President Donald Trump poses for a portrait in the Oval Office in Washington, Friday, April 21, 2017. (Photo: AP)

Looking back on President Donald Trump’s first year in office, he has compiled a shockingly strong record and long list of accomplishments. As was also the case with his rise to the presidency, President Trump has broken several records for a first-year commander-in-chief and fulfilled many of his key campaign promises.

Now, that’s not to say he hasn’t had failures and it’s not to mask the fact that many of these accomplishments were unilateral. But it is also true that President Trump has faced an unprecedented level of never-ending obstruction throughout the year. He was the first president in memory to be deprived of the “honeymoon” period after Inauguration Day and, frankly, opposition at times has risen to levels that could arguably constitute downright treason.

Sure, his presidency, much like his campaign, has been unconventional and his governing style appears to pundits and mediates to be rather messy.

And that’s exactly what America should’ve expected.

America didn’t elect Donald J. Trump to get more of the same and D.C. wouldn’t have had such a vial backlash had he not been trying to keep the promises he made to the American people. Had it been business as usual this year, then we would have grown suspect.

Here’s a long but still incomplete list of accomplishments during his first year in office. For those who believe the list isn’t at all long, we challenge you to read the whole article in one sitting. Some you will recognize and some you will not. But these are just some of the actions we believe will impact Americans’ lives and, in some cases, the human race.

Tax Cuts and Jobs Act

President Donald J. Trump speaks during a celebratory bill passage event following the final passage of the Tax Cuts and Jobs Act by Congress. (Photo: AP)

President Trump signed the Tax Cuts and Jobs Act before Christmas, ensuring U.S. business commitments for bonus payouts to at least hundreds of thousands of Americans workers. Within hours, numerous businesses announced wage increases and billions of dollars in various industry investments.

It was the first overhaul to the U.S. tax code in 31 years, but that’s not all it was.

Repealed Individual Mandate

The tax overhaul also repealed the individual mandate in ObamaCare. Republicans targeted the individual mandate during arguments before the U.S. Supreme Court and lost because the Bush-appointed Chief Justice John Roberts rewrote the law to uphold it.

The U.S. Senate attempted a half-hearted ObamaCare repeal after 7 years of campaign promises, and failed. They attempted to pass a so-called “skinny repeal,” and failed again. It was the businessman outsider with no political experience who worked with a few senators to sneak in a repeal of the least popular ObamaCare provision at the last minute, and it worked.

Big Media was working overtime for the Democratic Party to mislead the American people about the bill and they didn’t see it coming until it was too late. Democrats were left to pretend as if they were happy the individual mandate was repealed because they could pass off the blame for already-rising premiums on Republicans.

It remains to be seen whether that tactic works. But for Republican voters freedom and choice are more important than scoring political points. The Internal Revenue Service (IRS) — an agency that once targeted them for their political beliefs — has been weakened.

Arctic National Wildlife Refuge (ANWR)

For nearly 40 years, Republicans have tried and failed to open the Arctic National Wildlife Refuge (ANWR) for oil drilling. Since the 1980s, the effort always failed in the face of intense opposition because weak congressional Republicans were too afraid of the Democrat-Big Media coalition.

They repeatedly abandoned the decades-old campaign promise.

Yet, a provision for drilling in ANWR was included in the President’s signature tax bill with minimal backlash.

