Watch: President Trump Addresses the Nation on Independence Day

President Donald Trump delivered an address to the American people on Independence Day, July 4, 2018.

President Donald Trump delivered an address to

President Donald Trump delivered an address to the American people on Independence Day, July 4, 2018.

President Donald Trump delivered an address to

Independence Day July 4 File Photo. (Photo: StockSnap/People’s Pundit Daily)

The majority of Americans still view Independence Day as the nation’s most important holiday, though the percentage has slipped somewhat.

The latest Rasmussen Reports national telephone and online survey finds 52% of American Adults consider Independence Day one of the nation’s most important holidays. That’s down from 56% in 2017, 61% in 2016 and 58% in 2015.

Only six percent (6%) think Independence Day, or the Fourth of July, is the least important holiday. Another 40% feel it’s somewhere in between.

The poll also found that the vast majority — or, 73% — will stay home for the holiday, while 18% will be traveling and 9% were not yet sure.

On July 4, 1826, Thomas Jefferson & John Adams died. It was 50 years after the signing of the Declaration of Independence. John Adams uttered with his last breath: “Jefferson Survives.”

The survey of 1,000 American Adults was conducted on June 27-28, 2018 by Rasmussen Reports. The margin of sampling error is +/- 3 percentage points with a 95% level of confidence.

The majority of Americans still view Independence

Investor Mark Mobius agrees “completely” with the actions President Donald Trump is making to force concessions and a reduction in the trade deficit.

“I agree with him completely,” Mr. Mobius said, much to the surprise of the liberal commentators. “The U.S. has been taken for a ride — let’s face it — over the last 20 or 30 years. It’s time to start saying, ‘Look, there has to be some reciprocity between these two countries, because it’s just crazy to have this kind of deficit.’”

Mr. Mobius, the famed investor and founder of Mobius Capital Partners LLP, said “China needs the U.S.” more than the U.S. needs China.

“I think at the end of the day, the U.S. is going to win this one, because the U.S. is the biggest importer in the world, and China needs the U.S.,” he told CNBC in an interview late Monday. “Winning means getting some concessions and a reduction in the trade deficit.”

Lost in all the coverage about the impact tariffs could have on the U.S. economy, is the recent and unexpected narrowing in the U.S. trade deficit., which shrunk to $64.8 billion in May. It was fueled by a surge in exports that sliced $2.5 billion off of the $67.3 billion in April.

In April, the U.S. trade deficit narrowed sharply to $46.2 billion in April, a big net-positive for 2Q gross domestic product (GDP).

“What I would buy now is those countries who are going to be exporting to the U.S. instead of China — like Bangladesh , Vietnam, Turkey,” he added. “These are all big producers of garments and shoes and consumer goods.”

Investor Mark Mobius agrees "completely" with the

A Boeing 737 MAX plane is seen during a media tour of the Boeing 737 MAX at the Boeing plant in Renton, Washington December 7, 2015. (Photo: Reuters)

The U.S. Census Bureau reported orders for manufactured durable goods increased $1.8 billion or 0.4% to $498.2 billion. The headline durable goods orders number has risen for 3 of the last 4 months, but the underlaying strength in the report is even stronger.

Even with the 0.4% dip in April, there was a strong build in unfilled orders.

Shipments, up 12 of the last 13 months, rose $2.8 billion or 0.6% to $496.1 billion, following a 0.1% increase in April. Unfilled orders, up 6 of the last 7 months, gained $6.2 billion or 0.5% to $1,160.8 billion. This followed a 0.6% April increase.

The unfilled orders-to-shipments ratio was 6.68, down from 6.73 in April. Inventories, up 19 consecutive months, gained $1.3 billion or 0.2% to $668.4 billion after a 0.4% increase in April. The inventories-to-shipments ratio was 1.35, unchanged from April.

New orders for manufactured durable goods in May, which have been down for 2 consecutive months, fell $0.9 billion or 0.4% to $249.2 billion. That’s up from the previously published 0.6% loss and followed a 1.0% dip in April. Transportation equipment, also down 2 consecutive months, fueled the decrease with a $0.9 billion or 1.1% decline to $86.1 billion.

New orders for manufactured nondurable goods increased $2.7 billion or 1.1% to $249.0 billion.

Unfilled orders for manufactured durable goods in May, up six of the last seven months, increased $6.2 billion or 0.5% to $1,160.8 billion. That’s unchanged from the previously published increase and follows a 0.6% increase in April. Transportation equipment, also up 6 of the last 7 months, led the increase, $3.9 billion or 0.5% to $800.2 billion.

