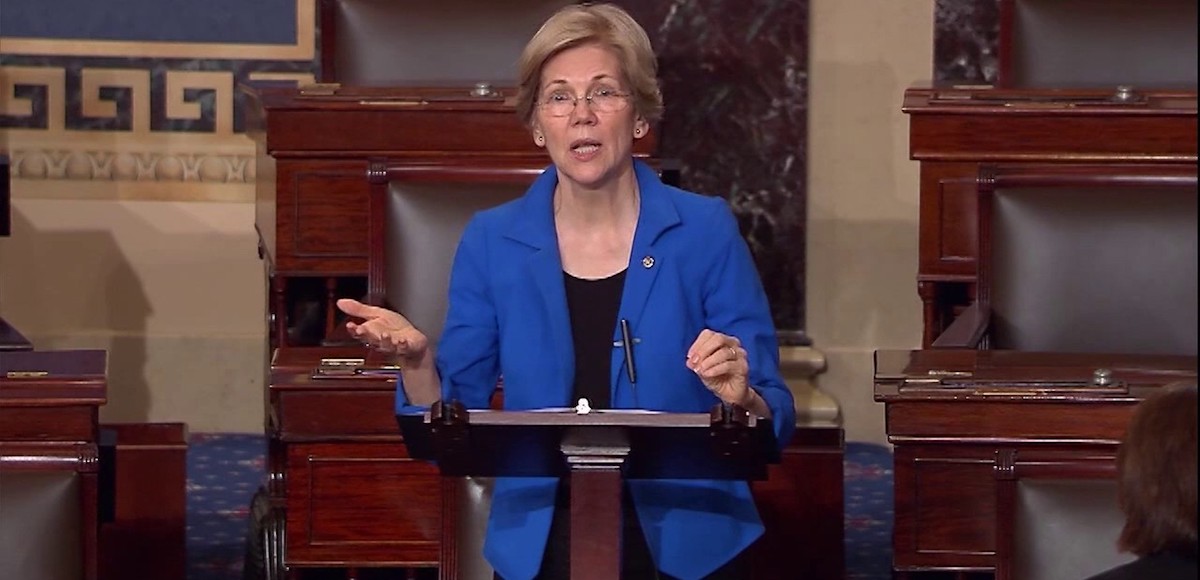

Senator Elizabeth Warren gives remarks on the Senate floor on June 22, 2017 after the release of the Senate Republicans’ health care bill.

Donald Trump wants to make protectionism great again. Bernie Sanders wants to make socialism great again.

And if we continue with sarcastic headlines, Elizabeth Warren wants to make cronyism great again.

She has a plan, which she explained in a column for the Wall Street Journal and also in this press release on her Senate website, that would give politicians and bureaucrats sweeping powers over large companies.

There’s a technical term for this system of private ownership/government control. It’s called fascism, though I prefer referring to it as corporatism or dirigisme to distinguish what Warren is doing from the racist and militaristic version of that ideology.

Or we can just call it crazy. Kevin Williamson summarizes this dangerous proposal for National Review.

Senator Elizabeth Warren of Massachusetts has one-upped socialists Bernie Sanders and Alexandria Ocasio-Cortez: She proposes to nationalize every major business in the United States of America. If successful, it would constitute the largest seizure of private property in human history. …Senator Warren’s proposal entails the wholesale expropriation of private enterprise in the United States,

and nothing less. It is unconstitutional, unethical, immoral, irresponsible, and — not to put too fine a point on it — utterly bonkers. …To propose such a thing for sincere reasons would be ghastly stupidity. …Politicians such as Senator Warren lack the courage to go to the American electorate and say: “We wish to provide these benefits, and they will cost an extra $3 trillion a year, which we will pay for by doubling taxes.” …It treats the productive capacity of the United States as a herd of dairy cows to be milked by Senator Warren et al. at their convenience. And, of course, Senator Warren and her colleagues get to decide how the milk gets distributed, too. …Recep Tayyip Erdogan, Hugo Chávez, Huey Long: The rogues’ gallery of those who sought to fortify their political power by bullying businesses is long, and it is sickening. Senator Warren now nominates herself to that list

Professor Don Boudreaux of George Mason University exposes Warren’s economic illiteracy.

Sen. Elizabeth Warren (D-MA)…outlined her new bill that “would require corporations to answer to employees and other stakeholders as well.” …If this mandate is ever enacted, it would radically restructure corporate law, governance, and finance, which is especially frightening because seldom have I encountered so many fallacies

…no company in a market economy can force anyone to buy its outputs or to supply it with labor and other inputs, every company, to survive, must continually make attractive offers to consumers, workers, and suppliers. The ability of consumers, workers, and suppliers to say no combines with the law of contract — which requires parties to honor whatever commitments they voluntarily make to each other — to guarantee that companies are fully accountable to everyone with whom they exchange. Companies therefore are fully accountable to their customers and to their workers… the senator offers absolutely no evidence — not even a single anecdote — that companies are unaccountable to consumers.

Not that we needed more evidence that she doesn’t understand economics.

Walter Olson points out that Warren’s legislation would expropriate wealth, presumably in violation of the Constitution’s taking clause.