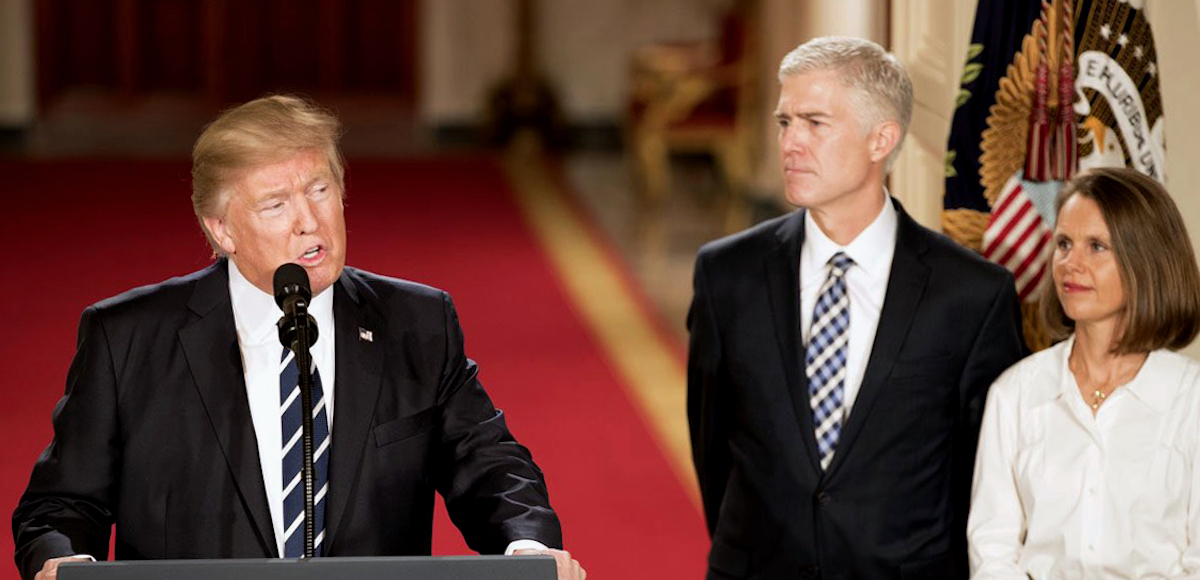

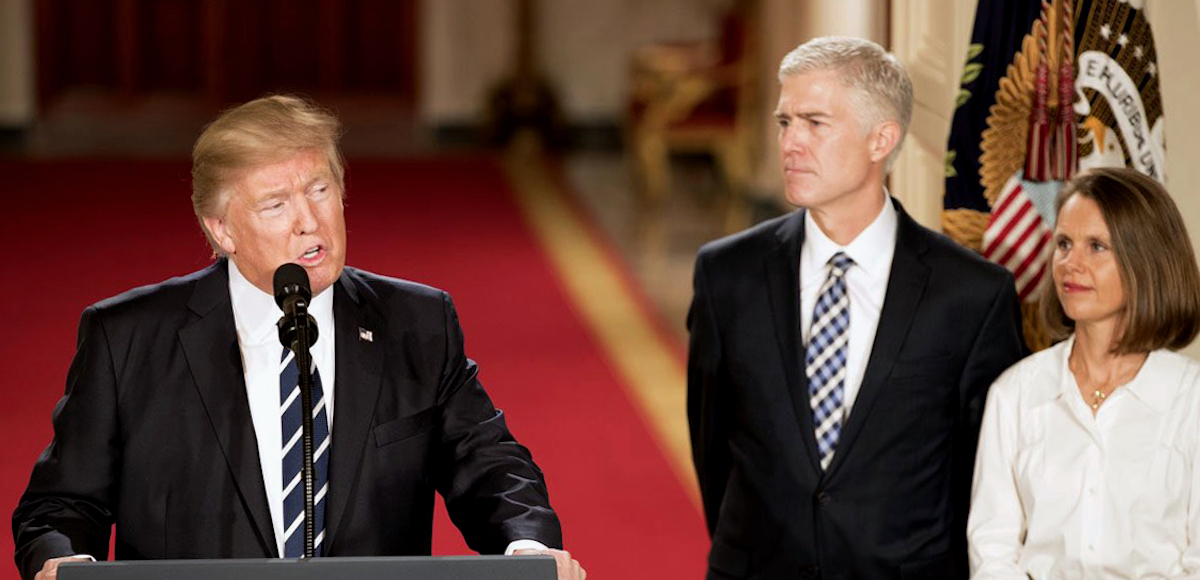

Justice Neil Gorsuch

Judge Neil Gorsuch, his wife Louise, with President Donald Trump during the nomination announcement in the East Room of the White House on January 31, 2017. (Photo: White House)

President Trump nominated and the U.S. Senate confirmed Justice Neil Gorsuch, despite unprecedented opposition and obstruction by Senate Democrats. Many of those same Democratic senators, including Minority Leader Chuck Schumer, D-N.Y., unanimously confirmed Justice Gorsuch to his prior role in a voice vote back in 2006.