The U.S. Census Bureau reported orders for

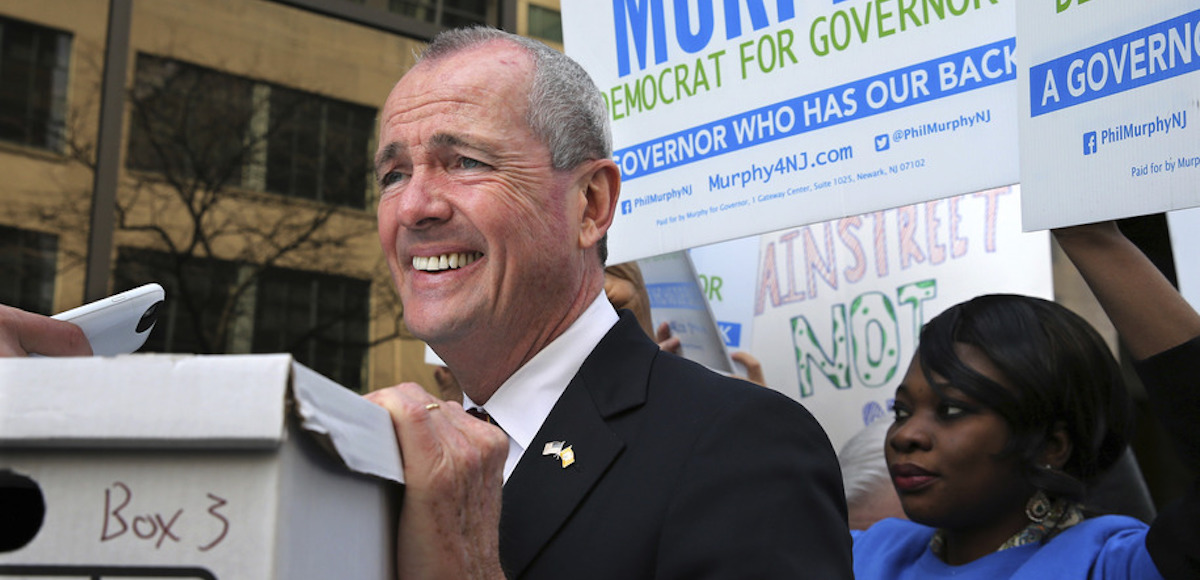

New Jersey Democratic gubernatorial candidate Phil Murphy rests his hand on a box of petitions as he answers a question before delivering the petitions to meet Monday’s deadline for candidates to file petitions to run, Monday, April 3, 2017, in Trenton, N.J. (Photo: AP)

New Jersey is a fiscal disaster area.

It’s in last place in the Tax Foundation’s index that measures a state’s business tax climate. It’s tied for last place in the Mercatus Center’s ranking of state fiscal conditions.

And it ranks in the bottom-10 in measures of state economic freedom and measures of unfunded liabilities for bureaucrat pensions.

All of this led me, last October, to warn that the state was suffering from fiscal decay.

Then, two months ago, James Freeman of the Wall Street Journal wrote about how New Jersey’s uncompetitive fiscal system was encouraging highly productive taxpayers to leave the state.

The Garden State already has the third largest overall tax burden and the country’s highest property tax collections per capita. Now that federal reform has limited the deduction for state and local taxes, the price of government is surging again

among high-income earners in New Jersey and other blue states. Taxpayers are searching for the exits. …says Jeffrey Sica, founder of Circle Squared, an alternative investments firm. “We structure real estate deals for family offices and high-net-worth individuals and at a record pace those family offices and individuals are leaving the TriState for lower-tax states. Probably a dozen this year at least,”…In the decade ending in 2016, real economic growth in New Jersey clocked in at a compound annual percentage rate of 0.1, just slightly higher than John Blutarsky’s GPA and less than a tenth of the national average for economic growth. The Tax Foundation ranks New Jersey dead last among the 50 states for its business tax climate. …Steven Malanga calls Mr. Murphy’s plan “the U-Haul Budget” for the new incentives it gives New Jersey residents to flee.

You would think that New Jersey politicians would try to stop the bleeding, particularly given the impact of federal tax reform.

But that assumes logic, common sense, and a willingness to put the interests of people above the interests of government. Unfortunately, all of those traits are in short supply in the Garden State, so instead the politicians decided to throw gasoline on the fire with another big tax hike.

The Wall Street Journal opines today on the new agreement from Trenton.

Governor Phil Murphy and State Senate leader Steve Sweeney have been fighting over whether to raise tax rates on individuals or businesses,

and over the weekend they decided to raise taxes on both. Messrs. Murphy and Sweeney agreed to raise the state’s income tax on residents making more than $5 million to 10.75% from 8.97% and the corporate rate on companies with more than $1 million in income to 11.5% from 9%. This will give New Jersey the fourth highest marginal income tax rate on individuals and the second highest corporate rate after Iowa.

