Workers in protective equipment are reflected in the window of a betting shop with a display inviting customers to place bets on tbe result of the general election with images of Britain’s Prime Minister Theresa May and opposition Labour Party leader Jeremy Corbyn, in London, June 7, 2017. (Photo: Reuters)

Since I’m in London for a couple of speeches, I’ve taken advantage of this opportunity to make sure I’m up to speed on Brexit.

Regular readers may recall that I supported the U.K.’s decision to leave the European Union. Simply stated, the European Union is a slowly sinking ship. Getting in a lifeboat doesn’t guarantee a good outcome, I noted, but at least there’s hope.

The European Union’s governmental manifestations…are – on net – a force for statism rather than liberalization. Combined with Europe’s grim demographic outlook, a decision to remain would guarantee a slow, gradual decline. A vote to leave, by contrast, would create uncertainty and anxiety in some quarters, but the United Kingdom would then have the ability to make decisions that will produce a more prosperous future. Leaving the EU would be like refinancing a mortgage when interest rates decline. In the first year or two, it might be more expensive because of one-time expenses. In the long run, though, it’s a wise decision.

Others reached the same conclusion.

“Black Swan” author Nassim Nicholas Taleb…told CNBC’s “Power Lunch” the EU has become a “metastatic and rather incompetent bureaucracy” that is too intrusive. “The way they’ve been building it top down from Brussels is doomed to fail. This is 2016. They are still thinking 1950 economics,” said Taleb, who is also the author of “Antifragile” and is an advisor to Universa Investments. Taleb has warned about an EU breakup for some time, calling it a horrible, stupid project back in 2012.

That being said, there is a lot of angst in the U.K. about what will happen during the divorce process, in part because of the less-than-stellar performance of the Tory leadership.

There are three things, however, that British politicians need to remember.

First, the EU bureaucrats are terrified at the prospect of losing $10 billion of annual payments from the U.K., which is why they are desperately trying to convince politicians in London to cough up a big pile of money as part of a “divorce” settlement.

And “desperately” is probably an understatement.

The UK…contributions to the EU do come to over €10 billion a year. That is a substantial fiscal hole for the European Commission to plug… The Commission would prefer not to reduce expenditure since the structural funds and agricultural subsidies it distributes help to justify the EU’s existence. …it is not surprising that the Brexit divorce bill has become a sticking point in the negotiations. If the amount is big enough, it could tide the EU over for a few years. In Brussels, a problem kicked down the road is treated as a problem solved. This gives the British some leverage because it is most unlikely that the Commission will have lined up any new sources of funding, or agreed what it can cut, before March 29, 2019, when negotiations have to be completed. With no deal, the EU might end up with nothing at all.

Second, European politicians are terrified that the U.K., which already has the world’s 10th-freest economy, will slash tax rates and become even more competitive in a post-Brexit world.

If you don’t believe me, maybe you’ll believe European officials who say the same thing.

European leaders will insist that the UK rules out tax dumping as part of any trade deal struck during Brexit negotiations… Matthias Machnig, the German deputy economy minister,  called for a “reasonable framework” in tax and regulation, and warning “a race to the bottom in tax and regulation matters would make trade relations difficult”. Donald Tusk, the European Council president, also warned this morning that a deal must “…encompass safeguards against unfair competitive advantages through, inter alia, fiscal, social and environmental dumping”. The fear is that unless the trade deal which binds the UK into the European standards on tax, competition and state aid the UK will lead a regulatory “race to the bottom”.

called for a “reasonable framework” in tax and regulation, and warning “a race to the bottom in tax and regulation matters would make trade relations difficult”. Donald Tusk, the European Council president, also warned this morning that a deal must “…encompass safeguards against unfair competitive advantages through, inter alia, fiscal, social and environmental dumping”. The fear is that unless the trade deal which binds the UK into the European standards on tax, competition and state aid the UK will lead a regulatory “race to the bottom”.

Third, failure to reach a deal (also know as a “hard Brexit”) isn’t the end of the world. It’s not even a bad outcome. A hard Brexit simply means that the U.K. trades with Europe under the default rules of the World Trade Organization. That’s not complete, unfettered free trade, but it means only modest trade barriers. And since Britain trades quite successfully with the rest of the world under those rules, there’s no reason to fear a collapse of trade with Europe.

