Brazil, Big Government and Mitchell’s Theorem of Societal Collapse

Brazilian President Dilma Rousseff told business leaders that the depreciation of the dollar impairs emerging countries’ growth following a 2012 meeting with President Barack Obama at the White House. (Photo: SHFWire/Robin Siteneski)

I remember feeling like an outlier a few years ago when so many people were waxing rhapsodic about a glowing economic outlook for Brazil, Russia, India, China, and South Africa. These so-called BRICS nations were enjoying some decent growth at the time, but I was not optimistic about their long-run prospects because they all suffered from too much statism according to the rankings from Economic Freedom of the World.

Well, the long run has arrived, at least to some degree. All of these nations have hit some serious speed bumps.

I’ve previously written about the economic challenges now being faced by China and South Africa. Today, let’s focus on Brazil.

Here’s some very dismal but accurate analysis from an article in this week’sEconomist (h/t: Tyler Cowen).

By the end of 2016 Brazil’s economy may be 8% smaller than it was in the first quarter of 2014, when it last saw growth; GDP per person could be down by a fifth since its peak in 2010, which is not as bad as the situation in Greece, but not far off. Two ratings agencies have demoted Brazilian debt to junk status. Joaquim Levy, who was appointed as finance minister last January with a mandate to cut the deficit, quit in December. Any country where it is hard to tell the difference between the inflation rate—which has edged into double digits—and the president’s approval rating—currently 12%, having dipped into single figures—has serious problems.

And why is Brazil’s economy is so much trouble?

Two words: Excessive government.

…the federal constitution of 1988… This 70,000-word doorstop of a document crams in as many social, political and economic rights as its drafters could dream up, some of them highly specific: a 44-hour working week; a retirement age of 65 for men and 60 for women. The “purchasing power” of benefits “shall be preserved”, it proclaims, creating a powerful ratchet on public spending. Since the constitution’s enactment, federal outlays have nearly doubled to 18% of GDP; total public spending is over 40%. Some 90% of the federal budget is ring-fenced either by the constitution or by legislation. Constitutionally protected pensions alone now swallow 11.6% of GDP, a higher proportion than in Japan, whose citizens are a great deal older. …government expenditure as a share of output rose in 2015. …Taxes already consume 36% of GDP, up from a quarter in 1991.

Ugh, what a grim set of numbers. Moreover, the pension system is terrible, as we discussed a few months ago.

And here’s some additional analysis from last week’s issue, which also highlights the negative impact of too much government.

Brazil faces political and economic disaster. …Ms Rousseff and her left-wing Workers’ Party (PT) have made a bad situation much worse. During her first term, in 2011-14, she spent extravagantly and unwisely on higher pensions.. The minimum benefit is the same as the minimum wage, which has risen by nearly 90% in real terms over the past decade. Women typically retire when they are 50 and men stop work at 55, nearly a decade earlier than the average in rich countries… A typical manufacturing firm spends 2,600 hours a year complying with the country’s ungainly tax code; the Latin American average is 356. Labour laws modelled on those of Mussolini make it expensive for firms to fire even incompetent employees. ….Because it is so hard to reform, Brazil’s public sector rivals European welfare states for size but emerging ones for inefficiency. Long a drain on economic vitality, Brazil’s overbearing state is now a chief cause of the fiscal crisis.

All this sounds very grim, but I’m going to argue that it’s even worse than it sounds.

In part, the problems are similar to what is found in so many nations facing economic challenges.

First, government is growing faster than the private sector. The fact that government spending now consumes twice as much of the economy’s output today as it did back in 1988 means that politicians have been repeatedly (and vigorously!) violating my Golden Rule.

Second, there’s too much government intervention. A nation that models any of its policies on Mussolini-style fascism obviously is making a big mistake since the net result is an economy burdened by corrupt cronyism (sadly, a common problem in Latin America).

But there’s another reason to be down on Brazil, and it is far more discouraging.

