Trump on Jobs Report: “Good News Keeps Rolling In”

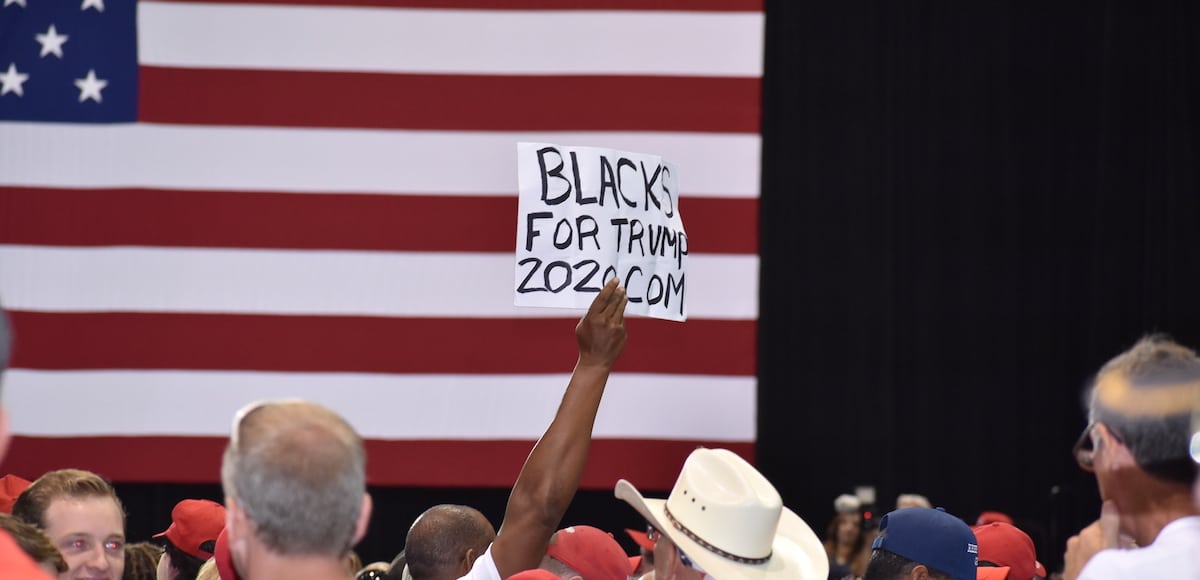

President Donald Trump touts record low unemployment for minorities during a rally in Tampa, Florida on Tuesday, July 31, 2018. (Photo: Laura Baris/People’s Pundit Daily)

President Donald Trump reacted to the jobs report for the month of July, calling it more “good news” about the “booming Trump economy.” The Labor Department via the Bureau of Labor Statistics reported Friday that the U.S. economy created 157,00 jobs and the unemployment rate fell to 3.9%.

“The good news keeps rolling in for the booming Trump economy!” the president said in a statement.

The Employment Situation, commonly referred to as the monthly jobs report, missed the consensus forecast of 190,000. But upward revisions to the change in nonfarm payrolls for the previous two months resulted in a combined additional 59,000 jobs than initially reported.

Regardless of the forecast, the government jobs report still did offer far more positives than negatives, as TJM Investments analyst Tim Anderson noted.

“While the July non farm payroll gains were a bit shy of expectations, combined upward revisions for May and June are very encouraging,” Mr. Anderson said in a statement. “Revisions always give us a good look at which direction data is trending.”

