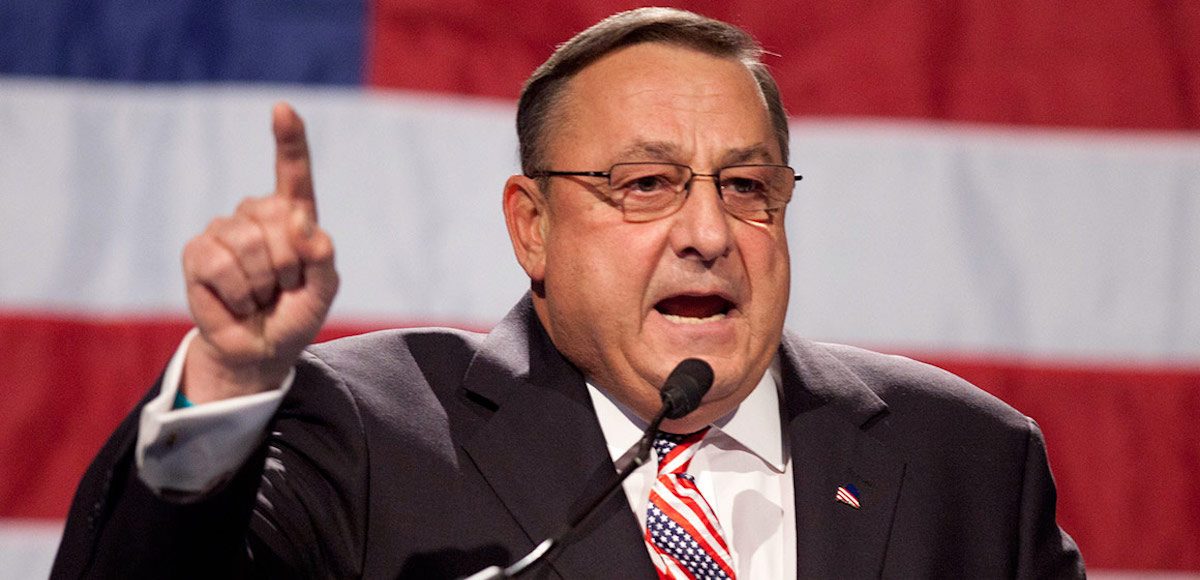

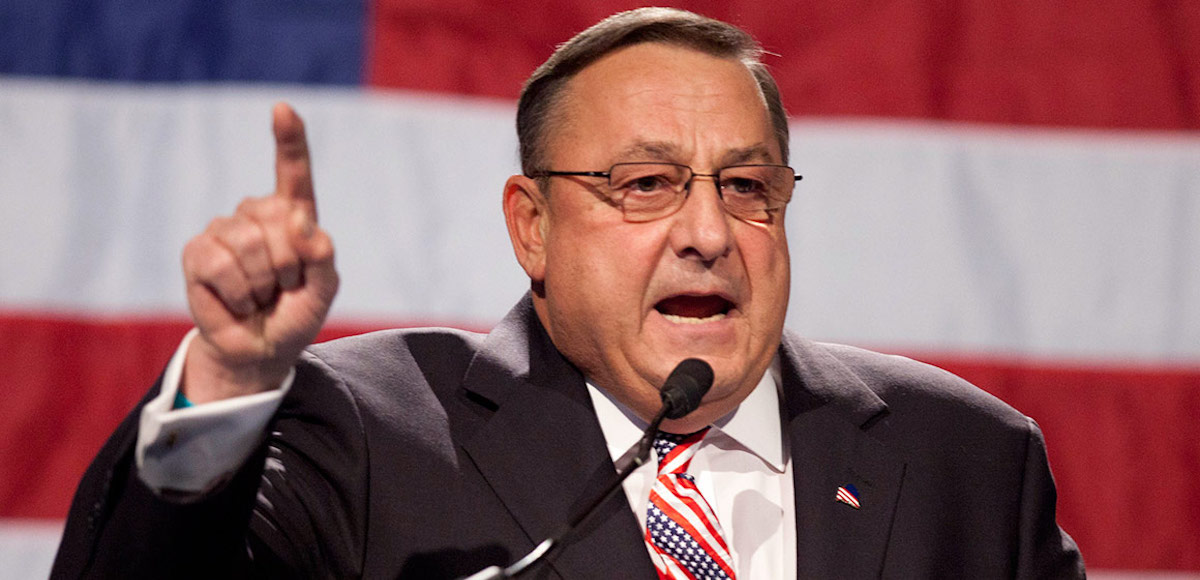

FILE – In this file photo made Sunday, May 6, 2012, Gov. Paul LePage speaks at the Maine GOP convention. (Photo: AP)

Back at the end of April, President Trump got rolled in his first big budget negotiation with Congress. The deal, which provided funding for the remainder of the 2017 fiscal year, was correctly perceived as a victory for Democrats.

How could this happen, given that Democrats are the minority party in both the House and the Senate? Simply stated, Republicans were afraid that they would get blamed for a “government shutdown” if no deal was struck. So they basically unfurled the white flag and acquiesced to most of the other side’s demands.

I subsequently explained how Trump should learn from that debacle. To be succinct, he should tell Congress that he will veto any spending bills for FY2018 (which begins October 1) that exceed his budget request, even if that means a shutdown.

