President Donald J. Trump says he wants to roll back the burden of regulation. Give the morass of red tape that is strangling the economy, this is a very worthy goal.

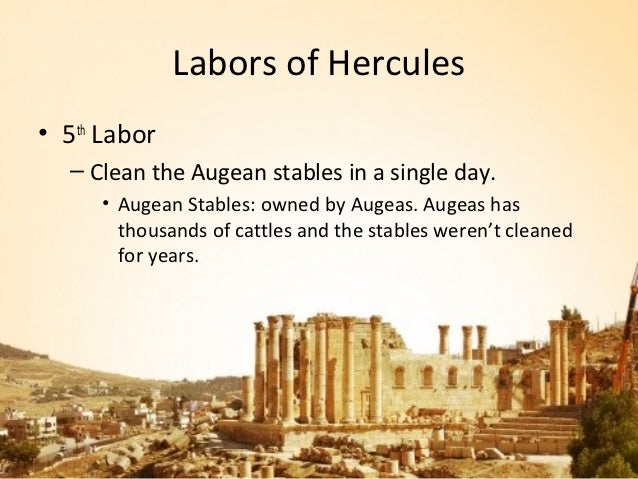

It’s also a daunting task. Fixing the sprawling regulatory state is the modern version of cleaning the Augean stables and I’m not brimming with confidence that Trump and his appointees have Herculean powers.

It’s also a daunting task. Fixing the sprawling regulatory state is the modern version of cleaning the Augean stables and I’m not brimming with confidence that Trump and his appointees have Herculean powers.

That being said, if they’re deciding where to focus their deregulatory efforts, cost-benefit analysis would be a very useful guide. Simply stated, go after the red tape that imposes the highest costs while yielding the fewest benefits.

And if that’s the approach, so-called anti-money laundering regulations should be on the chopping block. Banks and other financial institutions are now being forced to squander billions of dollars in order to comply with laws, rules, and red tape that require them to spy on all their customers. The ostensible purpose of AML policies is to discourage criminal behavior, but experts have concluded that this approach has been a failure.

To the extent that AML policies have had an impact, it’s been negative. In addition to high costs and inefficiency, the laws and regulations have disproportionately harmed poor people.

Richard Rahn, in a column for the Washington Times, says AML laws are the modern version of prohibition, well-meaning in theory but counter-productive in practice.

Money laundering fits under the definition of vague law because, unlike murder or robbery, it is not a crime of an act but one of “intent.” …This leads to many problems and substantial prosecutorial abuse. It is not only banks and financial institutions that are supposed to know the source of their clients’ funds, but also such diverse people as car dealers, pawnbrokers, real estate agents, and on and on. Often, it is not considered good enough to know the source of a customer’s funds (often a near-impossibility), but the source of the funds of the customer’s customer. …The result is that banks and other financial institutions increasingly refuse to open accounts for low-income people… There is a very high fixed cost for banks and others to do “due diligence” on their customers — the costs being roughly the same for a $5,000 deposit, a $500,000 deposit or a $5,000,000 deposit. Given the massive penalties banks and other financial institutions are subject to for making even an unintentional mistake, their safest course of action is to drop small customers. …Recent academic and think tank studies show the situation only getting worse — all cost and no gain. …the poor, including poor countries, and the honest pay a huge price for all of the additional compliance costs, which reduces productive global capital formation and real incomes.

And the price isn’t trivial for the nations that get targeted, as I pointed out in testimony to the Organization for American States.

A working paper from the Center for Global Development digs into the numbers.

The past fifteen years have seen an unprecedented level of attention on anti-money laundering…issues by financial regulators…the total value of fines levied by regulators peaked at $15 billion in 2014 in the US alone.  …Between 2010 and 2015, the Financial Action Task Force (FATF), an international group tasked with setting common AML standards across the globe, added over fifty different countries to an internationally-recognized list of high risk countries. …there are growing concerns that this increase in regulatory activity is leading to a chilling effect on cross-border economic activity as banks limit their exposure to high risk clients or jurisdictions, a process known as ‘de-risking’… This contraction of the correspondent banking network has sounded a number of alarm bells, as these services are seen as being crucial for most cross-border services… The ICC survey reported that over 40% of respondents felt that AML and know-your-customer (KYC) requirements were a significant impediment to trade finance, with nearly 70% reporting they declined transactions that year…a large number of money transfer companies in the US, the UK and Australia have lost access to banking services as a result of banks’ desire to reduce their exposure to regulatory risk, potentially leading to a reduction to a decrease in formal remittances to developing countries, a critical source of development finance… The combined effect of all of these pressures should be leading to declines in the aggregate flow of cross-border payments.

