Greek Prime Minister Alexis Tsipras speaks with the media after a meeting of eurozone heads of state at the EU Council building in Brussels on Monday, July 13, 2015. A summit of eurozone leaders reached a tentative agreement with Greece on Monday for a bailout program that includes “serious reforms” and aid, removing an immediate threat that Greece could collapse financially and leave the euro. (AP Photo/Geert Vanden Wijngaert)

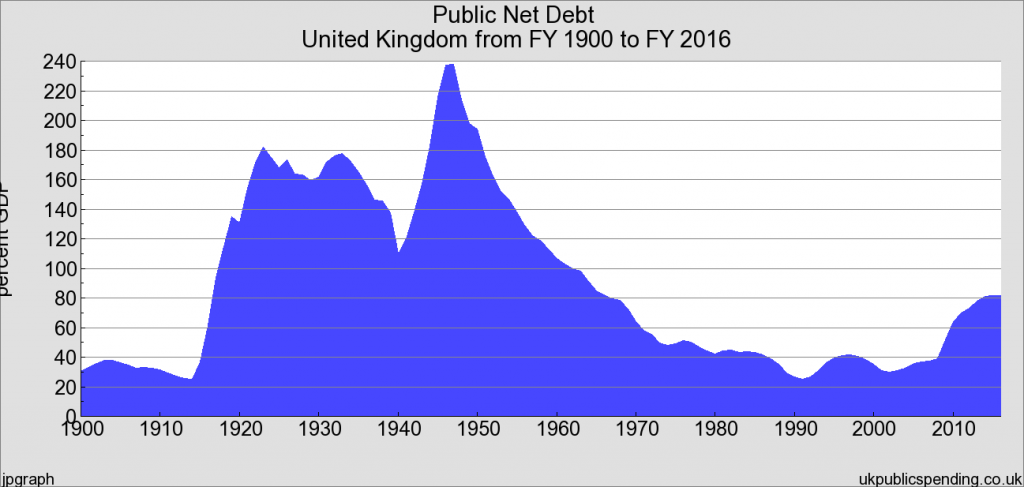

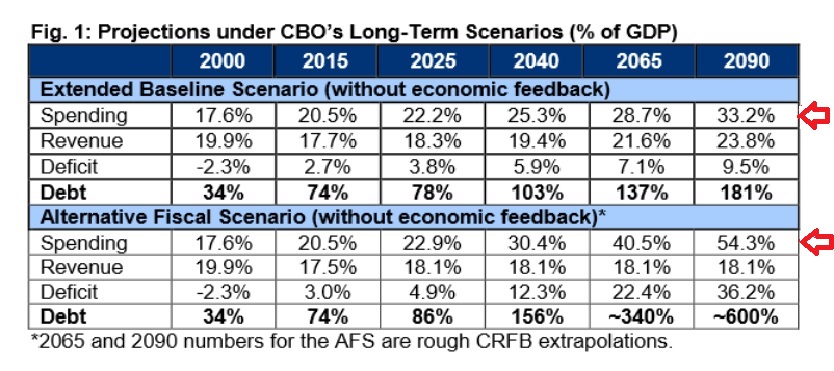

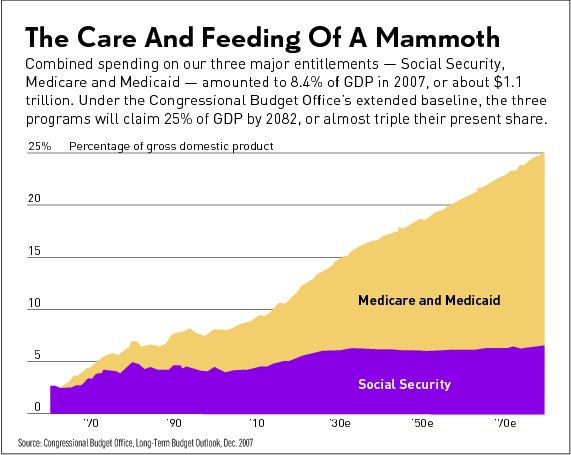

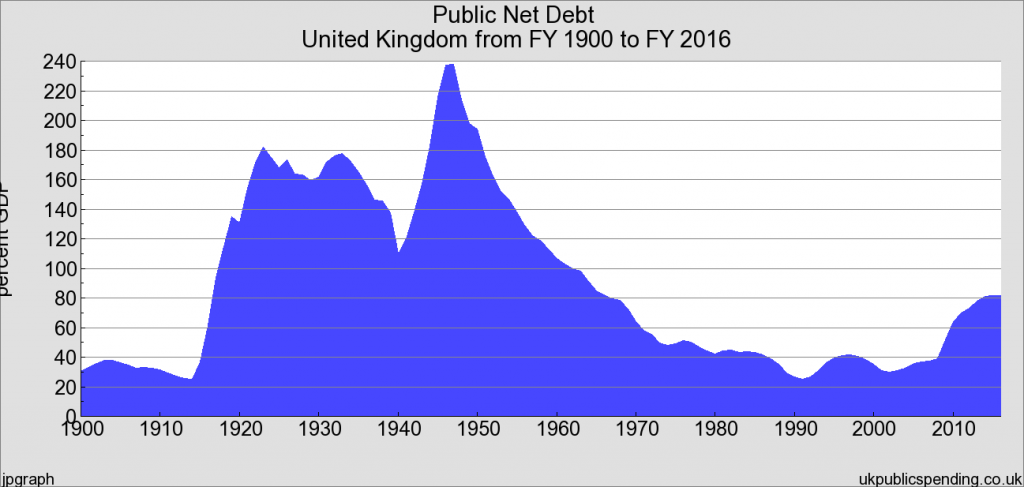

I wrote last month that the debt burden in Greece doesn’t preclude economic recovery. After all, both the United States and (especially) the United Kingdom had enormous debt burdens after World War II, yet those record levels of red ink didn’t prevent growth.

Climbing out of the debt hole didn’t require anything miraculous. Neither the United States nor the United Kingdom had great economic policy during the post-war decades. They didn’t even comply with Mitchell’s Golden Rule on spending.

