File: The $4 trillion U.S. federal budget proposed by Barack Obama in 2016. (Photo: Reuters)

Back in April, I shared a new video from the Center for Freedom and Prosperity that explained how poor nations can become rich nations by following the recipe of small government and free markets.

Now CF&P has released another video. Narrated by Yamila Feccia from Argentina, it succinctly explains – using both theory and evidence – why spending caps are the most prudent and effective way of achieving good fiscal results.

Ms. Feccia covers all the important issues, but here are five points that are worth emphasizing.

- Demographics – Almost all developed nations have major long-run fiscal problems because welfare states will implode because of aging populations and falling birthrates (Ponzi schemes need an ever-growing number of new people to stay afloat).

- Golden Rule – If government spending grows slower than the private sector, that reduces the relative burden of government spending (the underlying disease) and also reduces red ink (the symptom of the underlying disease).

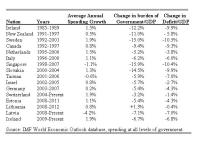

Success Stories – Simply stated, spending caps work. She lists the nations that have achieved very good resultswith multi-year periods of spending restraint. She points out that the U.S. made a lot of fiscal progress when GOPers aggressively fought Obama. And she shares the details about the very successful constitutional spending caps in Hong Kong and Switzerland.

Success Stories – Simply stated, spending caps work. She lists the nations that have achieved very good resultswith multi-year periods of spending restraint. She points out that the U.S. made a lot of fiscal progress when GOPers aggressively fought Obama. And she shares the details about the very successful constitutional spending caps in Hong Kong and Switzerland.- Better than Balanced Budget Amendments or Anti-Deficit Rules – The video explains why policies that try to target red ink are not very effective, mostly because tax revenues are very volatile.

- Even International Bureaucracies Agree – Remarkably, the International Monetary Fund (twice!), the European Central Bank, and the Organization for Economic Cooperation and Development (twice!) have acknowledged that spending caps are the most, if not only, effective fiscal rule.

I touch on some of these issues in one of my chapters in the Cato Handbook for Policymakers. The entire chapter is worth reading, in my humble opinion, but I want to share an excerpt echoing Point #4 that I just shared from Ms. Feccia’s video.

There’s a very practical reason to focus on capping long-run spending rather than trying to balance the budget every year. Simply stated, the “business cycle” makes the latter very difficult. …when a recession occurs and revenues drop, a balanced-budget mandate requires politicians to make dramatic changes at a time when they are especially reluctant to either raise taxes or impose spending restraint. Then, when the economy is enjoying strong growth and producing lots of tax revenue, a balanced-budget requirement doesn’t impose much restraint on spending. All of which creates an unfortunate cycle. Politicians spend a lot of money during the good years, creating expectations of more and more money for various interest groups. When a recession occurs, the politicians suddenly have to slam on the brakes. But even if they actually cut spending, it is rarely reduced to the level it was when the economy began its upswing. Moreover, politicians often raise taxes as part of these efforts to comply with anti-deficit rules. When the recession ends and revenues begin to rise again, the process starts over—this time from a higher base of spending and with a bigger tax burden. Over the long run, these cycles create a ratchet effect, with the burden of government spending always reaching new plateaus.

It’s not that I want to belabor this point, but the bottom line is that it is very difficult to amend a country’s constitution (at least in the United States, but presumably in other nations as well).

So if there’s going to be a major campaign to put a fiscal rule in a constitution, then I think it should be one that actually achieves the goal. And whether people want to address the economically important goal of spending restraint or the symbolically important goal of fiscal balance, what should matter is that a spending cap is the effective way of getting there.