U.S. Economy Adds 661,000 Jobs in September, Unemployment Falls to 7.9%

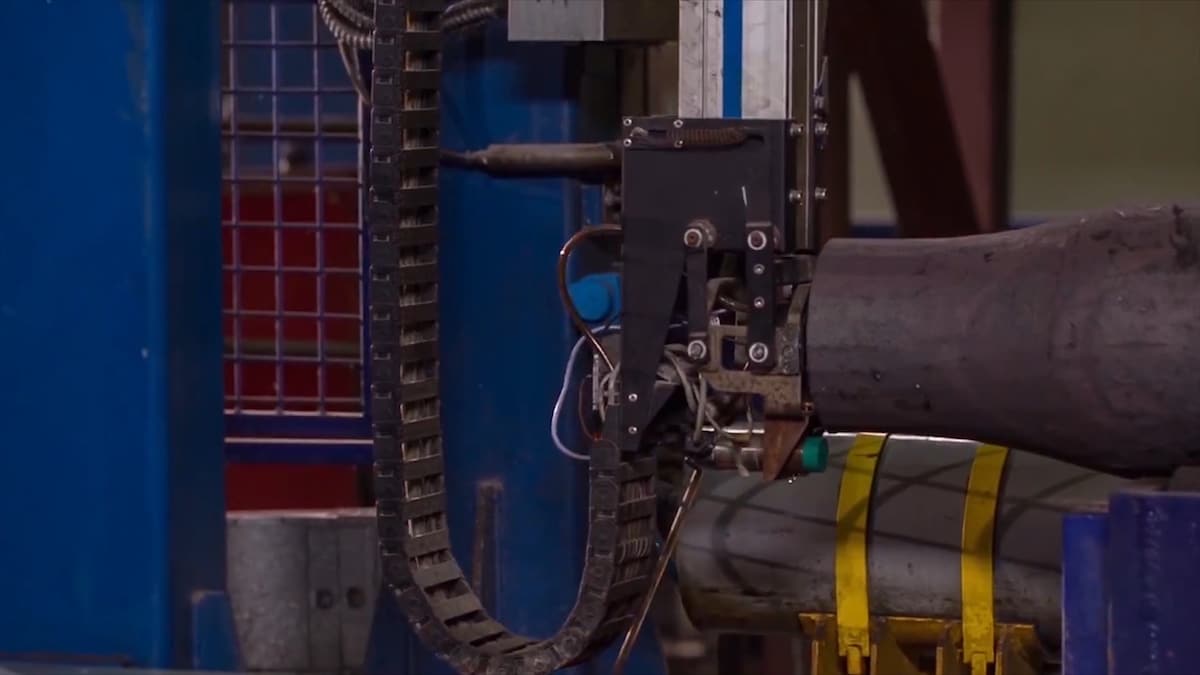

Manufacturing Employment Proves Bright Spot, Adding Double the Forecast

Washington, D.C. (PPD) — The U.S. Bureau of Labor Statistics (BLS) monthly jobs report finds the U.S. economy added 661,000 jobs in September and the unemployment rate fell more than expected to 7.9%.

Forecasts for total nonfarm employment ranged from a low of 400,000 to a high of 1,500,000. The consensus was 894,000. Forecasts for the unemployment rate ranged from a low of 7.1% to a high of 8.6%. The consensus forecast was 8.2%.

Manufacturing employment gained 66,000 jobs in September. Durable goods accounted for about two-thirds of it, fueled by motor vehicles and parts (+14,000) and machinery (+14,000). Forecasts ranged from a low of 20,000 to a high of 50,000. The consensus forecast was only 33,000.

While manufacturing has posted large gains over the past 5 months, it is still 647,000 below pre-Covid level. Regional factory activity surveys from Texas to Philadelphia have shown the highest numbers since 2018, indicating the sector is well on its way to recovery.

The labor force participation rate fell 0.3 to 61.4%, missing the forecast. Forecasts ranged from a low of 61.5% to a high of 61.9%. The consensus forecast was 61.8%. The less-cited employment-population ratio ticked slightly higher to 56.6%.

In August, average hourly earnings for all employees on private nonfarm payrolls was $29.47. Average hourly earnings of private-sector production and nonsupervisory employees was $24.79. Wage growth on the 12-month was a very solid 4.7%.

Forecasts for 12-month wage growth ranged from a low 4.5% to a high of 4.9%. The consensus was 4.8%. Wage growth was 4.7% in September.

The change in total nonfarm payroll employment for July was revised up by 27,000, from +1,734,000 to +1,761,000, and the change for August was revised up by 118,000, from +1,371,000 to +1,489,000.

With these revisions, employment in July and August combined was 145,000 more than previously reported.

U-6 is an alternative measure of unemployment defined as the rate for total unemployed, plus all marginally attached workers and total employed part time for economic reasons as a percent of the total civilian labor force, plus all marginally attached workers. In September, the U-6 rate fell significantly to 12.8% and has fallen 10.0% over the last five months.

The monthly jobs report finds the U.S.