Moreover, don’t forget that many industries in Europe will pressure their politicians to continue free trade because they benefit from sales to U.K. consumers.

Around one in seven German cars is exported to the UK. Around 950,000 newly registered vehicles in the UK last year were made in Germany. As many as 60,000 automotive jobs in Germany are dependent on exports to the UK. Deloitte have explored the potential effect of a “tariff war” on the industry. …German politicians are realising this. The Bavarian Minister for Economic Affairs, Ilse Aigner, has said that “Great Britain is one of the most important trading partners in Bavaria. We must do everything we can to eliminate the uncertainties that have arisen.” …The Minister is correct. …A comprehensive free trade agreement is not only vital, but should be easy to achieve. In other words, spiteful protectionism from the Commission would accomplish nothing but impoverishing all sides.

The bottom line is that the U.K. has plenty of negotiating power to get a good outcome.

So what does this mean? How should British politicians handle negotiations, considering that they would like free trade with Europe?

Part of the answer is diplomatic skill. British officials should quietly inform their counterparts that they understand a hard Brexit isn’t a bad outcome. And they should gently remind EU officials that a hard Brexit almost certainly guarantees a more aggressive agenda of tax cuts and deregulation.

But remember that it’s in the interest of U.K. policymakers to adopt good policy regardless of what deal (if any) is made with the European bureaucrats.

The first thing that should happen is for British politicians to adopt a low-tax model based on Singapore. Some experts in the U.K. are explicitly advocating this approach.

I call this the Singapore effect. When Singapore separated from the Malaysian Federation in 1965, it apparently faced a grim future. But the realisation that no one was going to do it any favours acted as a spur to effective government – with spectacular results. We could do the same. We need a strategy that lays out the path to reductions in corporation tax, lower personal tax.

Marian Tupy of the Cato Institute explains why copying Singapore would be a very good idea.

Why Singapore? Let’s look at a couple of statistics. In 1950, GDP per capita adjusted for inflation and purchasing power parity was $5,689.91 in Singapore. It was $11,920.58 in the U.K. Average income in Singapore, in other words, amounted to 48 percent of that in the U.K. In 2016, income in Singapore was $82,168.33 and $42,287.17 in the U.K. Put differently, Singaporeans earned 94 percent more than the British. During the intervening years, Singaporean incomes rose by 1,344 percent, while British incomes rose by 256 percent. …the “threat” of Singaporean tax rates and regulatory framework ought not to be a mere negotiating strategy for the British government vis-a-vis the EU. It ought to be a goal of the British decision makers—regardless of what the EU decides!

Here’s a chart from Marian’s article.

Or the U.K. could copy Hong Kong, as a Telegraph columnist suggests.

Our political leaders still seem to lack a vision of what Britain can achieve outside the EU… Perhaps they are lacking in inspiration. If so, …Hong Kong…is now one of the richest places in the world, with income per capita 40 per cent higher than Britain’s.

And much of the credit belongs to John Cowperthwaite, who unleashed great prosperity in Hong Kong by limiting the role of government.

Faced with…the approach being taken in much of the West: deficit financing, industrial planning, state ownership of industry, universal welfare and higher taxation. How much of this did the British civil servant think worth transposing to Hong Kong? Virtually nothing. He had a simple alternative: government spending depended on government revenues, and this in turn was determined by the strength of the economy. Therefore, the vital task for government was to facilitate growth. …He believed in the freest possible flow of goods and capital. He kept taxes low in order that savings could be reinvested in businesses to boost growth. …Cowperthwaite’s view was that higher government spending today destroys the growth of tomorrow. Indeed, over the last 70 years Hong Kong has limited the size of the state to below 20 per cent of GDP (in Britain it is over 40 per cent) and growth has been substantially faster than in the UK. He made a moral case for limiting the size of government, too.

In other words, the United Kingdom should seek comprehensive reforms to reduce the burden of government.

That includes obvious choices like lower tax rates and less red tape. And it also means taking advantage of Brexit to implement other pro-market reforms.

One example is that the U.K. will now be able to assert control over territorial waters. That should be immediately followed by the enactment of a property rights-based system for fisheries. It appears that Scottish fishermen already are agitating for this outcome.

