Senate Minority Leader Chuck Schumer (D-NY) speaks after the Democratic policy luncheon on Capitol Hill in Washington, U.S., January 9, 2018. (Photo: Reuters)

Defending nearly a dozen seats in states President Donald Trump carried in November of 2016, Senate Democrats intend to run on a massive tax hike and $1 trillion in new spending.

This week, Congressional Democrats released a detailed plan to increase taxes and spend that money on infrastructure if voters give them back control of the U.S. House of Representatives and the U.S. Senate in the 2018 midterm elections. After a year of arguing about the debt and 9 years of not caring about it, they proposed Stimulus 2.0.

Senate Minority Leader Chuck Schumer, D-N.Y., released the plan with Senators Patrick Leahy, D-Vt., Ron Wyden, D-Oreg., Bill Nelson, D-Fla., Tom Carper, D-Del., Debbie Stabenow, D-Mich., Maria Cantwell, D-Wa., Bernie Sanders, I/D/Socialist-Vt., and Sherrod Brown, D-Ohio.

Three of those senators are up for reelection in states President Trump won — Senators Nelson, Stabenow and Brown.

The plan was billed as a reversal of the “tax giveaways to corporations and the wealthy” in the Tax Cuts and Jobs Act (TCJA), the first overhaul to the U.S. tax code in 31 years. The president’s signature tax reform bill didn’t receive a single Democratic vote and is now supported by the majority of Americans, with larger margins among voters in battleground states.

As People’s Pundit Daily (PPD) and others reported, the TCJA has resulted in millions of Americans receiving bonuses, wage increases and other related benefits. Roughly 85% of American workers received a cut to their tax burden and 90% received more money in their paychecks, while less than 5% saw a hike. The latter group is mostly wealthy, higher-earning taxpayers.

The Democratic plan would increase the top marginal income tax rate to 39.6%, up from 37%. Unfortunately, that tax hike would also directly hit 30 million small and mid-sized sole proprietorships, partnerships, Subchapter-S corporations and LLCs. These companies pay their business taxes on their owners’ 1040 personal tax returns.

The ADP National Employment Report released this week showed small- and medium-sized businesses picking up the pace in hiring. The ADP and the Employment Situation report released Friday by the Labor Department via the Bureau of Labor Statistics (BLS) both crushed expectations.

Small Business Optimism, the Survey of Consumers and the Consumer Confidence Index are soaring, with panel respondents all citing the TCJA (here, here and here).

In response, the Democratic plan is to re-raise the corporate tax rate to what they called a “competitive” 25%, which they said would prevent “a massive windfall to special interests” and “CEO bonuses being prioritized over hiring new employees and increasing workers’ pay.”

In truth, Pfizer Inc (NYSE: PFE) and many other corporations specifically excluded chief executive officers and upper level positions from tax reform-related bonuses and benefits.

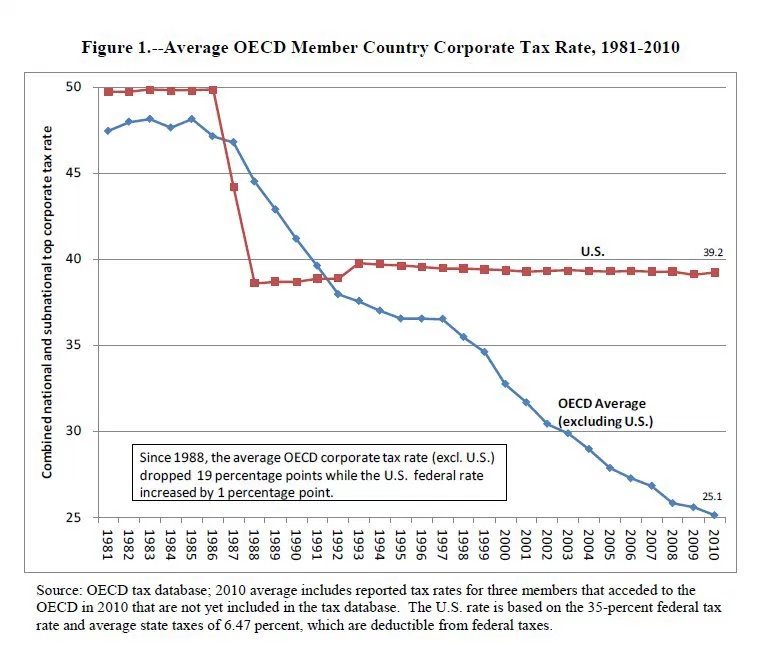

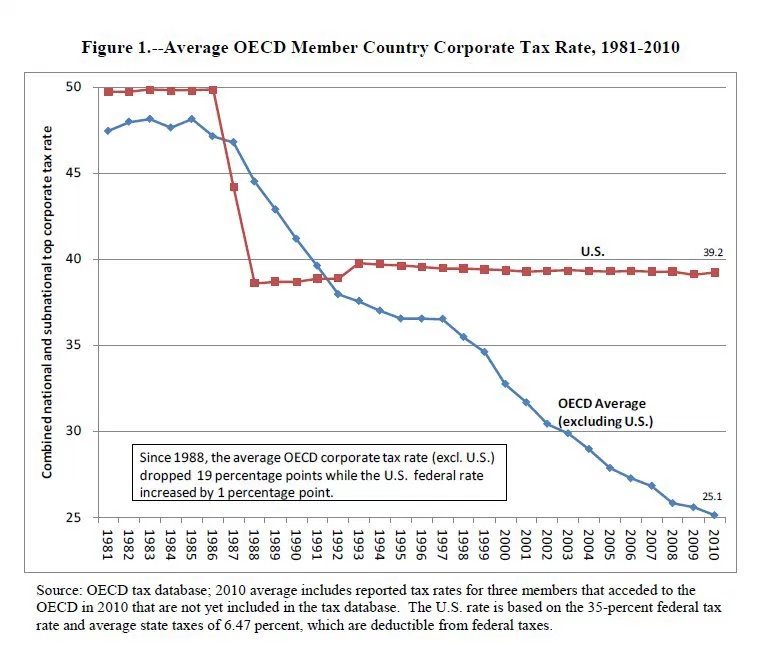

Prior to the TCJA, the U.S. suffered under the highest corporate income tax in the developed world. Republicans in Congress cut the U.S. corporate rate from 35% to 21%, which research shows does result in higher wages.

