President Donald Trump poses for a portrait in the Oval Office in Washington, Friday, April 21, 2017. (Photo: AP)

The media obsesses over this artificial timeline, but when historians look back at President Donald J. Trump’s first 100 days it will be little more than a footnote. Nevertheless, here’s a look back at the start of a historic presidency no one in Big Media wanted, anticipated or even believed was possible.

Let’s get a few things out of the way first. So-called “pundits” and other media talking heads have made historically inaccurate comparisons that need to be addressed. The worst of these has been the juxtaposition to Barack Obama’s first 100 days.

Mr. Obama is a lot of things, but a dealmaker and arm-twister he was not. Unlike President Trump, he came into office with a supermajority and did not work with members of Congress, even those within his own party.

Sen. Joe Manchin, D-W. Va., said last month he had been to the White House more in President Trump’s first two months than the entire time he was in the U.S. Senate during Mr. Obama’s tenure. ObamaCare, Mr. Obama’s signature legislation and main accomplishment, was passed 8 months into his presidency and was negotiated largely by Harry Reid and Nancy Pelosi.

There is not a lawmaker, journalist and other form of D.C.-ite who can or would argue this fact. Only the former president’s supporters living outside the Beltway or are out of the know believe that falsehood. Mr. Obama was not effective in the traditional presidential role, at all. He knew it, as well, and was quite open about not caring.

Legislation

There can be little doubt that the failure of the American Health Care Act (AHCA) was an embarrassment to the President and the Republican Party. After 7 years of vowing to repeal ObamaCare–if they just had the House, if they just had the Senate, if they just had the White House, the House and the Senate–conservatives and moderates could not find a consensus.

And that’s in the chamber where the GOP enjoys their largest, most comfortable majority.

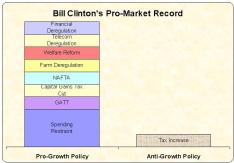

That said, despite the media crowing, President Trump’s first 100 days has not gone without legislative achievements, including some his administration has quietly used effectively to dismantle the pillars of Leviathan raised during the Obama presidency. During his reelection bid, Bill Clinton was forced by Newt Gingrich to give Congress a window of 60 legislative days to undo previous rules with a simple majority.

But as the Leviathan often goes, lawmakers and presidents have rarely exercised that power. In fact, it had only been invoked one time until President Trump, who has signed 13 Congressional Review Acts. That’s literally an unheard of number that dismantled a number of key Obama era rules.

A few of them include a rule by the Social Security Administration restricting gun purchases by the mentally ill through the use of additional firearms background checks; a Department of the Interior rule via the Bureau of Land Management Planning that gave the federal government more, and state and local government less, authority in land use decisions; new federal standards for new teachers that the Department of Education were hoping to impose through legislation signed by Mr. Obama in 2015; a Department of Labor regulation restricting the use of drug testing to determine workers’ eligibility to receive unemployment compensation; a Department of Labor rule permitting states to force workers to save; and a mandate that essentially required states to fund Planned Parenthood.

President Trump also signed the National Aeronautics and Space Administration Transition Authorization Act of 2017, which NASA acting Administrator Robert Lightfoot said was vital for “our nation’s space, aeronautics, science, and technology development programs to thrive.”

While it garners little attention–no doubt because we tend to view legislation in terms of partisan victories–the authorization act will have longstanding impact on the nation and mankind. Mr. Lightfoot added that the bill “ensures our nation’s space program will remain the world’s leader in pioneering new frontiers in exploration, innovation, and scientific achievement.”

Executive Action

President Trump has signed 78 executive actions so far, which, as Business Insider correctly noted, “will have far-reaching effects on Americans’ lives.” That includes 30 executive orders, 27 presidential memoranda and 21 proclamations. Worth noting, we often incorrectly cite the number of executive actions a president as a gauge for how much they exercise their power. It’s the content, scope and reach of the order that matters, particularly whether they overstep their bounds.

Take a look at the orders laid out by Business Insider below. People’s Pundit Daily reported on all of President Trump’s executive orders, which you can read right here after this article if you’d like. Feel free to skip to the end of the list, but we wanted to include it visually to put it in proper context.

Executive Order, April 28: Exploring Offshore Drilling/Energy Independence

Executive Order, April 27: Protecting Whistleblowers at the VA

Two Presidential Memoranda, April 20 and 27: Steel and Aluminum Dumping

Executive Order, April 26: Reviewing the Federal Government’s Role in Education

Executive Order, April 26: Review, Begin Reversing Obama Land Grab/National Lands

Executive Order, April 25: Agriculture and Rural Prosperity

Presidential proclamation, April 21: National Volunteer Week

Executive Order, April 21: Review Tax Regulations

Two Presidential Memoranda, April 21: Dodd-Frank rollback

Presidential Memorandum, April 20: Reporting sanctions on foreign persons

Executive Order, April 18: ‘Buy American, Hire American’