As People’s Pundit Daily (PPD) has previously examined, the Democratic Party historically has been the party of obstruction with judicial appointments, particularly relating to the Supreme Court.

“We’ve cemented the Supreme Court right-of-center for a generation,” Senate Majority Leader Mitch McConnell, R-Kty., said while rattling off his own list of year-one accomplishments during the celebration for tax reform at the White House. “Mr. President, thanks to your nominees, we’ve put 12 circuit court judges in place — the most since the circuit court system was established in 1891.”

Set Record for First-Year Judicial Appointments to Federal Appellate Courts

President Donald Trump speaks to the press alongside Senate Majority Leader Mitch McConnell (R), Republican of Kentucky, in the Rose Garden of the White House in Washington, DC, October 16, 2017. (Photo: Reuters)

President Trump on December 14 officially set a record for the most federal appeals judges appointed during the first year of a presidency, more than any other before him. The U.S. Senate pushed through the twelfth federal appeals court nominee that day, breaking the previous record held jointly by Presidents Richard Nixon and John F. Kennedy.

As we’ve seen front-and-center during the first year of the Trump Administration, judicial appointments can have a very significant impact on public policy and a president’s legacy. Democrats are particularly inclined to engage in “judge-shopping” when they fail to muster enough support for an initiative at the ballot box or implement policy through the legislative process.

That was the case with same-sex marriage, abortion, unfettered illegal immigration and numerous landmark decisions that have real-world impact on everyday life and the future of the nation.

For context, Barack Obama nominated and the Democrat-controlled Senate successfully confirmed only 3 appeals court judges in his first year in office in 2009. Former President George W. Bush got six federal judges confirmed.

As of mid-December, 19 of President Trump’s 66 total nominees this year have been confirmed.

Historic Reduction in Illegal Immigration

Homeland Security Secretary John Kelly, right, listens to U.S. President Donald Trump during a meeting with cyber security experts in the Roosevelt Room of the White House in Washington January 31, 2017. (Photo: Reuters)

President Trump made cracking down on illegal immigration the centerpiece of his campaign and end-of-year statistics from the Department of Homeland Security (DHS) show historic success during the first year of his administration.

The U.S. Customs and Border Protection (CBP) in FY 2017 reported a 23.7% decline over the previous year. Illegal migration along the Southwest border declined sharply from January 21 to April, which was the lowest month of border enforcement activity on record. In FY 2017, CBP reported the lowest level of illegal cross-border migration ever on record.

The U.S. Immigration and Customs Enforcement (ICE) and Removal Operations (ERO) conducted 143,470 arrests and removed 226,119 illegal aliens, an increase of 40% from the previous fiscal year. From the start of the Trump Administration on January 20, 2017 through the end of the fiscal year, ERO made 110,568 arrests juxtaposed to 77,806 in FY 2016, also an increase of 40%.

Worth noting, 92%, or 101,722 illegal aliens arrested by ICE during the Trump Administration, either had a criminal conviction or a pending criminal charge, were an ICE fugitive, or were an illegal re-entrant. In other words, he isn’t ripping babies out of their mother’s arms and dreamers out of their homes en masse as the hysterical media portray.

Crushing ISIS Caliphate

U.S. Secretary of State Rex Tillerson, accompanied by U.S. President Donald J. Trump, speaks after his swearing-in ceremony on February 1, 2017. (Photo: Reuters)

In October, the U.S. Pentagon confirmed to People’s Pundit Daily (PPD) that Raqqa, the “capital of terrorism” in Syria, had fallen. Secretary Rex Tillerson said the fall of the Islamic State (ISIS) capital was accelerated by “critical decisions” made by President Trump.

“In January, ISIS was actively plotting terrorist attacks against our allies and our homeland in Raqqa,” Secretary Tillerson noted. “Nine short months later, it is out of ISIS’s control due to critical decisions President Trump made to accelerate the campaign.”

