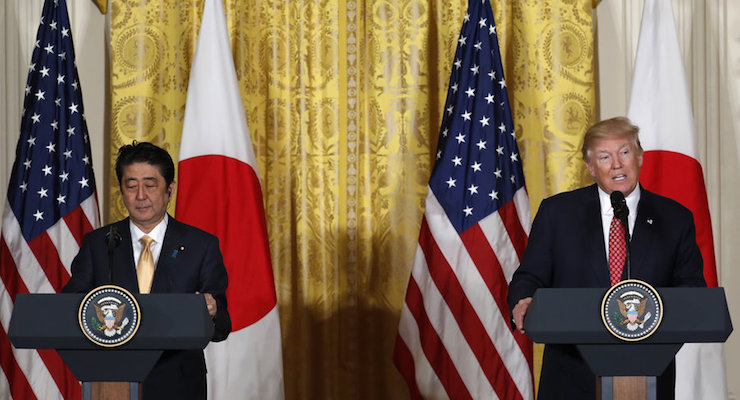

Illinois Governor Bruce Rauner (Photo: AP)

Once of the reasons that tax increases in Washington are such a bad idea–and one of the reasons why a value-added tax is an especially bad idea–is that the prospect of additional tax revenue kills any possibility of genuine entitlement reform. Simply stated, politicians won’t do the heavy lifting of fixing those programs if they think can use a tax hike to prop up the current system for a few more years.

However, if we don’t fix the entitlements, the United States faces a very grim fiscal future regardless of new revenue because the burden of government spending will be expanding faster than the growth of the private economy.

Indeed, tax hikes presumably will accelerate the problems by weakening economic performance, creating an even bigger gap between the growth of government spending and the growth of productive output. Sort of a double violation of my Golden Rule.

Well, the same thing is happening in Illinois.

That state is a fiscal disaster. Taxes already are high, government spending already is excessive, and promises of lavish future benefits for government bureaucrats have created a mountain of unfunded liabilities. To make matters worse, there’s a never-ending trickle of taxpayers fleeing to other states, thus making the long-run outlook even worse.

A column in today’s Wall Street Journal discusses this unfolding disaster.

…what about the state’s fiscal apocalypse, which is not only happening right now but has plunged Illinois into a bona fide financial disaster? …the state has amassed $11 billion in unpaid bills—predicted to climb to more than $27 billion by the end of 2019. Illinois is facing the worst pension crisis of any U.S. state, with unfunded obligations totaling $130 billion, according to the state’s Commission on Government Forecasting and Accountability. That amounts to about $10,000 in debt for each resident. …Illinois also had the lowest credit rating among the 50 states as of October, when Moody’s Investors Service downgraded it again… Given all this, it’s no surprise that people are leaving. In 2016 Illinois lost more residents than any other state—for the third consecutive year. A total of 37,508 people fled, leaving the state’s population at its lowest level in nearly a decade.

By the way, the net payers of tax are the ones leaving, not the net consumers of tax. And every time one of the geese with golden eggs decides to fly away, Illinois falls deeper into a hole.

I discussed this phenomenon in a column for The Hill.

…there are some very uncompetitive, high-tax states, such as Illinois, that are in deep trouble due to internal migration. Most people have focused on the overall population loss of 37,508 in Illinois, but the number that should worry state politicians is, on net, a staggering 114,144 people left for other states. Only New York (another high-tax state with a grim future) lost more people to internal migration.Of course, what really matters, at least from a fiscal perspective, is the type of person who leaves. Data from the internal revenue service shows that states like Illinois are losing people with above-average incomes. In other words, the net taxpayers are escaping.

And don’t forget that Illinois is increasingly uncompetitive compared to neighboring states.

Here’s a blurb from a Wall Street Journal editorial in January,

Nearby Kentucky passed a right-to-work law last week and Missouri is expected to take up similar legislation in coming weeks. …this would leave Illinois, a non-right-to-work state, as an island with undesirable labor laws surrounded by states including Michigan, Indiana and Wisconsin that provide more worker choice and business flexibility.