But both nations managed to at least shrink the relative burden of debt by having the private sector grow faster than red ink. And the recipe for that is very simple.

…all that’s needed is a semi-sincere effort to avoid big deficits, combined with a semi-decent amount of economic growth. Which is an apt description of…policy between WWII and the 1970s.

Greece could achieve that goal, particularly if politicians would allow faster growth. The government could reduce red tape, which would be a good start since the nation ranks a miserable #114 for regulation in Economic Freedom of the World.

But Greece also should try to reverse some of the economy-stifling tax increases that have been imposed in recent years.

That may seem a challenge considering the level of red ink, but good tax policy would be possible if the Greek government was more aggressive about reducing the burden of government spending.

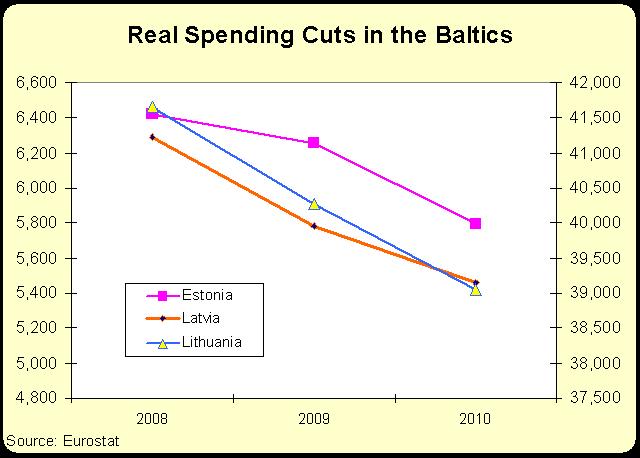

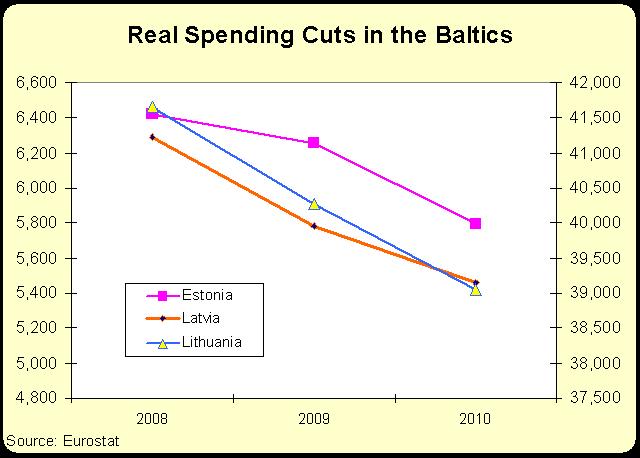

And if that’s the goal, then the Baltic nations are a good role model, as explained by Anders Aslund in the Berlin Policy Journal. With Latvia being the star pupil.