Elizabeth Warren of Massachusetts has introduced legislation that would radically overhaul corporate governance in America, requiring that the largest (over $1 billion) companies obtain revocable charters from the federal government to do business, instituting rules reminiscent of German-style co-determination…

Sen. Warren’s proposal would pull down three main pillars of U.S. corporate governance: shareholder primacy, director independence, and charter federalism. …Warren-style rules…would in effect confiscate at a stroke a large share of stockholder value, transferring it to some combination of worker and “community” interests. …This gigantic expropriation, of course, might be a Pyrrhic victory for many workers and retirees whose 401(k) values would take a huge hit… some early enthusiasts for the Warren plan are treating the collapse of shareholder value as a feature rather than a bug, arguing that it would reduce wealth inequality. …it would test the restraints the U.S. Constitution places on the taking of property without compensation.

Wow, it belies belief that some leftists support policies that will hurt everyone so long as rich people suffer the most. The ghost of Jonathan Swift is smiling.

Samuel Hammond of the Niskanen Center explains why Warren’s scheme would be devastating to fast-growing innovative companies.

The United States is home to 64 percent of the world’s billion-dollar privately held companies and a plurality of the world’s billion-dollar startups. Known in the industry as “unicorns,” they cover industries ranging from aerospace to biotechnology,

and they are the reason America remains the engine of innovation for the entire world. Unless Elizabeth Warren gets her way. In a bill unveiled this week, the Massachusetts senator has put forward a proposal that threatens to force America’s unicorns into a corral and domesticate the American economy indefinitely. …the Accountable Capitalism Act is in many ways the most radical proposal advanced by a mainstream Democratic lawmaker to date. …Warren’s proposal is to fundamentally upend the way the most productive companies in the American economy work from the top down.

Writing for CapX, Oliver Wiseman wisely warns that Warren’s power-grab will undermine productivity.

…her federal charter system would make large firms accountable to politicians – not the people. And that, given the current occupant of the White House, it is surprising that someone from the left of the Democratic party cannot see how this isn’t just deeply illiberal but really rather dangerous.

…much beyond the imposition of costly and inefficient box-ticking exercises. Firms will hold meetings with communities, conduct internal reviews and, in all likelihood, reach the same decision they would have reached anyway. Only more slowly and at greater expense. …If you are worried about stagnating wages, you should be preoccupied by one thing above all else: how to boost productivity. Warren’s vision for “accountable capitalism” not only has nothing to say on the issue, it would chip at way at the dynamism that has been the engine of America’s economic success. …The proposals in the Accountable Capitalism Act are drawn up by someone interested in how the pie is sliced up, not the size of the pie. …According to the economist William Nordhaus, innovators keep just 2 per cent of the social value of their innovations. The rest of us enjoy 98 per cent of the upside.

Amen. When there’s less innovation, investment, and productivity, that means lower wages for the rest of us.

Ryan Bourne highlights for the Weekly Standard how political meddling would create uncertainty and will harm both workers and shareholders.

While she might want businesses to notionally be private entities, the “Accountable Capitalism Act” she unveiled last week represents pure, unadulterated European corporatism… Warren’s proposal would establish in the Commerce Department an Office of United States Corporations

to review and grant charters… This office is an almighty and arbitrary Damocles sword, with the politicians that control it able to hold companies in breach of charter for anything and everything they are thought not to have considered. …To say the Act would muddy the waters and create perverse incentives is an understatement. … A 1995-96 meta-analysis of 46 studies on worker participation by economist Chris Doucouliagos found that…co-determination laws were a drag. This all means lower wages for employed workers and huge losses for pension funds and other shareholders.

Last but not least, Barry Brownstein, in an article for FEE, is concerned about politicians holding the whip hand over the economy.

Senator Elizabeth Warren… Her ignorance is bold. …Under her proposed law, Warren and others in government will pretend to know much about that which they know nothing—running every large business in America.

…In a few years, under a democratic socialist president—I almost wrote national socialist president—Warren’s dystopia could become a reality. …Imagine a major bear market and the resulting spike in fear. Then, it is not so hard to imagine a future president, with a mindset like that of Senator Warren, barnstorming the country dispensing field guidance. Is not President Trump managing trade via “bold ignorance” paving the way for more politicians like Senator Warren?

These seven articles do a great job of documenting the myriad flaws with Warren’s scheme.

So the only thing I’ll add is that we also need to realize that this plan, if ever enacted, would be a potent recipe for corruption.

We already have many examples of oleaginous interactions between big business and big government. Turbo-charging cronyism is hardly a step in the right direction.

Let’s wrap up. I used to have a schizophrenic view of Elizabeth Warren. Was she a laughable crank with a side order of sleazy ambition? Or was she a typical politician (i.e., a hypocrite and cronyist)?

Now I worry she’s something worse. Sort of a Kamala Harris on steroids.

The most damning journalistic sin committed by the media during the era of Russia collusion…

The first ecological study finds mask mandates were not effective at slowing the spread of…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris note how big tech…

On "What Are the Odds?" Monday, Robert Barnes and Rich Baris discuss why America First…

Personal income fell $1,516.6 billion (7.1%) in February, roughly the consensus forecast, while consumer spending…

Research finds those previously infected by or vaccinated against SARS-CoV-2 are not at risk of…

This website uses cookies.