Trump’s Spending Splurge Is a Long-Run Recipe for Higher Taxes and Less Prosperity

I sometimes sardonically comment about Democratic politicians playing Santa Claus, but Republicans can play that game as well.

Trump and his allies in Congress recently agreed on a big-spending budget deal that lavishes more money on both the Pentagon and domestic programs, and that was only a few weeks after agreeing on a tax reform plan that lower taxes (though only for nine years).

Even if I like part of what’s been happening, that kind of populist approach at some point becomes unsustainable. And when the D.C. swamp ultimately has to choose between lower taxes or higher spending, they’ll go with the latter and make things even worse by jacking up the tax burden.

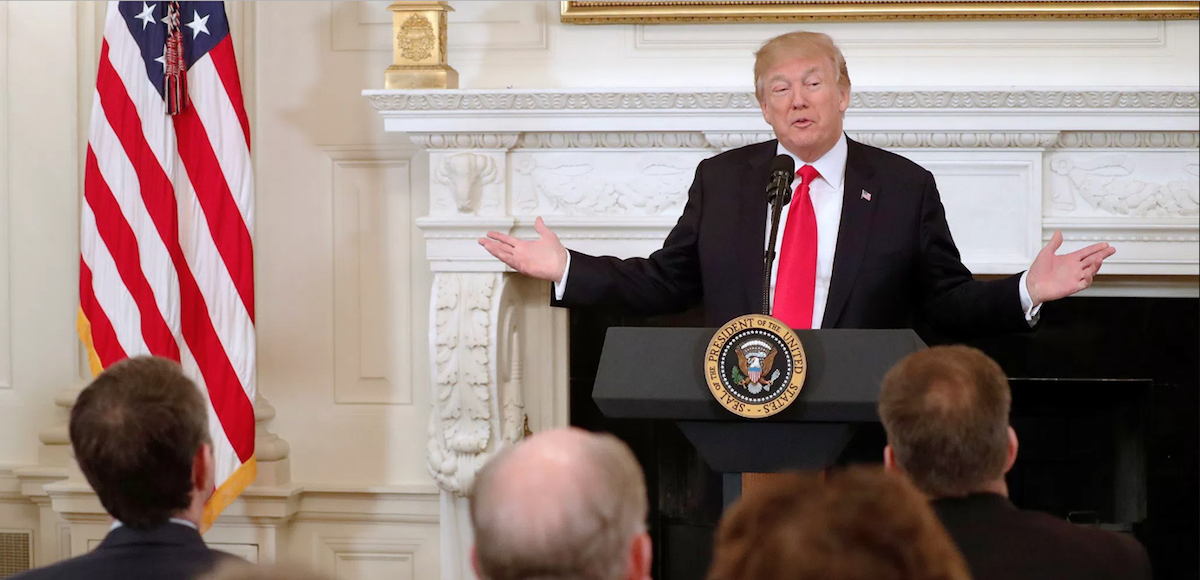

My frustration is apparent in this recent interview.

And I’m not the only one who sees the long-run dangers.

In a column for the Wall Street Journal, Professor Edward Lazear of Stanford explores the economic damage of ever-expanding government.

The budget deal President Trump signed earlier this month will send federal spending and the deficit skyrocketing. On top of this spending explosion, the administration now plans to add a $500 billion infrastructure bill. …over time high spending necessitates high taxes, and high taxes reduce work and restrain growth. Economic trends in developed nations consistently show that low taxes and hard work are linked to robust growth.

He looks at some of the cross-country evidence.

European countries trail the U.S. in working hard and controlling taxes, and their economies have lagged in comparison. France has a tax-to-GDP ratio of about 44%, and in Italy it’s 43%. The French and Italians work almost 30% fewer hours per person than Americans. Notably, the French economy has flatlined since 2010 while Italy’s has contracted. …Data from the Organization for Economic Cooperation and Development suggests that a 1% increase in a nation’s tax rate is associated with a 1.4% decrease in hours worked per person in the working-age population.

Here’s the part that resonated with me. It’s excessive spending that ultimately is the problem.

…taxes are ultimately dictated by spending. Countries can borrow to finance short-run spending, but they must eventually levy taxes to repay the loans. Whether a government raises taxes now or later to pay for expenditures is a minor consideration compared with its decision to spend in the first place. …Higher spending goes hand in hand with higher taxes, higher deficits, fewer worked hours and less growth. The international comparisons suggest that a 4% increase in spending is associated with a decrease of roughly 0.5 percentage point in the average annual growth rate. Furthermore, it is spending—rather than the deficit—that correlates with sluggish growth. …Deficits often coincide with low growth because deficit increases are usually caused by heightened spending, not reduced taxes. Raising taxes, or keeping them high without lowering spending, stifles growth.

Heck, even the OECD has produced research on the negative impact of government spending on economic performance.

And this approach can lead to a downward spiral.