…Between 2010 and 2015, the Financial Action Task Force (FATF), an international group tasked with setting common AML standards across the globe, added over fifty different countries to an internationally-recognized list of high risk countries. …there are growing concerns that this increase in regulatory activity is leading to a chilling effect on cross-border economic activity as banks limit their exposure to high risk clients or jurisdictions, a process known as ‘de-risking’… This contraction of the correspondent banking network has sounded a number of alarm bells, as these services are seen as being crucial for most cross-border services… The ICC survey reported that over 40% of respondents felt that AML and know-your-customer (KYC) requirements were a significant impediment to trade finance, with nearly 70% reporting they declined transactions that year…a large number of money transfer companies in the US, the UK and Australia have lost access to banking services as a result of banks’ desire to reduce their exposure to regulatory risk, potentially leading to a reduction to a decrease in formal remittances to developing countries, a critical source of development finance… The combined effect of all of these pressures should be leading to declines in the aggregate flow of cross-border payments.

And here are the results of the new empirical research in the study.

The combination of large scale fines, higher compliance costs and international naming-and-shaming has – anecdotally – led many banks to withdraw from certain lines of business or geographic areas, to the potential detriment of cross-border economic activity. …We find evidence that greylisting by the FATF is consistent with up to a 10% reduction in the number of payments received by an affected country. …Issues of economic impact aside, these results suggest there is more work to be done on assessing both the effectiveness and the efficiency of the global AML/CFT regulatory regime. …First, the reduction in payments received by countries subject to greater regulatory scrutiny raises the spectre of potential losses to these countries. Second, that there is either no effect or a positive effect of FATF greylisting on the number of payments leaving a designated country suggests that increased scrutiny may not do much to prevent illicit money from leaving high risk countries and entering the international financial system at large.

In other words, lots of costs, mostly borne by poor people and poor nations, but no evidence that criminals and terrorists are being stopped.

Rather than imposing lots of red tape and requiring banks to spy on everybody, it would be much better if the government followed normal rules in the fight against crime. By all means, it should investigate real crimes, collect evidence and build cases (within proper limits), and work to punish those who inflict harm on others.

But don’t squander resources in ways that aren’t effective.

Some have suggested that it would make sense to have banks monitor a discrete list of potential bad guys rather than promiscuously spy on all customers.

That might be a step in the right direction, but this story from the UK-based Times shows that this approach leaves something to be desired.

A controversial “blacklist” used by British banks to identify terrorists and potential money launderers has grown so bloated that it includes details of a three-year-old member of the royal family… World-Check, a database of more than two million “high-risk” individuals including criminals and senior politicians, is used by 49 of the world’s 50 biggest banks to carry out compliance checks on existing and potential clients. Customers who are flagged up face extra scrutiny and their accounts…hundreds of individuals were included partly on the basis of unverified blog posts and even far-right or extremist websites.

Wow. Since some of my leftist friends consider International Liberty a “far-right” and “extremist” website, this doesn’t bode well for me. I guess I’m lucky that I still have a bank account.

Here’s more from the story.

Thousands of others were listed on the database, which dates from 2014, only because they were relatives or friends of minor public figures. …Maud Windsor…was listed at nine months old. The apparent justification was that she was a family member of a “politically exposed person” (PEP), a reference to her father, who is the son of Prince Michael of Kent and 43rd in line to the throne. …Other British PEPs on the database include Sir Neil Cossons, a historian and former chairman of English Heritage. …Heather Wheeler, a Conservative MP listed on the database, told parliament this year that her bank of 30 years informed her that she was “high risk” and that it “would not deal with me anymore and that it was closing my account.”

These absurd results are driven by government policies that force financial institutions to treat all customers as potential crooks.

And given the huge fines that are being levied on banks and other firms, you can understand why they drop customers and charge high fees. They are forced to act defensively.