I have some theoretical problems with right-to-work laws, but the WSJ is correct that private employers tend to avoid states where unions wield a lot of power.

Also, we can’t forget that the main city in Illinois has its own set of problems.

As discussed in an article for the American Thinker, Chicago adds crime and corruption to the mix.

Chicago has become the icon of bloody violence on its streets, but corruption also is part of its misery… Chicago’s city government is known for much more than just its one-sidedness. From Mayor Richard J. Daley’s well known rackets of yesteryear to former U.S House representative Jesse Jackson, Jr. (who just last year completed his prison sentence after having pleaded guilty to multiple federal charges including fraud, conspiracy, wire fraud, criminal forfeiture, and more), the list of Democrats committing and getting caught committing fraud, taking bribes, running scams, and other malfeasance while in office is very long. …As reported by Gazette.com, “according to Illinois corruption researchers Dick Simpson and Thomas Gradel, more than 30 Chicago aldermen have been convicted of crimes since 1973, most of them on bribery and extortion charges. “More than 1,000 public officials and businessmen in Illinois have been convicted of public corruption since 1970, including imprisoned former Gov. Rod Blagojevich. But corruption among politicians on Chicago’s premier lawmaking body has been ‘particularly persistent’, the researchers wrote in an anti-corruption report.”

Gee, what a surprise. Politicians create big government in part so they have lots of goodies to distribute, and they then use those goodies to extort money from people.

Hmmm…, where have I seen that message before?

But let’s not get distracted. We’ve now established that Illinois is a giant mess. We also know that the state can only be saved if there is both short-run spending restraint and long-run spending restraint (to deal with unaffordable benefits promised to the state’s massive bureaucracy). Though we also know that the chances of getting those necessary reforms will evaporate if tax hikes are an option.

So is anybody surprised that the state’s supposedly anti-tax governor is getting seduced/pressured into throwing taxpayers under the bus?

The Wall Street Journal opines on this development.

Illinois Governor Bruce Rauner has been trying to pull the Land of Lincoln out of economic decline…, and it’s a losing battle. After two years without a state budget, Mr. Rauner is now bending as Democrats promise to hold the budget hostage if he doesn’t sign a tax increase. In his State of the State address last week, Mr. Rauner said he was open to “consider revenue increases” in conjunction with “job-creating changes” in pursuit of a budget deal. He endorsed negotiations underway with state lawmakers to craft a “grand bargain”…the speech was greeted with derision by the state’s Springfield mafia that assumes it now has the Governor where it wants him. …The deal now being crafted in the state Senate would increase the state’s flat income-tax rate to somewhere around 5% from the current 3.75%. …Democrats are still peddling that they can tax their way out of Illinois’s economic decline, while taxpayers are picking up and heading to neighboring states.

Incidentally, there was a temporary hike in the tax to 5 percent a few years ago. How did that work out?

…the years of an elevated income tax produced one of the country’s weakest state economic recoveries, with bond-rating declines in Chicago and staggering deficits statewide. …Senate President John Cullerton said the point of the temporary hike was to pay pensions, “pay off our debt [and] to have enough money to pay the interest on that debt.” But the roughly $31 billion it generated made hardly a dent. Since 2011 the unfunded pension liability in Illinois has grown by $47 billion, even as the tax hike was mostly spent on pensions.

Here’s the bottom line. Governor Rauner made a huge mistake by stating that he would “consider revenue increases.”

Illinois, after all, is not suffering from inadequate tax collections.

Moreover, now that Rauner has waved the white flag, there’s a near-zero chance that he’ll be able to get something in exchange such as a Colorado-style spending cap or much-need constitutional reform to control pension expenditures.

Instead, higher revenues will trigger even more wasteful outlays.

I guess there’s still a chance he’ll do what’s best for the state and reject tax hikes, but as of now it looks like Rauner will be the next winner of the Charlie Brown Award. Oh, and he’ll also jeopardize his own political career. Which helps to explain why the GOP is known as the “stupid party.”