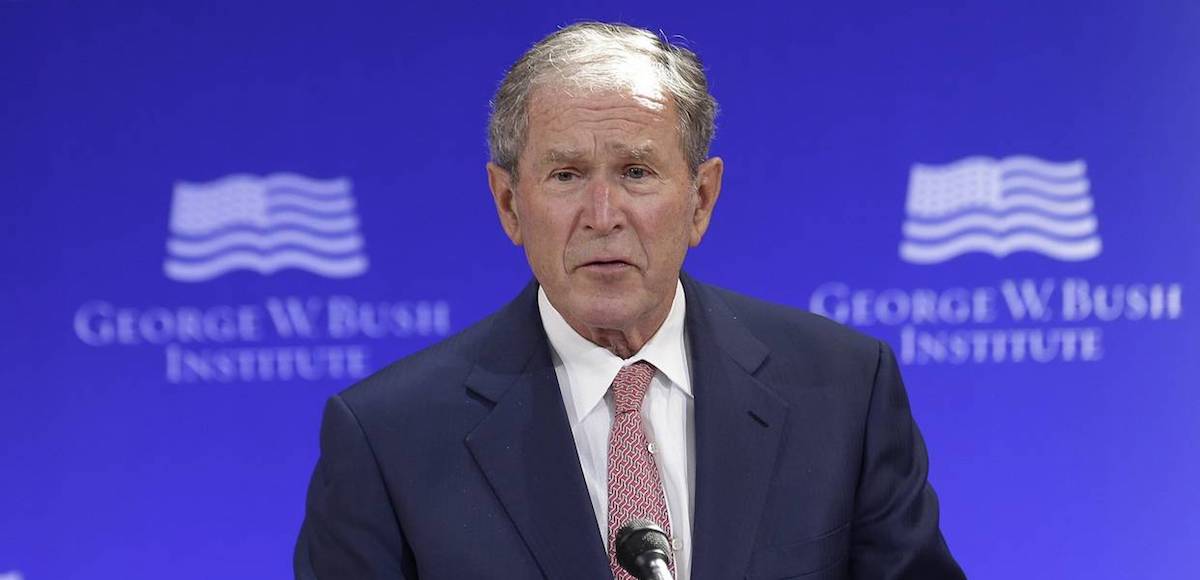

Former President George W. Bush speaks at a forum sponsored by the George W. Bush Institute in New York, Thursday, Oct. 19, 2017. (Photo: AP)

Back in 2013, I did an assessment of economic policy changes that occurred during the Clinton Administration.

The bottom line was that the overall burden of government declined by a semi-significant amount. Which presumably helps to explain why the economy enjoyed good growth and job creation in the 1990s, especially in the last half of the decade when most of the pro-growth reforms were enacted.

The chart I prepared has been very helpful when speaking to audiences about what actually happened during the Clinton years, so I decided to do the same thing for other presidents.

A week ago, I put together my summary of economic policy changes during the Nixon years. At the risk of understatement, it was a very grim era for free markets.

A few days ago, I followed up with a look at overall economic policy during the Reagan years. That was a much better era, at least for those of us who favor economic liberty over statism.

President |

Domestic Spending (Non-TARP) |

| Reagan | 0.6% |

| Clinton | 2.5% |

| Carter | 2.8% |

| Obama | 3.3% |

| G. W. Bush | 3.9% |

| H. W. Bush | 6.3% |

| Johnson | 6.5% |

| Nixon | 8.4% |

Now it’s time to look at the record of George W. Bush. It’s not a pretty picture.

I think the TARP bailout was the low point of the Bush years, though he also deserves criticism for big spending hikes, especially the rapid rise of domestic spending, additional red tape, special-interest trade taxes, and more centralization of education.

On the plus side, there was a good tax cut in 2003–though the 2001 version was mostly Keynesian and thus didn’t help growth–as well as some targeted trade liberalization. Unfortunately, those good reforms were swamped by bad policy.

As has been the case for other presidents, my calculations are based solely on policy changes. Presidents don’t get credit or blame for policies they endorsed or opposed. So when fans of President Bush tell me he was better on policy than his record indicates, I shrug my shoulders (just like I don’t particularly care when Republicans on Capitol Hill tell me that Clinton’s good record was because of the post-1994 GOP Congress).

I simply want to show where policy improved and where it deteriorated when various presidents were in office. Other people can argue about the degree to which those presidents deserve credit or blame.

In the case of Bush, for what it’s worth, I think he does deserve blame. None of the bad laws I listed were enacted over his veto.

Incidentally, I was torn by how to handle monetary policy. The artificially low interest rates of the mid-2000s contributed to the housing bubble and subsequent financial meltdown. Should I have blamed Bush for that because of his Federal Reserve appointments?

On a related note, the affordable lending mandates of Fannie Mae and Freddie Mac were made more onerous during the Bush years, thus exacerbating perverse incentives in the financial sector to make unwise loans. Was that Bush’s fault, or were those regulations unavoidable because of legislation that was enacted before Bush became President?

Ultimately, I decided to omit any reference to the Fed, as well as Fannie and Freddie. But I double-weighted TARP, both because it was awful economic policy and because that was a way of partially dinging Bush for his acquiescence to bad monetary and housing policy.

If there’s a lesson to learn from this analysis of Bush policy, it is that party labels don’t necessarily have any meaning. The economy suffers just as much if a Republican expands the burden of government as it does when the same thing happens under a Democrat.

P.S. I haven’t decided whether to replicate this exercise for pre-World War II presidents. If I do, Calvin Coolidge and Grover Cleveland presumably would look very good.

Ranking Presidents on Economic Policy: The Awful Record of Richard Nixon

Ranking Presidents on Economic Policy: The Impressive Record of Ronald Reagan

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.