U.S. military officials said this week that ISIS has lost 98% of the territory it once held and the latest U.S. intelligence assessment reveals fewer than 1,000 ISIS militants remain in Iraq and Syria, down from a peak of nearly 45,000 when the Islamic caliphate rose to power under Mr. Obama just two years ago.

The fall of the caliphate is a crushing blow to ISIS because the physical caliphate served as validation to would-be recruits that Allah was on their side. With the caliphate gone, it appears to the believer that Allah has abandoned their cause.

Resurgence of U.S. Economy — the American Spirit

President Donald Trump hosts a meeting with business leaders in the Roosevelt Room of the White House in Washington on Monday January 23, 2017. (Photo: Reuters)

In February, Dow Chemical CEO Andrew Liveris said that the Trump Administration is “probably the most pro-business administration since the founding fathers.” His remarks came after attending a meeting with President Trump, who hosted manufacturing leaders at the White House almost one month exactly after his inauguration.

Roughly 10 months later, forecast models project the U.S. economy to grow by 3% or higher in the fourth quarter (4Q) 2017.

Under Mr. Obama, “experts” told us we just had to live with the new normal — 2% annual economic growth.

Now, if the 4Q forecasts are matched or exceeded, it’ll mark the third straight quarter of economic growth at or above 3% for the first time since 2004. It also means the first year of economic growth under President Trump is all but certain to surpass the strongest under his predecessor Mr. Obama.

Under Mr. Obama, “experts” told us we just had to live with the new normal — no manufacturing base.

Now, the National Association of Manufacturers (NAM) said manufacturers’ optimism in the 4Q of 2017 is the highest in the 20-year history of the Manufacturers’ Outlook Survey. The NAM said the survey has “risen to unprecedented heights” as a result of the tax reform bill.

As with tax reform, this should be broken down into separate subcategories of accomplishments. But make no mistake, President Trump’s policies have fueled historic levels of optimism among consumers and businesses.

Stock Market Records, Wealth Creation

The Dow Jones Industrial Average has hit record highs nearly 70 times in 2017 and U.S. markets have created roughly 6.3 trillion in new wealth. In 2017, Americans’ 401Ks appreciated by 25% to 33% and Bank of America is forecasting the S&P 500 and NASDAQ Composite to rise at least another 12% and 16%, respectively, in 2018.

Deregulation: Rolling Back the Militant Administrative State

“What the economists and market strategists have totally underestimated in their GDP forecasting is the positive effect from the multi-agency regulatory roll back from the Trump Administration,” TJM Investments analyst Tim Anderson said. “This has led to a record high level of business confidence indicators and most recently the highest level of industrial production in 3 years.”

Mr. Anderson is in part referring to what is known as a Congressional Review Act (CRA), a tool used by the Trump Administration to unravel regulations put in place by his predecessor. President Trump also signed an executive order requiring agencies to rollback 2 regulations for every new one they created.

However, as of mid-December, President Trump’s policies have resulted in a 22-to-1 deregulation ratio, crushing his goal.

The window for using the CRA closed in early May. President Trump and congressional Republicans made historic use of it. The 21-year-old law that created CRAs, a fast track for reversing “midnight rules” finalized within the last 60 days of a presidential administration, had been used only once before the Trump Administration.

Republicans had hoped for 6 to 12 rollbacks, but were successful in 14 of their 15 attempts. It saved the U.S. economy billions.

The Trump Environmental Protection Agency (EPA) under Scott Pruitt dismantled the Waters of the United States and the Clean Power Plan, a slew of significant and unpopular Obama-era regulations. The Trump Federal Communications Commission (FCC) under Ajit Pai repealed net neutrality.

The Trump Department of Education under Betsy DeVos revoked Title IX, which created “kangaroo courts” that rob the accused of due process and too often destroyed their lives without cause.

Reviving the National Aeronautics and Space Administration (NASA)

In his first 100 days, President Trump signed the National Aeronautics and Space Administration Transition Authorization Act of 2017, which acting Administrator Robert Lightfoot said was vital for “our nation’s space, aeronautics, science, and technology development programs to thrive.”