Thomson Reuters, the media company that makes millions of pounds compiling and selling the database, does not inform individuals if they are included and banks have no obligation to tell clients why they have been denied services. …Many financial institutions have become risk-averse… “You have an arms race where there’s this immense pressure to build a ‘robust’ database,” one expert on World-Check said. “They’ll pack this database with as many names of individuals as possible. You end up getting a ton of false positives.”

And some of those “false positives” are mentioned in this video I narrated for the Center for Freedom and Prosperity.

It’s also a daunting task. Fixing the sprawling regulatory state is the modern version of cleaning the Augean stables and I’m not brimming with confidence that Trump and his appointees have Herculean powers.

It’s also a daunting task. Fixing the sprawling regulatory state is the modern version of cleaning the Augean stables and I’m not brimming with confidence that Trump and his appointees have Herculean powers.

That being said, if they’re deciding where to focus their deregulatory efforts, cost-benefit analysis would be a very useful guide. Simply stated, go after the red tape that imposes the highest costs while yielding the fewest benefits.

And if that’s the approach, so-called anti-money laundering regulations should be on the chopping block. Banks and other financial institutions are now being forced to squander billions of dollars in order to comply with laws, rules, and red tape that require them to spy on all their customers. The ostensible purpose of AML policies is to discourage criminal behavior, but experts have concluded that this approach has been a failure.

To the extent that AML policies have had an impact, it’s been negative. In addition to high costs and inefficiency, the laws and regulations have disproportionately harmed poor people.

Richard Rahn, in a column for the Washington Times, says AML laws are the modern version of prohibition, well-meaning in theory but counter-productive in practice.

Money laundering fits under the definition of vague law because, unlike murder or robbery, it is not a crime of an act but one of “intent.” …This leads to many problems and substantial prosecutorial abuse. It is not only banks and financial institutions that are supposed to know the source of their clients’ funds, but also such diverse people as car dealers, pawnbrokers, real estate agents, and on and on. Often, it is not considered good enough to know the source of a customer’s funds (often a near-impossibility), but the source of the funds of the customer’s customer. …The result is that banks and other financial institutions increasingly refuse to open accounts for low-income people… There is a very high fixed cost for banks and others to do “due diligence” on their customers — the costs being roughly the same for a $5,000 deposit, a $500,000 deposit or a $5,000,000 deposit. Given the massive penalties banks and other financial institutions are subject to for making even an unintentional mistake, their safest course of action is to drop small customers. …Recent academic and think tank studies show the situation only getting worse — all cost and no gain. …the poor, including poor countries, and the honest pay a huge price for all of the additional compliance costs, which reduces productive global capital formation and real incomes.

And the price isn’t trivial for the nations that get targeted, as I pointed out in testimony to the Organization for American States.

A working paper from the Center for Global Development digs into the numbers.

The past fifteen years have seen an unprecedented level of attention on anti-money laundering…issues by financial regulators…the total value of fines levied by regulators peaked at $15 billion in 2014 in the US alone.  …Between 2010 and 2015, the Financial Action Task Force (FATF), an international group tasked with setting common AML standards across the globe, added over fifty different countries to an internationally-recognized list of high risk countries. …there are growing concerns that this increase in regulatory activity is leading to a chilling effect on cross-border economic activity as banks limit their exposure to high risk clients or jurisdictions, a process known as ‘de-risking’… This contraction of the correspondent banking network has sounded a number of alarm bells, as these services are seen as being crucial for most cross-border services… The ICC survey reported that over 40% of respondents felt that AML and know-your-customer (KYC) requirements were a significant impediment to trade finance, with nearly 70% reporting they declined transactions that year…a large number of money transfer companies in the US, the UK and Australia have lost access to banking services as a result of banks’ desire to reduce their exposure to regulatory risk, potentially leading to a reduction to a decrease in formal remittances to developing countries, a critical source of development finance… The combined effect of all of these pressures should be leading to declines in the aggregate flow of cross-border payments.

