President-elect Donald Trump, accompanied by SoftBank CEO Masayoshi Son, speaks to members of the media at Trump Tower in New York, Tuesday, Dec. 6, 2016. (Photo: AP)

For the next four years, I suspect I’m going to suffer a lot of whiplash as I yank myself back and forth, acting as both a critic and supporter of Donald Trump’s policy.

This happened a lot during the campaign, as Trump would say very good things one day and then say very bad things the next day.

And now that he’s President-Elect Trump, that pattern is continuing. Consider his approach to American businesses. In the space of just a few minutes, he manages to be a Reaganesque tax cutter and an Obamaesque cronyist.

I discussed this bizarre mix in a recent interview with Dana Loesch.

[brid video=”103742″ player=”2077″ title=”Dan Mitchell Discussing Trump’ Good and Bad Approach to Business”]

I guess the only way to make sense of Trump’s policy is that it’s a random collection of carrots and sticks. The carrots are policies to encourage companies to create jobs in America, and Trump is proposing both good carrots such as a much lower corporate tax rate and bad carrots such as special Solyndra-style handouts(except, instead of loot for green energy, firms get loot for maintaining production in America).

And the sticks are all bad, ranging for public shaming to explicit protectionism.

As I said during the interview, Trump is probably scoring political points, but what we should really care about is whether policy is moving in the right direction.

The Wall Street Journal is rather skeptical, opining that Republican-backed cronyism will be just as bad as Democrat-backed cronyism.

A giant flaw in President Obama’s economic policy has been the politicized allocation of capital, from green energy to housing. Donald Trump suffers from a similar industrial-policy temptation, as we’ve seen…with his arm-twisting of Carrier to change its decision to move a plant to Mexico from Indiana. …A mercantilist Trump trade policy that jeopardized those exports would throw far more Americans out of work than the relatively low-paying jobs he’s preserved for now in Indianapolis. Mr. Trump’s Carrier squeeze might even cost more U.S. jobs if it makes CEOs more reluctant to build plants in the U.S. because it would be politically difficult to close them. Mr. Trump has now muscled his way into at least two corporate decisions about where and how to do business. But who would you rather have making a decision about where to make furnaces or cars? A company whose profitability depends on making good decisions, or a branding executive turned politician who wants to claim political credit? The larger point is that America won’t become more prosperous by forcing companies to make noneconomic investments.

Here’s some of what Tyler Cowen wrote about Trump’s approach.

One of Donald Trump’s most consistent campaign promises has been to prevent U.S. businesses from moving good jobs to Mexico… Economists might regard this as a misguided form of protectionism, but in fact, it’s worse than that: If instituted, it could prove a major step toward imposing capital controls on the American economy and politicizing many business decisions. …Using the law to forbid factory closures would have serious negative consequences. For one thing, those factories may be losing money and end up going bankrupt. For another, stopping the closure of old plants would lock the U.S. into earlier technologies and modes of production, limiting progress and economic advancement. An alternative policy would prohibit companies from cutting American production and expanding in Mexico… The end result would be that Asian, European and Mexican investors would gain at the expense of U.S. companies. …Furthermore, if we limit the export of American capital to Mexico, the biggest winner would be China, as one of its most significant low-wage competitors — Mexico — suddenly would be hobbled.

Those are all very practical and sensible arguments against protectionism.

But Tyler points out that Trump’s agenda could lead to something even worse.

…a policy limiting the ability of American companies to move funds outside of the U.S. would create a dangerous new set of government powers. Imagine giving an administration the potential to rule whether a given transfer of funds would endanger job creation or job maintenance in the United States. That’s not exactly an objective standard, and so every capital transfer decision would be subject to the arbitrary diktats of politicians and bureaucrats. It’s not hard to imagine a Trump administration using such regulations to reward supportive businesses and to punish opponents. Even in the absence of explicit favoritism, companies wouldn’t know the rules of the game in advance, and they would be reluctant to speak out in ways that anger the powers that be. …It also could bring the kind of crony capitalist nightmare scenarios described by Ayn Rand in her novel “Atlas Shrugged,” a book many Republican legislators would be well advised to now read or reread.

Tyler’s best-case scenario is that Trump doesn’t try to change policy and instead just uses the bully pulpit to…well, be a bully.

…public jawboning also would be an unfortunate form of politicizing the economy, but at least there wouldn’t be new laws or regulations to back it up in a systematic way.

Though I’ll close by noting that this best-case scenario is still a very bad case.

The mere fact that politicians think they have the right to interfere with the internal decisions of companies is a dangerous development.

The mere fact that politicians think they have the right to interfere with the internal decisions of companies is a dangerous development.