New Jersey is pursuing class warfare, but the politicians don’t seem to realize that the geese with the golden eggs can fly away.

The two Democrats claim this will do no harm because about 0.04% of New Jersey taxpayers will get smacked. But those taxpayers account for 12.5% of state income-tax revenue and their investment income is highly mobile. The state treasurer said in 2016 that a mere 100 filers pay more than 5.5% of all state receipts. Billionaire David Tepper escaped from New Jersey for Florida in 2015, and other hedge fund managers could follow. Between 2012 and 2016 a net $11.9 billion of income left New Jersey, according to the IRS. The flight risk will increase with the new limit of $10,000 on deducting state and local taxes on federal tax returns. …About two-thirds of New Jersey’s $3.5 billion income outflow last year went to Florida, which doesn’t have an income tax. …The fair question is why any rational person or business that can move would stay in New Jersey.

That’s not merely a fair question, it’s a description of what’s already happening. And it’s going to accelerate – in New Jersey and other uncompetitive states – when additional soak-the-rich schemes are imposed (unless politicians figure out a way to put fences and guard towers at the border).

A few months ago, I conducted a poll on which state would be the first to suffer a fiscal collapse. For understandable reasons, Illinois was the easy “winner.” But I won’t be surprised if there are a bunch of new votes for New Jersey. Simply stated, the state is committing fiscal suicide.

New Jersey is a fiscal disaster. Now,

American businesswomen of all races. (Photo: AdobeStock)

Over the years, I’ve shared some rankings that are utterly preposterous.

Needless to say, none of these ranking pass the laugh test. You know the people involved are either deluded or dishonest.

Well, we have a new addition to this disreputable collection, as reported by CBS.

The United States has been ranked for the first time among the 10 nations deemed to be the most dangerous for women by experts in the field. A survey by the Thomson Reuters Foundation of about 550 experts in women’s issues around the globe labeled the U.S. the 10th most dangerous nation in terms of the risk of sexual violence, harassment and being coerced into sex. …According to the survey, which was last carried out in 2011 and did not then rank the U.S. among the top 10 most dangerous nations, India is the most perilous country for women… Most of the other countries in the top-10 determined by the foundation’s survey are countries with ongoing military conflicts or insurgencies, or where long-held religious and political views have kept women on an unequal footing in terms of law enforcement and treatment in society generally. …The foundation asked the experts which five of the 193 United Nations member states they felt were “most dangerous for women and which country was worst in terms of health care, economic resources, cultural or traditional practices, sexual violence and harassment, non-sexual violence and human trafficking,” according to the foundation.

And here’s their list of the supposed 10-worst countries for women.

I’m assuming that the top-9 countries are not good places for women, but think about what sort of person would put the United States at #10.

In other words, the list is a joke. And the 550 supposed “experts” in women’s issues beclowned themselves.

By the way, my criticisms have nothing to do with ideology. There are many lists from left-wing groups that are intellectually rigorous. I strongly disagree with the folks at the Tax Justice Network, for instance, but their Financial Secrecy Index is methodologically honest and sound.

I also should point out that my objections have nothing to do with the USA looking bad. I don’t like it when the United States doesn’t crack the top-10 in measures of rule of law, tax competitiveness, or economic liberty, yet I share such data with no hesitation.

Shame on the Thomson Reuters Foundation is a joke for publishing such a list.

A "disreputable" Thomson Reuters Foundation survey claims

President Donald Trump speaks during a bicameral meeting with lawmakers working on the tax cuts in the Cabinet Meeting Room of the White House in Washington, Wednesday, Dec. 13, 2017. Attending the meeting are, from left, Rep. Kevin Brady, R-Texas; Trump; Sen. Orrin Hatch, R-Utah; Rep. John Shimkus, R-Ill., and Rep. Fred Upton, R-Mich. (AP Photo)

During the Obama years, I used data from the Minneapolis Federal Reserve to explain that the economic recovery was rather weak. And when people responded by pointing to a reasonably strong stock market, I expressed concern that easy-money policies might be creating an artificial boom.

Now that Trump’s in the White House, some policies are changing. On the plus side, we got some better-than-expected tax reform. Moreover, the onslaught of red tape from the Obama years has abated, and we’re even seeing some modest moves to reduce regulation.

But there’s also been bad news. Trump’s bad protectionist rhetoric is now turning into bad policy. And his track record on spending is very discouraging.