While it garners little attention – no doubt because we tend to view legislation in terms of partisan victories – the authorization act will have longstanding impact on the nation and humankind. Mr. Lightfoot added that the bill “ensures our nation’s space program will remain the world’s leader in pioneering new frontiers in exploration, innovation, and scientific achievement.”

In December, President Trump signed White House Space Policy Directive 1, a public-private partnership for human missions to the Moon, Mars and beyond. The U.S.-led program represents the latest change in national space policy under the Trump Administration aimed at renewing U.S. engagement in space.

In July, President Trump revived the National Space Council and empowered them to help implement his space policy — to make human exploration of the solar system a national priority. White House Space Policy Directive 1 was the result of a unanimous recommendation made by the new council, which is chaired by Vice President Mike Pence, after its first meeting on October 5.

We don’t think we have to explain how important of an impact the Trump Administration’s policy could have on the human race. We’ll just leave you with this on the subject.

“This work represents a national effort on many fronts, with America leading the way. We will engage the best and brightest across government and private industry and our partners across the world to reach new milestones in human achievement,” Administration Lightfoot said of the directive. “The next generation will dream even bigger and reach higher as we launch challenging new missions, and make new discoveries and technological breakthroughs on this dynamic path.”

VA Accountability and Whistleblower Protection Act (VA Reforms)

President Donald J. Trump held up the Department of Veterans Affairs Accountability and Whistleblower Protection Act of 2017 on June 23, 2017. (Photo: AP)

In June, President Trump signed the VA Accountability and Whistleblower Protection Act. The legislation fulfilled a major campaign promise and was the most significant reform bill in the history of the Department of Veterans Affairs.

It gave Secretary David Shulkin and VA leadership the power to fire bad employees for misconduct and provided more whistleblower protection to those who report wrongdoing. The VA is now required to release a monthly report detailing whatever disciplinary actions have been taken during that month each month since the bill was signed.

And it’s working. After the very first month, more than 500 employees had been fired for bad behavior as a result. The Adverse Actions Report also showed more than 180 had been put on suspension for a period greater than 14 days.

The Trump Administration has taken veterans’ issues head on since taking office. The White House created the VA accountability office, launched a website posting wait-times at hospitals and a same-day mental health care initiative at each facility.

The President also signed the The Veteran’s Affairs Choice and Quality Employment Act of 2017, which begins permitting qualified veterans to get the care of their choice.

North Atlantic Treaty Organization (NATO) Reforms

German Chancellor Angela Merkel, center, talks with Canadian Prime Minister Justin Trudeau, left, and President Donald Trump during a family photo with G7 leaders at the Ancient Greek Theater of Taormina during the G7 Summit, Friday, May 26, 2017, in Taormina, Italy. (Photo: AP)

As People’s Pundit Daily (PPD) recently explained, there are two main strategies nation-states use to gain power and prevent aggressors from tipping the balance of power: balancing and buck-passing.

Balancing is when states make a serious commitment to deter and contain a rival, by force if necessary. With buck-passing, states will attempt to get another great power to shoulder the costly burden, which is what most NATO-member nations have done to the U.S. for decades. President Trump made it clear in Brussels that the era of buck-passing is over.

Prior to the Trump Administration, only 5 North Atlantic Treaty Organization (NATO) countries had met their obligations: the United States, the United Kingdom, Greece, Poland and Estonia. Germany, which has opened their door and welfare programs to more than a million refugees, was not meeting their obligation.

After years of U.S. administrations allowing NATO to ignore their obligations, President Trump is now employing what is known as “structural realism.” It dominates international relations in security studies and yet it was met with ridicule from D.C. dummies. In truth, once that demand was delivered, they never really had a choice.

President Trump was just the first with enough gall to make it.

81 Signed Legislative Accomplishments

Whether you agree with them all policy-wise or consider them significant accomplishments, is irrelevant. As a data journalism-centered site, we find records noteworthy and this is yet another record. The previous record was held by President Harry S. Truman.

UPDATE: Per requests from readers, we will update this list to make it more comprehensive throughout the week even though the article is already 3,000 words in length.