Illinois Governor Bruce Rauner (Photo: AP)

There’s a somewhat famous quote from Adam Smith (“there is a great deal of ruin in a nation“) about the ability of a country to survive and withstand lots of bad public policy.

Growth will be weaker with bad policy, of course, but if a nation already is relatively rich, then perhaps voters don’t really care.

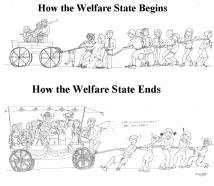

But there’s a catch. If you add demographic change to the equation, then bad policy can be a recipe for crisis rather than slow growth. This is one of the reasons why I’m worried about the long-run outlook for Europe, with particular concern about Eastern Europe (by the way, we also have to worry in America).

But there’s another form of demographic change that also can have a big impact. Migration patterns can alter the economic vitality of a jurisdiction. I’ve written aboutthe exodus of French entrepreneurs who move to other countries with better tax systems, and the same thing happens with migration between American states.

And you probably won’t be surprised to learn that Illinois is usually on the losing end.

The Wall Street Journal opines on the state’s grim outlook.

…taxpayers are fleeing the Land of Lincoln in record numbers. According to the Census Bureau, Illinois now leads the nation for the steepest population decline. Between July 2015 and July 2016, Illinois lost some 114,000 people in net migration to other states, with total population decline of 37,508 (including births and deaths). For the third year in a row it was the only state to have lost population among the nine in its Great Lakes and Mid-America region.

But what’s really important, the WSJ explains, is that Illinois is losing people who are net producers and contributors.

…the average person moving out of the state earns some $20,000 more than the average person moving in. According to IRS data for tax year 2014 (filed in 2015), the average income of the taxpayer leaving Illinois was $76,824 while the average income of the new arrival was $56,689. That gap is widening and the differential can be traced to policy decisions as the state staggers under pension debt and an entrenched Democratic-public union machine in Springfield. In an effort to cover growing debt, in January 2011 state lawmakers raised the personal income tax rate to 5% from 3% and the corporate income tax to 9.5% from 7.3%. …The exodus accelerated to 73,500 from July 2011 to July 2012, 67,300 in 2012-2013, 95,000 in 2013-2014, 105,000 in 2014-2015 and 114,000 this year.

The class-warfare tax hike in 2011 was a terrible signal to investors and entrepreneurs.

And keep in mind that the state also has a gigantic unfunded liabilitybecause of absurd promises of lavish pensions and fringe benefits for state and local government employees.

It’s almost as if the politicians in Springfield want to make the state unattractive.

Though the situation isn’t totally hopeless. Voters elected an anti-tax governor in 2014 and there’s a possibility that the destructive tax increase of 2011 won’t be renewed.

The Wall Street Journal makes a very wise recommendation to the Governor.

Democrats are trying to shake Mr. Rauner down for a repeat. He needs to hold firm to stop the state’s population exodus.

Needless to say, it would be a good idea to let the tax hike expire. That being said, that simply gets the state back to where it was in 2010, which wasn’t exactly a strong position.

The bottom line is that Illinois may have passed the tipping point and entered a death spiral. Sort of akin to being the Greece of America.

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.

View Comments

Know of a family that moved across state line to Indiana to flee taxes (income and property). Claim they save $20K annually