What’s hard to pin down, though, is the impact of monetary policy. The Federal Reserve apparently is in the process of slowly unwinding the artificially low interest rates that were part of its easy-money approach. Is this too little, too late? Is it just right? What’s the net effect?

Since economists are lousy forecasters, I don’t pretend to know the answer, but I think we should worry about the legacy impact of all the easy money, which is the point I made in this clip from a recent interview.

James Pethokoukis from the American Enterprise Institute has similar concerns.

Here’s some of what he recently wrote on the topic.

…this supposed “boom” looks more like same-old, same-old. First quarter GDP, for instance, was just revised down two ticks to 2% and monthly job growth is a bit weaker than under President Obama’s final few years. …What’s more, pretty much every recession for a century has been accompanied by some magnitude of explicit Fed tightening. And, of course, the Fed is now well into a tightening cycle. …Another complicating factor is the Trump trade policy, which seems to be a market suppressant right now, if not yet a significant economic one.

Those are all good points, though we still don’t know the answer.

I’ll close with two observations.

And that second issue gives me an excuse to re-emphasize that Keynesian monetary policy is just as foolish as Keynesian fiscal policy. You may enjoy a “sugar high” for a period of time, but eventually there’s a painful reckoning.

The U.S. economy has bounced back strongly

New residential homes are shown under construction in Carlsbad, California September 19, 2011. (Photo: Reuters)

Construction spending was estimated at a seasonally adjusted annual rate of $1,309.5 billion, 0.4% above the revised April estimate of $1,304.5 billion. The reading in May is 4.5% above the May 2017 estimate of $1,253.6 billion.

During the first 5 months of this year, construction spending amounted to $497.1 billion, 4.3% above the $476.7 billion for the same period in 2017.

Spending on private construction was at a seasonally adjusted annual rate of $1,005.4 billion, 0.3% above the revised April estimate of $1,002.3 billion. Residential construction was at a seasonally adjusted annual rate of $553.8 billion in May, 0.8% above the revised April estimate of $549.3 billion.

Nonresidential construction was at a seasonally adjusted annual rate of $451.5 billion in May, 0.3% below the revised April estimate of $453.0 billion.

In May, the estimated seasonally adjusted annual rate of public construction spending was $304.1 billion, 0.7% above the revised April estimate of $302.1 billion. Educational construction was at a seasonally adjusted annual rate of $74.3 billion, 0.9% above the revised April estimate of $73.6 billion.

Highway construction was at a seasonally adjusted annual rate of $94.6 billion, 0.2% below the revised April estimate of $94.8 billion

Construction spending was estimated at a seasonally

An American Flag flying in front of a U.S. manufacturing factory. (Photo: AdobeStock)

The Institute for Supply Management (ISM) PMI Manufacturing Index (PMI) grew for the 110th consecutive month, rising from an already strong 58.7 to 60.2. The reading for June easily beat the 58.5 consensus forecast.

“Comments from the panel reflect continued expanding business strength,” Timothy R. Fiore, Chair of the ISM Manufacturing Business Survey Committee. “Demand remains strong, with the New Orders Index at 60 percent or above for the 14th straight month, and the Customers’ Inventories Index remaining low.”

The New Orders Index registered 63.5%, a tiny decline of of 0.2% from the May reading of 63.7%. The Production Index registered 62.3%, a 0.8% increase compared to the May reading of 61.5%. The Employment Index registered 56%, a decrease of 0.3% from the May reading of 56.3%.

The Supplier Deliveries Index registered 68.2%, an increase of 6.2% from the May reading of 62%. The Inventories Index registered 50.8%, an increase of 0.6% from the May reading of 50.2%.

The Prices Index registered 76.8% in June, a decline of 2.7% from the May reading of 79.5%, indicating higher raw materials prices for the 28th consecutive month.

“Demand remains robust, but the nation’s employment resources and supply chains continue to struggle,” Mr. Fiore. “Respondents are overwhelmingly concerned about how tariff related activity is and will continue to affect their business.”

No industry reported a decrease in June compared to May.

The Institute for Supply Management (ISM) PMI

President Donald Trump speaks during a swearing-in ceremony for Attorney General Jeff Sessions at the White House. (Photo: Reuters)

In July 2017, the Trump Administration announced the largest healthcare fraud bust in U.S. history, charging more than 400 defendants in federal 41 districts. This week, the administration announced an even bigger bust, breaking the record previously set last July.

As was the first, this massive operation was a partnership between the Justice Department (DOJ) Criminal Division, U.S. Attorney’s Offices, the Federal Bureau of Investigation (FBI), the Department of Health and Human Services (HHS)-OIG and Medicare Fraud Strike Force (MFSF). Thirty state Medicaid Fraud Control Units also participated.