…Between 2010 and 2015, the Financial Action Task Force (FATF), an international group tasked with setting common AML standards across the globe, added over fifty different countries to an internationally-recognized list of high risk countries. …there are growing concerns that this increase in regulatory activity is leading to a chilling effect on cross-border economic activity as banks limit their exposure to high risk clients or jurisdictions, a process known as ‘de-risking’… This contraction of the correspondent banking network has sounded a number of alarm bells, as these services are seen as being crucial for most cross-border services… The ICC survey reported that over 40% of respondents felt that AML and know-your-customer (KYC) requirements were a significant impediment to trade finance, with nearly 70% reporting they declined transactions that year…a large number of money transfer companies in the US, the UK and Australia have lost access to banking services as a result of banks’ desire to reduce their exposure to regulatory risk, potentially leading to a reduction to a decrease in formal remittances to developing countries, a critical source of development finance… The combined effect of all of these pressures should be leading to declines in the aggregate flow of cross-border payments.

And here are the results of the new empirical research in the study.

The combination of large scale fines, higher compliance costs and international naming-and-shaming has – anecdotally – led many banks to withdraw from certain lines of business or geographic areas, to the potential detriment of cross-border economic activity. …We find evidence that greylisting by the FATF is consistent with up to a 10% reduction in the number of payments received by an affected country. …Issues of economic impact aside, these results suggest there is more work to be done on assessing both the effectiveness and the efficiency of the global AML/CFT regulatory regime. …First, the reduction in payments received by countries subject to greater regulatory scrutiny raises the spectre of potential losses to these countries. Second, that there is either no effect or a positive effect of FATF greylisting on the number of payments leaving a designated country suggests that increased scrutiny may not do much to prevent illicit money from leaving high risk countries and entering the international financial system at large.

In other words, lots of costs, mostly borne by poor people and poor nations, but no evidence that criminals and terrorists are being stopped.

Rather than imposing lots of red tape and requiring banks to spy on everybody, it would be much better if the government followed normal rules in the fight against crime. By all means, it should investigate real crimes, collect evidence and build cases (within proper limits), and work to punish those who inflict harm on others.

But don’t squander resources in ways that aren’t effective.

Some have suggested that it would make sense to have banks monitor a discrete list of potential bad guys rather than promiscuously spy on all customers.

That might be a step in the right direction, but this story from the UK-based Times shows that this approach leaves something to be desired.

A controversial “blacklist” used by British banks to identify terrorists and potential money launderers has grown so bloated that it includes details of a three-year-old member of the royal family… World-Check, a database of more than two million “high-risk” individuals including criminals and senior politicians, is used by 49 of the world’s 50 biggest banks to carry out compliance checks on existing and potential clients. Customers who are flagged up face extra scrutiny and their accounts…hundreds of individuals were included partly on the basis of unverified blog posts and even far-right or extremist websites.

Wow. Since some of my leftist friends consider International Liberty a “far-right” and “extremist” website, this doesn’t bode well for me. I guess I’m lucky that I still have a bank account.

Here’s more from the story.

Thousands of others were listed on the database, which dates from 2014, only because they were relatives or friends of minor public figures. …Maud Windsor…was listed at nine months old. The apparent justification was that she was a family member of a “politically exposed person” (PEP), a reference to her father, who is the son of Prince Michael of Kent and 43rd in line to the throne. …Other British PEPs on the database include Sir Neil Cossons, a historian and former chairman of English Heritage. …Heather Wheeler, a Conservative MP listed on the database, told parliament this year that her bank of 30 years informed her that she was “high risk” and that it “would not deal with me anymore and that it was closing my account.”

These absurd results are driven by government policies that force financial institutions to treat all customers as potential crooks.

And given the huge fines that are being levied on banks and other firms, you can understand why they drop customers and charge high fees. They are forced to act defensively.

Thomson Reuters, the media company that makes millions of pounds compiling and selling the database, does not inform individuals if they are included and banks have no obligation to tell clients why they have been denied services. …Many financial institutions have become risk-averse… “You have an arms race where there’s this immense pressure to build a ‘robust’ database,” one expert on World-Check said. “They’ll pack this database with as many names of individuals as possible. You end up getting a ton of false positives.”

And some of those “false positives” are mentioned in this video I narrated for the Center for Freedom and Prosperity.

[social-media-buttons]

[brid video=”9365″ player=”2077″ title=”The Failure of AntiMoney Laundering Laws”]

President Donald J. Trump says he wants