To the extent that government spending goes to programs such as welfare that directly discourage work, it has an additional growth-reducing effect. When fewer people work, those who do must be taxed even more to cover public expenses. These heightened taxes on labor discourage work in turn, pushing more potential workers toward government support.

In other words, if we stay on this path, we’ll eventually become Greece. Not a good idea, to put it mildly.

Since we’re on the topic, let’s look at some additional evidence. Three economists from Australia and the United Kingdom did a meta-analysis of studies on the relationship between government spending and economic growth. Here are some of the findings.

One of the most contentious issues in economics is whether ‘big government’ is good or bad for economic growth. …Theoretically, big government can have both negative and positive effects on growth. …In this study, we include all effect-size estimates reported by empirical studies that examine the direct effect of government size on growth.

Here’s what they found.

… findings indicate that: (i) total government expenditures have a medium and adverse effect on per-capita income growth in developed countries only; (ii) the effect of government consumption on per-capita income growth is also medium in developed countries and in developed and LDCs pooled together; and (iii) neither total expenditures nor government consumption has a significant effect on per-capita income growth in LDCs.

I’m not surprised that they didn’t find a strong link in poor nations. The data show that those countries are generally too mismanaged and corrupt to collect much revenue. Therefore, as I noted in my recent analysis of Indian economic policy, they can’t spend much.

What’s primarily holding back those countries is weak rule of law, excessive regulation, and protectionism.

But I’m digressing. The study also acknowledges the Rahn Curve, though they call it the Armey Curve.

…government size tends to have a negative effect on per-capita income growth as the level of income increases. This finding ties in with the Armey curve hypothesis (Armey, 1995), which posits an inverted-U relationship between government size and economic growth. The theoretical argument here is that government size may be characterised by decreasing returns. Another theoretical argument relates to the distortionary nature of taxes, which is minimal for low levels of taxation, but beyond a certain threshold, they grow rapidly and become extremely large.

Quite true.

Sadly, some people mistakenly conclude that if a little bit of government is associated with more prosperity, then a bloated public sector must be even better.

On a related note, Professor Alexander Salter dismisses the assertion (pushed by international bureaucracies) that big government is a pre-condition for prosperity. Here’s some of what he wrote.

Why are Western countries like the United States and Germany so much richer today than other countries around the world? …One explanation for the success of the West is, in a word, liberty. Over the last few hundred years, classical liberal ideas such as the rights of man and the rule of law put constraints on European governments’ power, which resulted in a strong protection of private property rights. This resulted in meteoric economic growth, which delivered the modern cornucopia of wealth. …Free countries get rich; unfree countries stay poor.

But there’s a competing theory.

…another explanation — state capacity…is the idea that economic development requires strong, centralized states to uphold the rule of law and provide crucial public goods. …The state capacity literature in economics…places heavy emphasis on a single, strong, central legal authority. In this framework, the fractured and decentralized legal authorities in medieval and early modern Europe are now seen as antithetical to economic development.

Salter is skeptical of the second theory.

…it is undeniable that economic growth in the West did not take off until the rise of modern nation-states. … While governance institutions obviously began centralizing at the beginning of the modern era, …that’s insufficient as a causal explanation. …the state capacity literature has a hard time dealing with a very troubling counterexample: the totalitarian states of the 20th century: like the USSR and China. These states had plenty of capacity, as evidenced by their ability to murder millions of their own citizens… Needless to say, these kinds of things aren’t conducive to economic development.

So he concludes that the first theory must be the answer, at least in part.

…whatever is “doing the work” of promoting economic growth, it is upstream of the creation of states. …State capacity may or may not be a valuable steppingstone to an explanation, but it is not itself an explanation that social scientists should accept. …it seems the old hypothesis — that the big ideas of classical liberalism created Western economic growth — is worth another look!

My bottom line, for what it’s worth, is that the classical-liberalism approach is the necessary condition, but that doesn’t automatically make it a sufficient condition.

In a column last year on the emerging micro-state of Liberland, I tried to square the circle. Here’s some of what I wrote after looking at the literature on state capacity.

…the key to prosperity is having a state strong enough and effective enough to provide rule of law, but to somehow constrain that state so that it doesn’t venture into destructive redistribution policies. This is why competition between governments played a key role in the economic development of the western world. When governments have to worry about productive resources escaping, that forces them to focus on things that help an economy (i.e., rule of law) while minimizing the policies that hinder prosperity (i.e., high taxes and spending). …America’s Founding Fathers dealt with the same issues… Their solution was a constitution that explicitly limited the size and scope of the federal government. …that system worked reasonably well until the 1930s.

I find this issue fascinating, but I suspect most people are more concerned about the real-world consequences rather than the theoretical underpinnings.

So I’ll end on a pessimistic note by observing that we normally get bad fiscal policy from Democrats and worse fiscal policy from Republicans (Reagan being the only modern-era exception).

President Donald Trump is doing little to