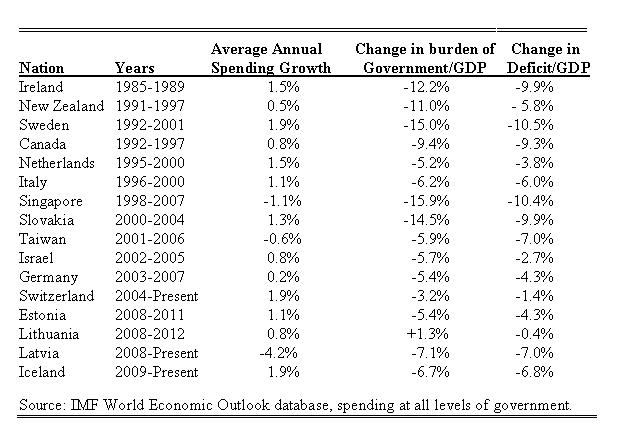

Which is why I very much enjoy sharing this chart whenever I’m debating one of my statist friends. It shows all the nations that have enjoyed great success with multi-year periods of spending restraint.

Source: IMF World Economic Outlook database.

During these periods of fiscal responsibility, the burden of government falls as a share of economic output and deficits also decline as a share of GDP.

I then ask my leftist pals to show a similar table of countries that have gotten good results by raising taxes.

As you can imagine, that’s when there’s an uncomfortable silence in the room, perhaps because the European evidence very clearly shows that higher taxes lead to bigger government and more red ink (I also get a response of silence when I issue my challenge for statists to identify a single success story of big government).

*Congress has reverted to (bad) form, voting last year to weaken spending caps.

[mybooktable book=”global-tax-revolution-the-rise-of-tax-competition-and-the-battle-to-defend-it” display=”summary” buybutton_shadowbox=”true”]