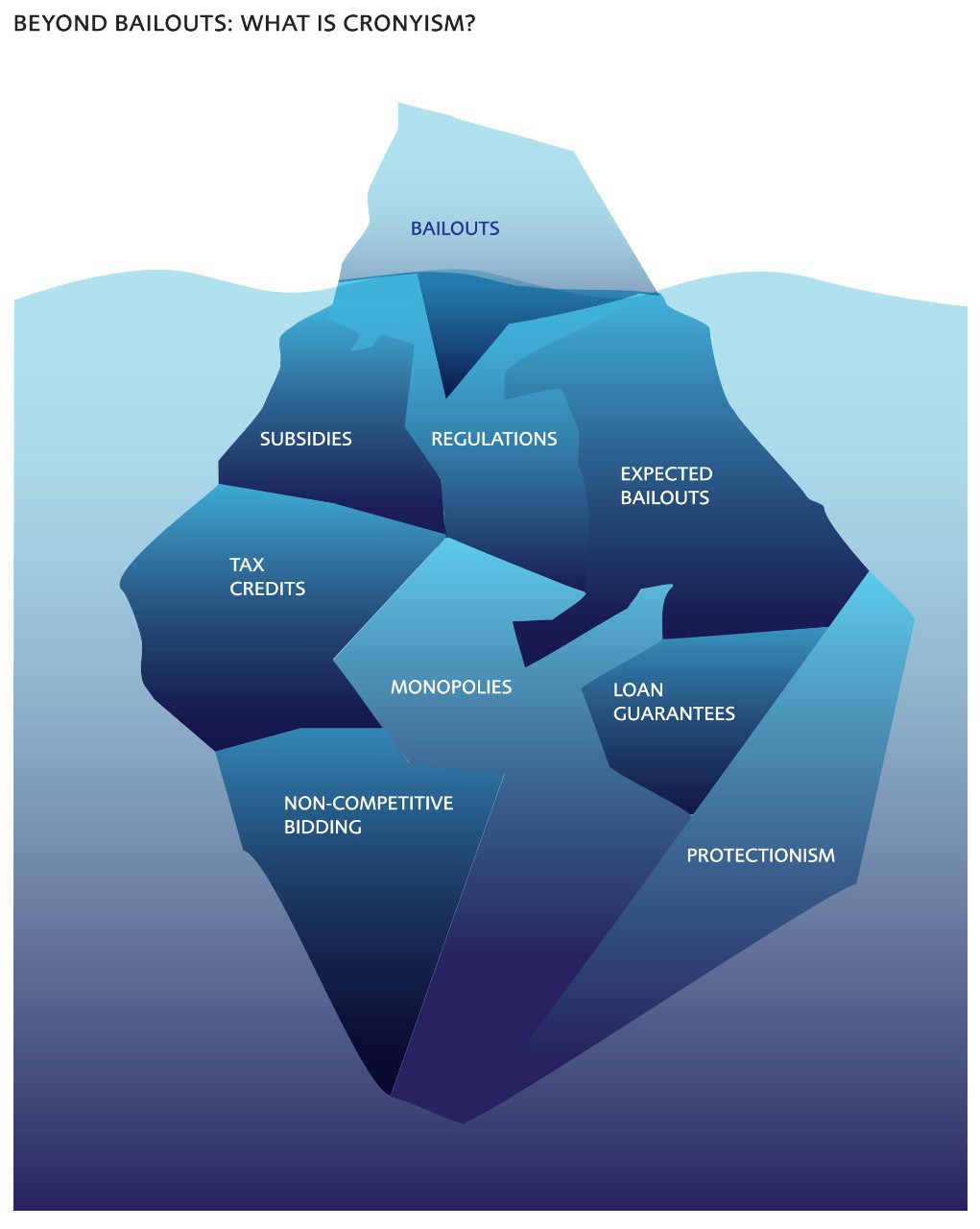

It’s cronyism on steroids.

And even if Trump somehow restrains himself (how likely is that?!?), sooner or later that bad mentality will lead to bad policy.

Yes, I’m making a slippery-slope argument. But not just because I’m a libertarian who is paranoid about government power.

My fear is based on lots of real-world evidence. It turns out that slippery slopes are very slippery.

- Consider the federal income tax, which started as a simple 2-page form with a top rate of 7 percent, but now has become a 75,000-page monstrosity with confiscatory rates.

- Consider the Clean Water Act, which was enacted to regulate “navigable waterways,” but now has metastasized to the extent that the government now

tries to regulate ponds on private property and control the building of houses on dry land.

tries to regulate ponds on private property and control the building of houses on dry land. - Consider money laundering laws, which began ostensibly to stop crooks from using ill-gotten gains, but now have become a multi-billion dollar burden that require banks to spy on all customers.

- Consider Medicaid, which the Washington Post reported, “was supposed to be a very small program with annual expenditures of about $1 billion,” but now costs taxpayers about $500 billion per year.

The bottom line is that politicians don’t even do a good job of running the government. Let’s not allow them to run private companies as well. And that’s true whether they have an R after their names or a D after their names.