Research from the liberal Organization for Economic Cooperation and Development (OECD) showed the U.S. corporate tax rate was well above the average for the developed world.

As CATO economist Dan Mitchell explained, OECD research also shows cutting the corporate tax rate resulted in higher wages for workers. The Personal Income and Outlays report from the Bureau of Economic Analysis (BEA) confirmed the near-immediate rise in wages due to the TCJA.

Congressional Democrats said reversing the “trickle-down economic policy” of corporate tax cuts would raise $359 billion in revenue to spend on infrastructure. However, Chris Edwards of the Cato Institute reviewed fifty years of data for industrialized nations and ascertained that lower tax rates are associated with rising revenue.

Democrats also propose to bring back the alternative minimum tax (AMT), which would impact 4 million U.S. families. The TCJA repealed the heavy tax burden for roughly 99% of those previously impacted. The AMT disproportionately hit two-income, white collar families with children in blue states such as California, New York and New Jersey.

In the TCJA, Republicans doubled the exemption for the “death tax,” which Democrats refer to as the more palatable estate tax, from $5.5 million to $11 million for individuals and a $22 million for married couples. Democrats plan to bring back the death tax, though between 6 to 7 in 10 Americans oppose it, to raise another $83 billion in revenues over 10 years.

Nevertheless, the Democratic plan to spend hypothetical revenue raised from tax hikes on an infrastructure plan would cost taxpayers more than $1 trillion. Here is how it brakes down:

– $140 Billion to Repair America’s Roads & Bridges

– $10 Billion to Expand the TIGER Program

– $115 Billion to Modernize America’s Water & Sewer Systems

– $115 Billion to Repair & Improve Public Transportation

– $50 Billion to Modernize and Improve the Safety of America’s Rail Infrastructure

– $40 Billion for a new Vital Infrastructure Program

– $30 Billion to Revitalize Main Street & Promote Innovative Transportation

– $62 Billion for Neighborhood Revitalization, Lead Remediation, & Affordable Housing

– $50 Billion to Rebuild America’s Schools

– $30 Billion to Modernize America’s Ports & Waterways

– $40 Billion to Improve America’s Airports & Airspace

– $25 Billion to Build More Resilient Communities

– $80 Billion to Bring Innovation to America’s Energy Grid & Promote Clean Energy

– $40 Billion to Provide Universal High-Speed Internet

– $15 Billion for Construction on America’s Public Lands

– $10 Billion for Tribal Infrastructure

– $10 Billion to Address the Construction Backlog at VA Healthcare Facilities

– $20 Billion in Innovative Financing Tools

– $140 Billion to Ensure the Solvency of the Highway Trust Fund for the next 10 years

But there’s another potential and major problem with their infrastructure plan aside from the loss in revenue that would result from tax avoidance behavior. Put simply, the federal government doesn’t have the ability or legal authority to make the very necessary repairs to America’s infrastructure often cited.

By comparison, President Trump unveiled a $1.5 trillion proposal to rebuild the nation’s infrastructure through public-private partnerships. However, it doesn’t call for Congress to write a check for that amount.

The plan instead calls for $200 billion in federal funds to spur at least $1.5 trillion in infrastructure investments with partners at the state, local, tribal and private level. Even if the federal government could fund all the projects the Democrats propose, they don’t have the legal authority to go it on their own.

For instance, the American Society of Civil Engineers (ASCE) gave U.S. infrastructure a cumulative D+ GPA in 2017. With 90,580 dams in the country having an average age of 56-years-old, the sub-sector received a D grade. By 2025, 7 out of 10 dams in the U.S. will be over 50 years old.

It is estimated that it will require an investment of nearly $45 billion to repair critical, aging, high-hazard potential dams. But according to the Association of State Dam Safety Officials, only 14% of dams in the U.S. are owned or regulated by government agencies.

Without a public-private partnership program such as the one proposed by President Trump, the nation’s dams and other sub-sector repairs have no hope for repair.

Neither the Democratic National Committee (DNC), the Democratic Congressional Campaign Committee (DCCC) nor the office of the minority leader responded to a request for comment.

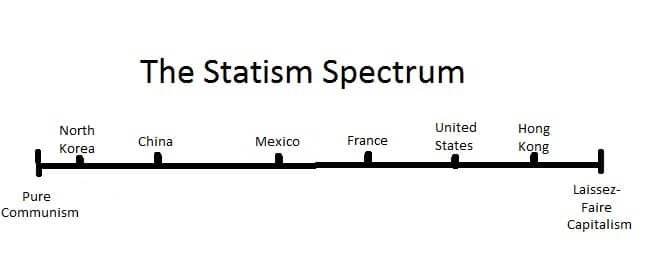

You don’t need to be an economist to understand why Sanders and Corbyn are wrong. Normal people

You don’t need to be an economist to understand why Sanders and Corbyn are wrong. Normal people