The Scottish Fishermen’s Federation says the UK’s exit from the European Union will boost jobs in the sector, reports The Guardian. It’s chief executive Bertie Armstrong said the exit will give them “the ability to recover proper, sustainable, rational stewardship through our own exclusive economic zone for fisheries”.

Let’s close with some Brexit-related humor.

I already shared some examples last year, and we can augment that collection with this video. It’s more about USexit, but there’s some Brexit material as well.

And here’s some more satire, albeit unintentional.

The President of the European Commission is so irked by Trump’s support for Brexit that he is threatening to campaign for secession in the United States.

In an extraordinary speech the EU Commission president said he would push for Ohio and Texas to split from the rest of America if the Republican president does not change his tune and become more supportive of the EU. …A spokesman for the bloc later said that the remarks were not meant to be taken literally, but also tellingly did not try to pass them off as humorous and insisted the EU chief was making a serious comparison.

I have no idea why Juncker picked Ohio and Texas, but I can state with full certainty that zero people in either state will care with a European bureaucrat thinks.

And speaking of accidental satire, this tweet captures the mindset of the critics who wanted to pretend that nativism was the only reason people were supporting Brexit.

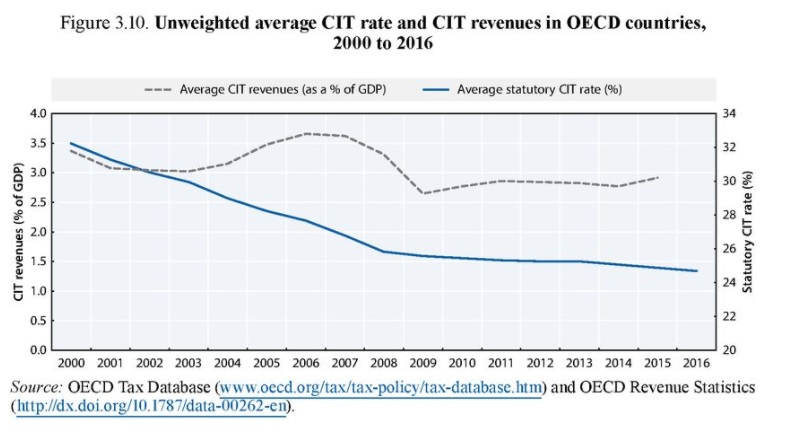

Last but not least, we have another example of unintentional humor. The pro-tax bureaucrats at the OECD are trying to convince U.K. lawmakers that tax cuts are a bad idea.

The head of tax at the Organization for Economic Co-operation and Development, which advises developed nations on policy, said the UK could use its freedom from EU rules to slash corporate tax but the political price would be high. …”A further step in that direction would really turn the UK into a tax haven type of economy,” he said, adding that there were practical and domestic political barriers to doing this. …The UK is already in the process of cutting its corporate tax rate to 17 percent.

Though maybe I shouldn’t list this as unintentional humor. Maybe some British politicians will be deterred simply because some tax-free bureaucrats in Paris expressed disapproval. If so, the joke will be on British workers who get lower wages as a result of foregone investment.

By the way, here’s a reminder, by Diana Furchtgott-Roth in the Washington Examiner, of why Brexit was the right choice.

As we celebrate Independence Day on July 4, we can send a cheer across the pond to the British, who declared independence from the European Union on June 23. For the British, that means no more tax and regulatory harmonization without representation. Laws passed by Parliament will no longer have to be EU-compatible. It even means they will be able to keep their high-efficiency kettles, toasters, hair dryers and vacuum cleaners. As just one example of the absurdity of EU regulation, vacuum cleaners with over 1600 watts were banned by Brussels in 2014, and those over 900 watts are scheduled to be phased out in 2017. Brussels bureaucrats say that these vacuum cleaners use too much energy. No matter that the additional energy cost of a 2300-watt vacuum cleaner compared with a 1600-watt model is less than $20 a year, that it takes more time to vacuum with a low-energy model, and, most important, people should be able to choose for themselves how they want to spend their time and money. I, for one, prefer less time housecleaning.

Amen. As much as I despise the busybodies in Washington for subjecting me to inferior light bulbs, substandard toilets, second-rate dishwashers, weak-flow showerheads, and inadequate washing machines, I would be far more upset if those nanny-state policies were being imposed by some unaccountable international bureaucracy.