Left: President Donald J. Trump announces his decision to pull out of the Paris Climate Accord, the Paris Agreement on June 1, 2017. Right: The illuminated Arc de Triomphe in Paris, France, on November 4, 2016. (Photos: PPD/Reuters)

On Friday, the United States (US) officially submitted notification to the United Nations (UN) regarding its intent to withdraw from the Paris Climate Agreement. The State Department said in a statement that, “in its capacity as depositary for the Paris Agreement,” it will “withdraw from the Paris Agreement as soon as it is eligible to do so.”

The Trump Administration is abiding by the part of the agreement that dictated a duration of time before a nation could pull out of the deal negotiated by his predecessor, Barack Obama.

“As the President indicated in his June 1 announcement and subsequently, he is open to re-engaging in the Paris Agreement if the United States can identify terms that are more favorable to it, its businesses, its workers, its people, and its taxpayers,” the State Department said in a statement.

“The United States supports a balanced approach to climate policy that lowers emissions while promoting economic growth and ensuring energy security.”

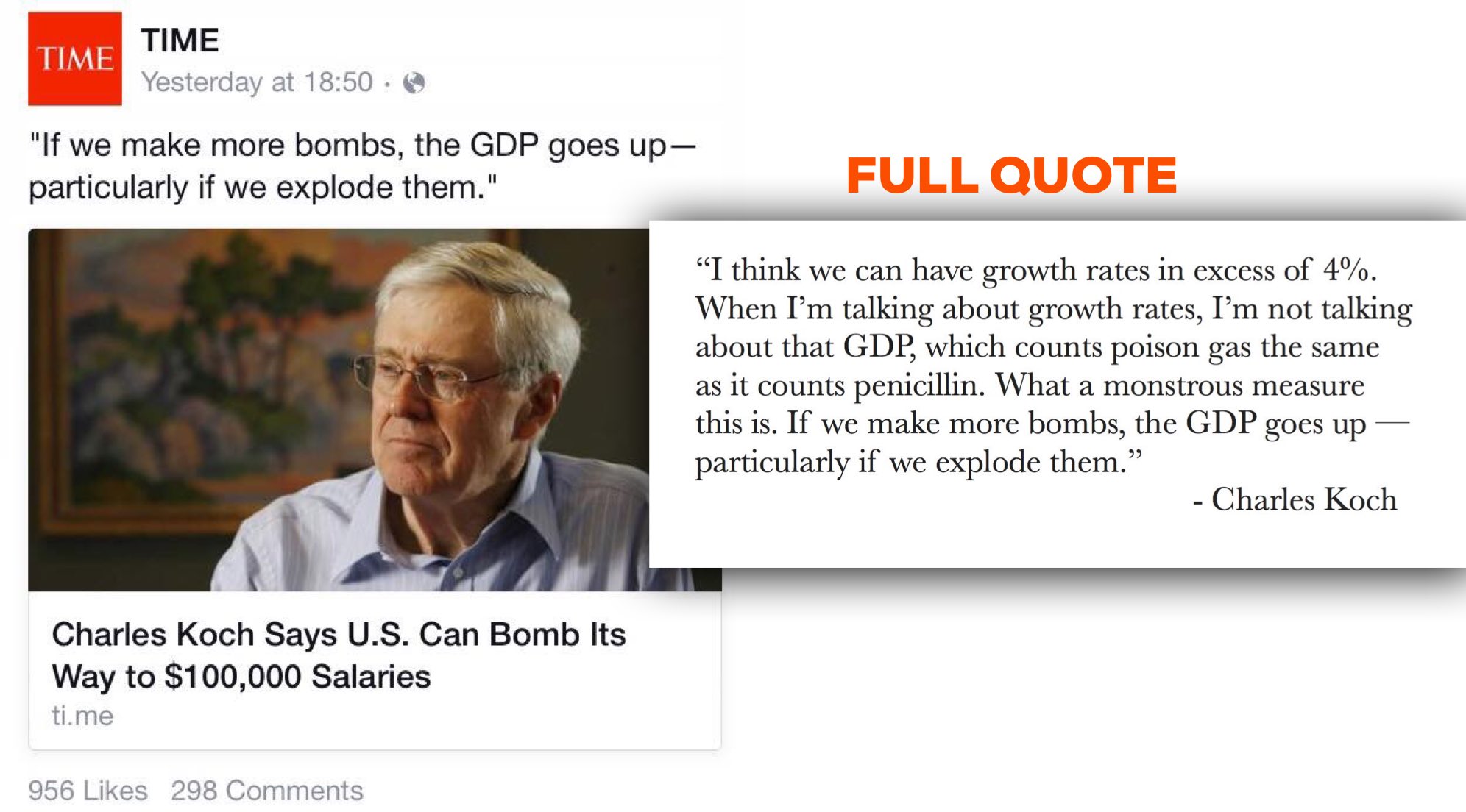

While the agreement’s impact on the climate itself is minimal and very much in question, the impact on the U.S. economy and American families, is not.

According to the National Economic Research Associates, compliance with the terms of the Paris Climate Agreement would destroy 6.5 million industrial sector jobs, cost an eliminated $3 trillion in gross domestic product (GDP) and $7,000 in Americans’ household income, per capita, all by 2040.

Nevertheless, Big Media and leftwing activists were hysterical over President Trump’s decision, which was a major campaign issue and promise. In his announcement, the President expressed a willingness to work with other nation’s on new agreement that better protects American workers and industry, which the State Department affirmed.

“The United States will continue to participate in international climate change negotiations and meetings, including the 23rd Conference of the Parties (COP-23) of the UN Framework Convention on Climate Change, to protect U.S. interests and ensure all future policy options remain open to the administration,” the State Department said.

“Such participation will include ongoing negotiations related to guidance for implementing the Paris Agreement.”

President George W. Bush dealt with similiar hysteria when he pulled the U.S. out of the Kyoto Protocol, which called for emissions to be reduced by 5.2% by 2012. Bush 43 said he took climate change “very seriously” but opposed Kyoto because “it exempts 80% of the world, including major population centers such as China and India, from compliance, and would cause serious harm to the U.S. economy.”

Over the next 14 years, American innovators in the free market reduced U.S. emissions to the lowest levels since 1994, far exceeding the Kyoto target. The U.S. did so without government intervention–which hinders economic growth and liberty–and at a faster pace than their European counterparts.

The Trump Administration’s position is almost identical to the last Republican administration’s position.

“We will continue to reduce our greenhouse gas emissions through innovation and technology breakthroughs, and work with other countries to help them access and use fossil fuels more cleanly and efficiently and deploy renewable and other clean energy sources, given the importance of energy access and security in many nationally determined contributions.”

Worth noting, in February, a high-level whistleblower at the National Oceanic and Atmospheric Administration (NOAA) revealed they used a flawed global warming study to influence decision-making by world leaders at the Paris Climate Change Conference. It was based on misleading, “unverified” data, but timed to have maximum impact on the global summit.

Dr John Bates, a top NOAA scientist with an impeccable reputation, gave The Daily Mail “irrefutable evidence” that NOAA–the world’s leading source of climate change data–intentionally rushed to publish a landmark paper that exaggerated global warming.