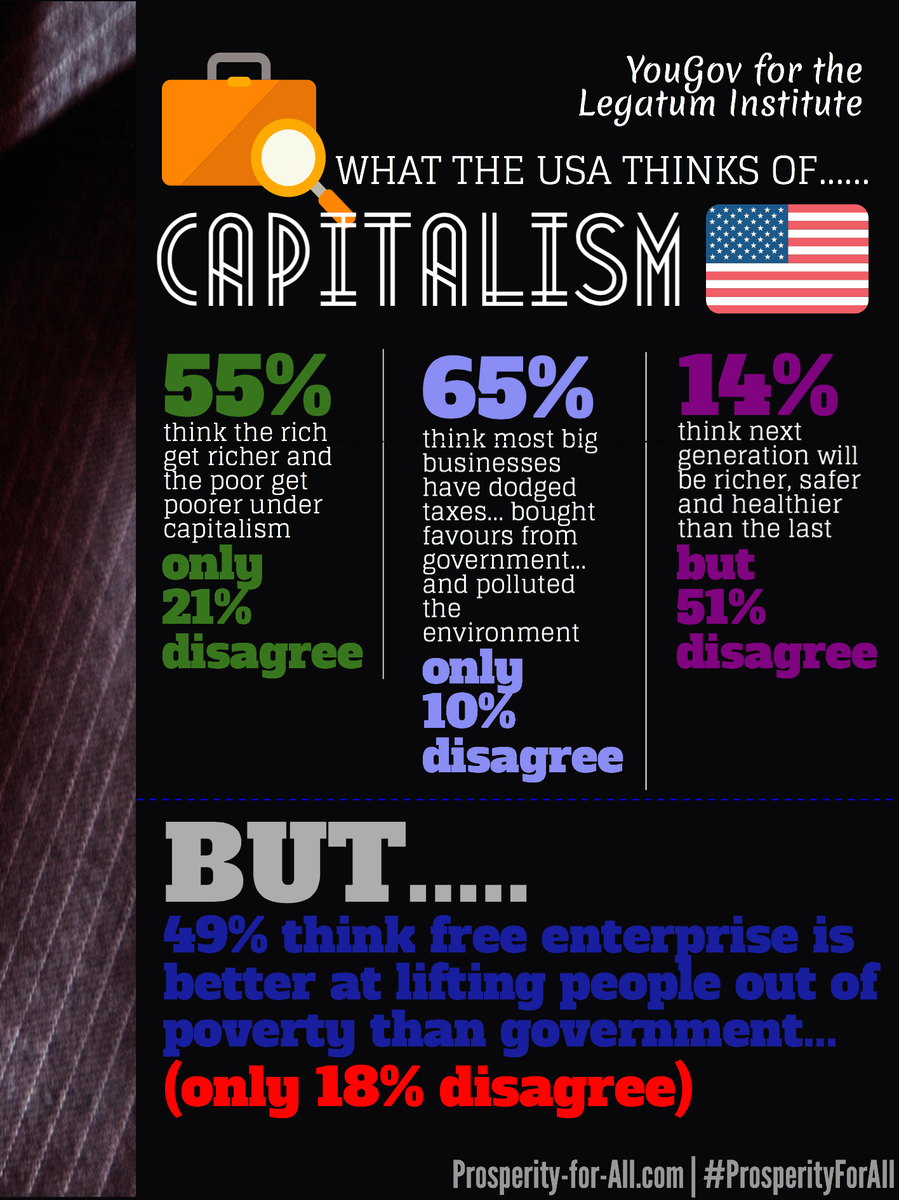

Third, the social capital of the country has been eroded. Simply stated, there are too many people–as data from the 2014 election reveal–who view government as a vehicle for personal (and unearned) enrichment.

And when this third problem develops, it’s all but certain that a nation is doomed. After all, many nations have reversed bad fiscal policy. And many nations have reduced government intervention. But fixing the culture of a people is like putting toothpaste back in a tube.

Indeed, I’m going to augment my list of pithy adages. In addition to Mitchell’s Golden Rule and Mitchell’s Law, we not have Mitchell’s Theorem of Societal Collapse.

Like my other adages, I’m not pretending there’s any original insight. In this case, I’ve simply come up with a different way of saying the line attributed (erroneously, from what I can tell) to either Benjamin Franklin or Alexis de Tocqueville: “A democracy cannot exist as a permanent form of government. It can only exist until the voters discover that they can vote themselves largesse from the public treasury. ”

P.S. I’m worried about the degree to which America has traveled down the path toward societal decay, but I don’t think we’ve yet reached a tipping point.

P.P.S. While I’m not a fan of Brazilian economic policy, I actually defended that nation when Hillary Clinton applauded Brazil for being more statist than it actually is.

P.P.P.S. Being less statist than Hillary is not exactly something to brag about, so I will note that Brazil deserves credit for moving in the right direction on gun rightsand also having some semi-honest left-wing politicians.

P.P.P.P.S. Let’s end, however, with some bad news. Recall from above that Brazil has a very statist constitution. Well, it’s always possible to make a bad thing even worse. And that’s what some Brazilian politicians are trying to do with a proposal to have government somehow create a “right to happiness.”

Brazil and its economy are now suffering