A Respectful Appeal to Trump Supporters

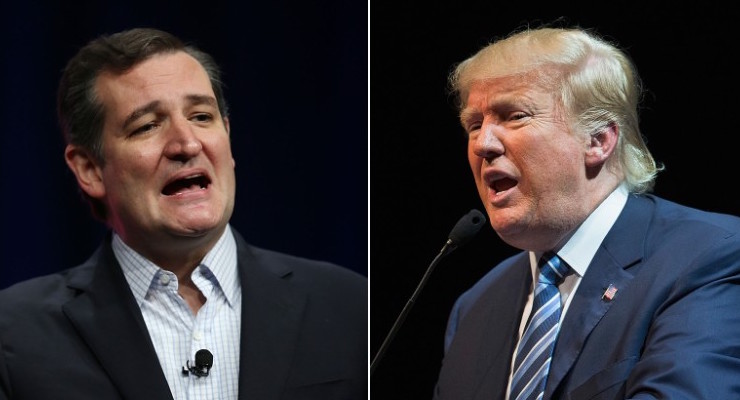

Texas Sen. Ted Cruz, left, and Donald Trump, right. (Photo: AFP/Getty Images)

As a Reagan conservative this is a particularly difficult primary season. We finally have what many of us consider a near-perfect candidate on the issues at a perfect time in our history, but obstacles persist.

Admittedly, it’s not like America got in this desperate condition accidentally. For decades, we have been electing leaders who have been undermining the American dream, and in the last two presidential elections the majority has virtually furnished what could be the final nails in the nation’s coffin.

Thankfully, Obama had reverse coattails. His agenda was decisively rejected in both the 2010 and 2014 congressional elections, which led many of us to believe his policies weren’t popular even if he was.

If there was any doubt about the public angst over the status quo, it has been removed with the rise of Trump on the right and Bernie Sanders on the left. It’s bizarre that some voters’ reaction to the failure of leftist policies is to double-down on them, but I’ve come to expect no less from leftist voters.

Sophisticated analysis aside, it’s clear that the public is mad as hell and is not going to take it anymore.

What a perfect storm for the quintessentially conservative candidate, Sen. Ted Cruz, a freedom lover’s one-man dream team. He’s not just an ideal constitutional conservative; he is perfectly situated to capitalize on the anti-establishment sentiment in the GOP electorate because he has been in the trenches, proving he’ll fight the insiders from within.

Then in rides brash businessman Donald Trump — a wildcard of a political maverick — and sucks all the anti-establishment oxygen out of the politisphere. He apparently has just the right personality, just the right bluster, just the right bravado, and more than enough money and moxie to mesmerize the disenfranchised class — those voters who have seen no evidence that any politician, once elected, has any intention of addressing their concerns.

But is their anger skewing their vision and sabotaging their judgment? They seem to have rallied around Trump because he’s convinced them he would close our borders, rebuild our military, create jobs and, overall, “make America great again.”

But would he? And even if he would, would he inflict other damage?

To the first question my honest answer is: I don’t know. On the second, I think that given his history of supporting liberal causes and politicians and many recent statements betraying an instinct for statist solutions, there’s a good chance he’d inflict damage, on the courts and elsewhere.

Given the alternatives, it would be a reckless decision to bet the survival of the nation I love and my children’s future largely on powerful rhetoric tailored for itching ears. On something so critically important I have to have more assurance than bold promises from a man with — viewed in the most favorable light — a stunningly ambivalent political history.

Meaning no offense, to support Donald Trump for the GOP nomination is a crapshoot — a blind wager based on nothing more than violently shifting sands. How does this make sense when I can choose the real deal in Ted Cruz — a man whose genuine patriotism and constitutional conservatism seep from his very pores, a man who is off-the-charts brilliant and so right on the issues that one’s authenticity as a conservative could be measured, quite literally, by how closely his views conform to Ted’s views and record?

Cruz is a full spectrum Reagan conservative, on economic, defense and social issues. He has concrete plans, not generalities, to unleash economic growth, restructure entitlements and begin reducing the debt, rebuild the military, seal our borders, defeat our terrorist enemies, reform health care, appoint solid, originalist judges and protect our religious liberties and innocent life.

It is tragic that people have concluded that you have to have a person with no experience inside politics to take on the establishment. Under that theory, Donald Trump would immediately become tainted on his first day in office. Additionally, Ted Cruz has actually already fought the establishment — at great cost to himself.

Cruz is the antithesis of a politician with his finger in the wind. He is the one who took on ethanol on the eve of the Iowa election. He took on his entire party in budget fights with President Obama because he promised his constituents he would and because he believes it was the right thing to do.

It’s ironic that Donald Trump, hailed as the anti-establishment savior, has supported and funded establishment and liberal causes much of his adult life, and to this day is getting less opposition from the establishment than bad boy Ted Cruz.

Even though Trump and a number of other Republican candidates have ganged up on Cruz, he has not changed his positions midstream out of political expediency. Even though he’s not the only one whose campaign has been accused of dirty tricks, Cruz is the only one who has apologized for anything and has recently fired his communications director.

I appeal to Trump supporters to reconsider your decision. Why take a risk on the unknown when you have from Ted Cruz an established record of bold, anti-establishment action based on tried and tested policy solutions? Don’t be put off by the label “conservative” just because too many politicians self-identifying as such didn’t deliver. Ted Cruz deserves your consideration precisely because he did. He is also, from all indications, more electable in the general election.

I believe you are patriots and I understand and share your frustration. But I implore you to channel it wisely, judiciously and constructively. If we bet wrong we might not get another chance.

I appeal to Trump supporters to reconsider