Presidential Proclamation, April 14: National Park Week

Presidential Memorandum, April 12: Delegating terrorist report request

Presidential Memorandum, April 11: Signing letter on including Montenegro in NATO

Presidential Memorandum, April 8: Notifying Congress of the US Syria strike

Five Presidential Proclamations, April 3-7: Honoring and drawing awareness

Presidential Memorandum, April 3: Principles for reforming the draft

Two Executive Orders, March 31: Lowering the trade deficit and collecting import duties

Executive Orders, March 31 and February 9: Changing the DOJ order of succession

Six Presidential Proclamations, March 31: Sexual assault awareness and others

Executive Order, March 29: Combating the opioid crisis

Executive Order, March 28: Dismantling Obama’s climate change protections

Executive Order, March 27: Revoking Obama’s fair pay and safe workplaces orders

Presidential Memorandum, March 27: Establishing the White House Office of American Innovation

Presidential Proclamation, March 24: Greek Independence Day

Two Presidential Memoranda, March 23: Declaring an emergency in South Sudan

Presidential Memorandum, March 20: Delegating to Tillerson

Presidential Proclamation, March 17: National Poison Prevention Week

Presidential Memorandum, March 16: A letter to the House of Representatives outlining Trump’s proposed budget

Executive Order, March 13: Reorganizing the Executive Branch

Presidential proclamation, March 6: National Consumer Protection Week

Executive Order, March 6: New Travel Ban

Presidential Memorandum, March 6: Guidance for agencies to implement the new travel ban

Three Presidential Proclamations, March 1: National months for women, the American Red Cross, and Irish-Americans

Executive Order, February 28: Promoting Historically Black Colleges and Universities

Executive Order, February 28: Reviewing the ‘Waters of the United States’ rule

Executive Order, February 24: Enforcing Regulatory Reform

Executive Order, February 9: Combating Criminal Organizations (CARTELS)

Executive Order, February 9: Reducing Crime

Executive Order, February 9: Protecting Law Enforcement

Executive Order, February 3: Reviewing Wall Street regulations

Presidential Memorandum, February 3: Reviewing the fiduciary duty rule

Presidential Proclamation, February 2: American Heart Month

Executive Order, January 30: For every new regulation proposed, repeal two existing ones

Executive Order, January 28: Drain the swamp

Presidential Memorandum, January 28: Reorganizing the National and Homeland Security Councils

Presidential Memorandum, January 28: Defeating ISIS

Executive Order, January 27: Immigration ban

Presidential Memorandum, January 27: ‘Rebuilding’ the military

Presidential proclamation, January 26: National School Choice Week

Executive Order, January 25: Build the Wall

Executive Order, January 25: Defunding Sanctuary Cities

Executive Order, January 24: Expediting Environmental Review for Infrastructure Projects (Coal)

Three Presidential Memoranda, January 24: Approving Keystone XL and Dakota Access Pipelines

Presidential Memorandum, January 24: Reduce Regulations for US Manufacturing

Presidential Memorandum, January 23: Reinstating the ‘Mexico City policy’

Presidential Memorandum, January 23: Federal Government Hiring Freeze (Military Exempted)

Presidential Memorandum, January 23: Withdraw U.S. from Trans-Pacific Partnership

Executive Order, January 20: Declaring Intention to Repeal ObamaCare, the Affordable Care Act (Instructed IRS not to enforce mandate)

Presidential Memorandum, January 20: Regulatory Freeze

From withdrawing from the Trans-Pacific Partnership (TPP) to approving the Keystone and Dakota pipelines to signing executive orders that helped reduce illegal border crossings by nearly 70%, the President checked off one campaign promise after another. While you may not agree with the policy, you cannot deny the impact they will have on Americans’ lives and the fact he can cite them as promised accomplishments.

From the Mexico City Policy to defunding Planned Parenthood, the New York businessman has become an unlikely champion of the faithful in America. Again, you may not like it, but you can’t deny it.

While it’s true that he suffered setbacks on immigration and the refugee ban, all of that is a charade, not an affirmation that he overreached on executive power. Most in the media know it (they just lie to you), so you should know it, too.

Even fair-minded, well-respected liberal law professors acknowledge the Left only got injunctions by judge-shopping in far leftwing courts that will be reversed by the Supreme Court.

The Long Game

Charles Krauthammer’s best-selling book Things That Matter now comes to mind because, in the grand scheme of things, the appointment of Justice Neil Gorsuch was the most historically consequential achievement during President Trump’s first 100 days.

“For the first time in the modern political era, we have confirmed a Supreme Court justice in the first 100 days,” he said during his address to the National Rifle Association (NRA) annual convention in Atlanta, Ga., on Friday.

He’s right. Mr. Trump is the first president in 136 years to have Supreme Court bragging rights. The last time it was done was in 1881 and, speaking of time, Justice Gorsuch is a relatively young member of the Court. His textualist legal history and judgement will affect policy for at least 3 decades.

The impact of the stimulus bill passed by the Democratic supermajority and signed by Mr. Obama before his first 100 days didn’t last until his second term, let alone 3 decades.