“Health care fraud is a betrayal of vulnerable patients, and often it is theft from the taxpayer,” Attorney General Jeff Sessions said in a statement. “In many cases, doctors, nurses, and pharmacists take advantage of people suffering from drug addiction in order to line their pockets. These are despicable crimes.”

A stunning 601 defendants were charged as a result of the bust across 58 federal districts. That includes 165 doctors, nurses and other licensed medical professionals for their alleged participation in health care fraud schemes involving more than $2 billion in false billings.

Justice noted that the number of medical professionals charged in the bust is also significant considering that “virtually every health care fraud scheme requires a corrupt medical professional to be involved” in order for Medicare or Medicaid to pay out claims.

“Healthcare fraud touches every corner of the United States and not only costs taxpayers money, but also can have deadly consequences,” FBI Deputy Director David L. Bowdich said in a statement. “Through investigations across the country, we have seen medical professionals putting greed above their patients’ well-being and trusted doctors fanning the flames of the opioid crisis.”

According to court documents, the defendants allegedly participated in schemes to submit fraudulent claims to Medicare, Medicaid, TRICARE, and private insurance companies. The claims billed for treatments that DOJ said were medically unnecessary. Often, these treatments were never even provided to the patients.

In exchange for giving beneficiary information to providers, many patient recruiters, beneficiaries and other co-conspirators were allegedly paid cash kickbacks.

Further, from July 2017 to the present, HHS has excluded 2,700 individuals from participation in Medicare, Medicaid, and all other government-centered health care programs. That includes 587 providers excluded for conduct related to opioid diversion and abuse.

“Much of this fraud is related to our ongoing opioid crisis—which is the deadliest drug epidemic in American history,” Attorney General Sessions said Thursday at a press conference. “Some of our most trusted medical professionals look at their patients—vulnerable people suffering from addiction—and they see dollar signs.”

President Donald Trump campaigned on combating the opioid crisis and, as commander-in-chief, has made the scourge of opioid abuse a central focus of his administration. In fact, the Trump Administration has effectively waged a war against opioid abuse and those who enable it.

The National Institute of Drug Abuse found nearly 80% of heroin users started with prescription opioids. From 1999 to 2016, overdose deaths as a result of heroin use increased 7x, and deaths from synthetic opioids such as fentanyl has risen by nearly 21x.

In March 2018, the White House unveiled the Initiative to Stop Opioids Abuse and Reduce Drug Supply and Demand. The three-pronged strategy targets the factors the Commission and others identified as fueling the opioid crisis, including increased prosecution of those fueling the crisis.

On the 500th day of the Trump Administration, Mr. Sessions announced they have added 311 new Assistant U.S. Attorneys “to assist in priority areas” such as the opioid criss, immigration and violent crimes. It is the largest increase in AUSAs in decades.

“That’s why this Department of Justice has taken historic new steps to go after fraudsters, including hiring more prosecutors and leveraging the power of data analytics,” Attorney General Sessions added. “This is the most fraud, the most defendants, and the most doctors ever charged in a single operation—and we have evidence that our ongoing work has stopped or prevented billions of dollars’ worth of fraud.”

Since January 2017, DOJ have charged nearly 200 doctors and another 220 other medical personnel for opioid-related crimes. Sixteen of those doctors prescribed more than 20.3 million pills illegally. This year alone, DOJ charged 76 doctors, 23 pharmacists, 19 nurses, and other medical personnel with medical fraud totaling more than $2 billion.

For as long as the American electorate can remember, presidential candidates have vowed to crackdown on healthcare fraud and other waster, fraud and abuse in government programs. But come Election Day, those promises have traditionally evaporated.

But not under the Trump Administration.

“I believe that is already deterring and preventing fraud,” Attorney General Sessions continued. “In two districts where we have Health Care Fraud Strike Forces, we have seen a 20 percent drop in Medicare Parts A & B billings.”

The (FY) 2017 Health Care Fraud and Abuse Control Program released a report in April that found for every dollar the federal government spent on healthcare-related fraud and abuse in the last three years, they recovered $4.00. In FY 2017, the Trump Administration’s efforts recovered $2.6 billion in taxpayer dollars from individuals and entities.

“Every dollar recovered in this year’s operation represents not just a taxpayer’s hard-earned money—it’s a dollar that can go toward providing healthcare for Americans in need,” HHS Secretary Alex Azar said. “This year’s Takedown Day is a significant accomplishment for the American people, and every public servant involved should be proud of their work.”

This week, the Trump Administration announced the