For what it’s worth, I don’t really expect Trump or folks in the White House to care about my advice. But I am hoping that they paid attention to what just happened in Maine. That state’s Republican Governor, Paul LePage, just prevailed in a shutdown fight with the Maine legislature.

Here are some details on what happened, as reported by CNN.

The three-day government shutdown in Maine ended early Tuesday morning after Gov. Paul LePage signed a new budget, according to a statement from his office.The shutdown had closed all non-emergency government functions, prompting protests from state employees in Augusta. …The key contention for the governor was over taxes. LePage met Monday afternoon with House Republicans and pledged to sign a budget that eliminated an increase in the lodging tax from 9 to 10.5 percent, according to the statement from the governor’s office. Once the lodging tax hike was off the table, negotiations sped up as the state House voted 147-2 and the Senate 35-0 for the new budget. “I thank legislators for doing the right thing by passing a budget that does not increase taxes on the Maine people,” said LePage in a statement.

And here are some excerpts from a local news report.

Partisan disagreements over a new two-year spending plan were finally resolved late Monday. The final budget eliminated a proposed 1.5 percent increase to Maine’s lodging tax – a hike that represented less than three-tenths of one percent of the entire $7.1 billion package but held up the process for days.

…Gideon and other Democrats complained about the constantly-changing proposals being presented by House Republicans, who were acting as a proxy for LePage. Representative Ken Fredette, the House Minority Leader, insisted that his members were simply fighting back against tax hikes and making sure the governor was involved in the process. …Republicans in the Senate who, over the past several months, were able to negotiate away a three-percent income tax surcharge on high-income earners that was approved by voters last fall.

What’s particularly amazing is that Democrats in the state legislature even agreed to repeal a class-warfare tax hike (the 3-percentage point increase in the top income tax rate) that was narrowly adopted in a referendum last November.

This is a remarkable development. I had listed this referendum as one of the worst ballot initiatives of 2016 and was very disappointed when voters made the wrong choice.

So why did the state’s leftists not fight harder to preserve this awful tax?

So why did the state’s leftists not fight harder to preserve this awful tax?

One of the reasons they surrendered on that issue is that there was a big Laffer-Curve effect. Taxpayers with large incomes predictably decided to earn and report less income in Maine.

The moral of the story is that Maine’s Democrats were willing to give up on the surtax because they realized it wasn’t going to give them any revenue to redistribute. And unlike some DC-based leftists, they didn’t want a tax hike that resulted in less revenue.

Here are some passages from a report by the state’s Revenue Forecasting Committee.

The RFC has reduced its forecast of individual income tax receipts by $15.9 million in FY17, $40.3 million in the 2018-2019 biennium, and $43.9 million in the 2020-2021 biennium. While there was no so-called “April Surprise” to report for 2016 final payments in April, the first estimated payment for tax year 2017 was $9.3 million under budget; flat compared to a year ago. The committee had expected an increase of 25% or more in the April and June estimated payments because of the 3 percent surtax passed by the voters last November. … there is concern that high-income taxpayers impacted by the surtax may be taking some action to reduce their exposure to the surtax. The forecast accepted by the committee today assumes a reduction of approximately $250 million in taxable income by the top 1% of Maine resident tax returns and similarly situated non-resident returns. This reduction in taxable income translates into a total decrease in annual individual income tax liability of approximately $30 million; $10 million from the 3% surtax and $20 million from the regular income tax liability.

And here’s the relevant table from the appendix showing how the state had to reduce estimated income tax receipts.

But I’m getting sidetracked.

Let’s return to the lessons that Trump should learn from Governor LePage about how to win a shutdown fight.

One of the lessons is to stake out the high ground. Have the fight over something important. LePage wanted to kill the lodging tax and the referendum surtax. Since those taxes were so damaging, it was very easy for the Governor to justify his position.

Another lesson is to go on offense. Republicans in Maine explained that higher taxes would make the state less competitive. Here’s a chart they disseminated comparing the tax burden in Maine, New Hampshire, and Massachusetts.

And here’s another very powerful chart that was circulated to policy makers, showing the migration of taxpayers from high-tax states to zero-income-tax states.

Trump should do something similar. The fight later this year in DC (assuming the President is willing to fight) will be about spending levels. And leftists will be complaining about “savage” and “draconian” cuts.

So the Trump Administration should respond with charts showing that the other side is being hysterical and inaccurate since he’s merely trying to slow down the growth of government.

But the most important lesson of all is that Trump holds a veto pen. And that means he (just like Gov. LePage in Maine) controls the situation. He can veto bad budget legislation. And when the interest groups start to squeal that the spending faucet is no longer dispensing goodies because of a shutdown, he should understand that those interest groups feeling the pinch generally will be on the left. And when they complain, it is the big spenders in Congress who will feel the most pressure to capitulate in order to reopen the faucet. Moreover, the longer the government is shut down, the greater the pinch on the pro-spending lobbies.

In other words, Trump has the leverage, if he is willing to use it.

This assumes, of course, that Trump has the brains and fortitude to hold firm when the press tries to create a fake narrative about the world coming to an end, (just like they did with the sequester in 2013 and the shutdown fight that same year).