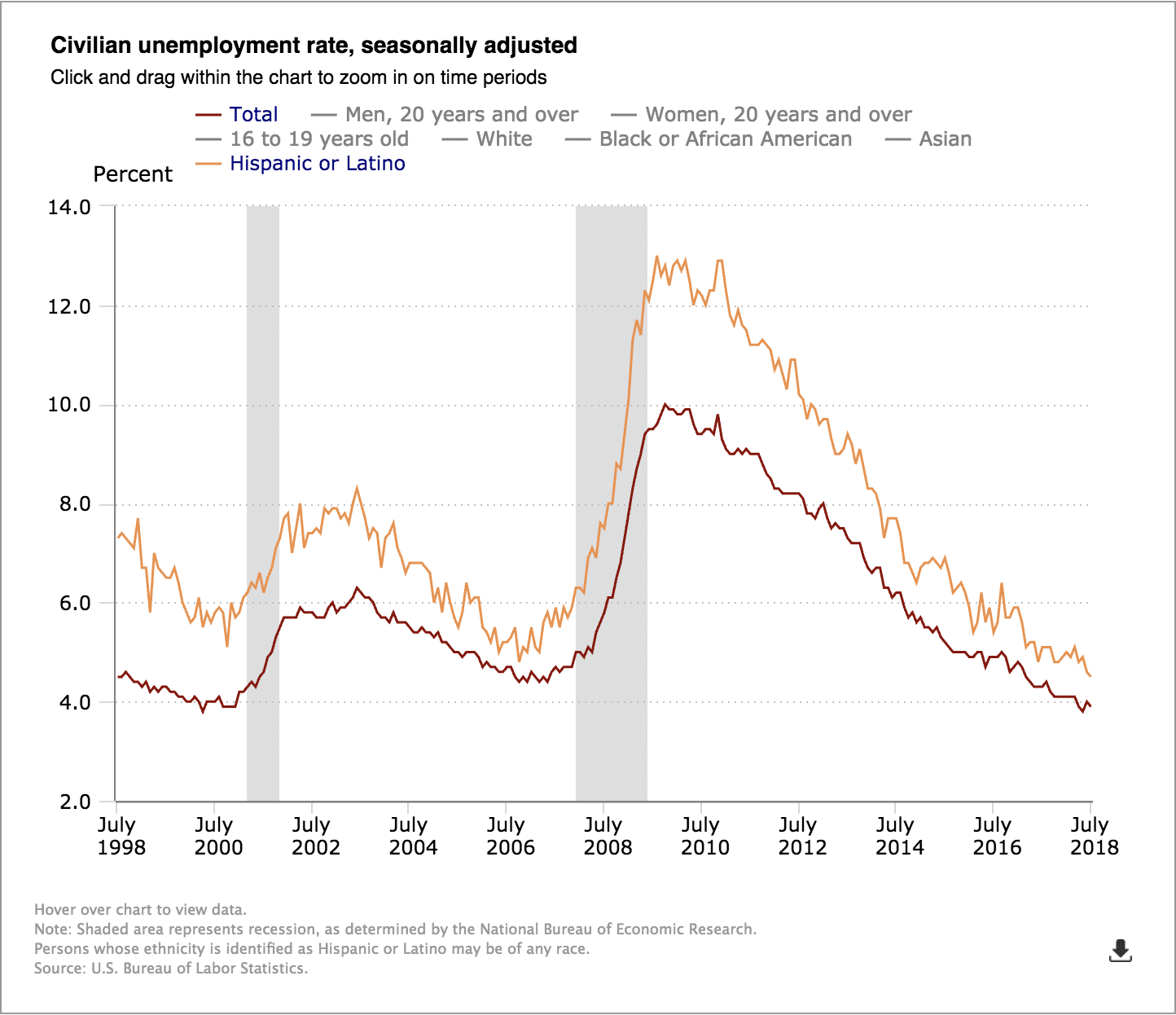

The Hispanic unemployment rate ticked down 0.1% to 4.5% in July, falling again to the lowest level ever recorded. In June, the rate among Hispanics hit the previous low (4.6%). President Trump seized on these numbers in his statement.

As the overall unemployment rate fell to 3.9%, unemployment for Hispanics and for those without a high school diploma fell to their lowest levels in recorded history, 37,000 new manufacturing jobs were created in July for an average of 21,000 new manufacturing jobs under President Trump, and average weekly earnings rose 3.0% over the past 12 months, this is the best economic progress we’ve made in years.

Hispanic unemployment averaged 1.9% higher than the general population under Barack Obama. That gap has narrowed to 0.9% for Hispanics under the Trump Administration.

The unemployment rate for African Americans ticked slightly higher by 0.1% in July, coming off an all-time low. Still, African American unemployment averaged 5.2% higher than the general population under Mr. Obama. That gap has narrowed to just 3% under the Trump Administration.

The U-6 alternative unemployment rate fell to 7.5%, down from the previous low of 7.8% measured last May. That’s the lowest U-6 rate since May 2001, and a clear indication the U.S. economy has reverted back to a full-time economy, rather than a part-time.

President Donald Trump reacted to the jobs