…austerity policies have not been attempted most aggressively in Greece: all three Baltic countries pursued more aggressive fiscal adjustments, especially Latvia. The Latvian government faced the global financial crisis head-on. …The Latvian government carried out a fiscal adjustment of 8.8 percent of GDP in 2009 and 5.9 percent of GDP in 2010, amounting to a fiscal adjustment of 14.7 percent of GDP over the course of two years, totaling 17.5 percent of GDP over four years, according to IMF calculations. Greece did the opposite. According to the IMF, its fiscal adjustment in the initial crisis year of 2010 was a paltry 2.5 percent of GDP, and in 2011 only 4.1 percent, a total of only 6.6 percent of GDP over two years. Greece’s total fiscal adjustment over four years was only 11.1 percent of GDP.

In other words, Latvia (like the other Baltic nations) did more reform and did it faster. And it’s also worth noting that the reforms were generally the right kind of austerity, meaning that expenditure commitments were reduced. Whereas Greece has implemented some expenditure reforms, but has relied far more on tax increases.

Better policy, not surprisingly, meant better results.

In 2008-10 Latvia suffered an output decline of 24 percent, as much as Greece did in the six-year span from 2009-14. However, thanks to its front-loaded fiscal adjustment, Latvia was able to restore its public finances after two years. The country has shown solid economic growth, averaging 4.3 percent per year from 2011-14, according to Eurostat. …The consequences of tepid Greek fiscal stabilization have been a devastating six years of declining output, even as the Latvian economy has revived. In 2013 Latvia’s GDP at constant prices was 4 percent lower than in 2008, while Greece’s was 23 percent less than in 2008, according to the IMF. A cumulative difference in GDP development of 19 percentage points over six years cannot be a statistical blip – it is real.

The bottom line is that Latvia and the other Baltics were willing to endure more short-term pain in order to achieve a quicker economic rebound.

That was a wise choice, particularly since the alternative, as we see in Greece, is seemingly permanent stagnation.

Anders Paalzow of the Stockholm School of Economics in Riga also suggests, in a recent article in Foreign Affairs, that Latvia is a good role model.

Professor Paalzow starts by explaining that Latvia is now enjoying good growth after enduring a dramatic boom-bust cycle last decade.

In 2008, Europe’s most overheated economy, which had been fuelled by cheap credit and rapidly raising wages and real estate prices, collapsed. GDP dropped by 20 percent and unemployment rose to more than 20 percent. But here’s where things take an unexpected turn. By late 2010, the first glimmers of recovery became apparent. Today, the economy is among Europe’s fastest growing, and its GDP is back at pre-crisis levels. So how did Latvia, the hero of this story, do it?

The first thing to understand is that Latvia was determined to join the eurozone, so that meant it wasn’t going to devalue its currency in hopes of inflating away its problems. Which meant the only other choice was “internal devaluation.”

…the Latvian government’s only real option was fiscal policy adjustment, the details of which it unveiled in its supplementary budget for 2009 and its budget for 2010. Both of these saw substantial reductions in social benefits accompanied by long overdue cuts in public employment with close to 30 percent of civil servants laid off. Those who remained in the public sector saw their salaries cut by 25 percent, on average, whereas salaries in the private sector fell by on average ten percent. …the reductions made during the crisis years amounted to approximately 11 percent of GDP. Most of the fiscal consolidation was done on the expenditure side of the public budget… The fiscal consolidation program continued into 2011 and the years following, even though the economy started to grow again.

Not only did the economy grow, but the government was rewarded for making tough choices.

…in 2010, the government responsible for austerity was reelected.

But here’s the challenge. Professor Paalzow warns that fiscal reforms won’t mean much unless the chronic dysfunction of the Greek government is somehow addressed.

The importance of the institutional framework cannot be overestimated. …it seems like a fool’s errand to try to sell off the public assets of a country riddled with high corruption… Furthermore, with a legal system incapable of enforcing current legislation and characterized by slow judicial processes, inefficient courts, and weak investor protection, legal reform will be a necessary condition for an economic turnaround.

So he suggests that Latvian-type fiscal reforms should be accompanied by Nordic-style institutional reforms.

Greece should look further north to Finland and Sweden, which overcame their own crises in the early 1990s. …The three to four years following the initial economic disaster saw remarkable institutional reform…substantial changes in both welfare systems. …both countries pursued austerity…, a remedy that both nations had frequently tried in the 1970s and 1980s without any success. What made the difference this time was that the institutional, and hence the fundamental roots, of the problems were addressed.

While I like his prescription, I suspect Paalzow is being too optimistic.

You can’t turn the Greeks into Finns or Swedes, at least not without some sort of massive jolt.

Which is why my preferred policy is to end bailouts, even if it means that Greece repudiates its existing debt. If the Greeks no longer got any handouts, that necessarily would mean an immediate end to deficit spending (assuming the government doesn’t ditch the euro in order to finance spending by printing drachmas).

And that might be a very sobering experience that would teach the Greek people about the dangers of having too many people trying to ride in the wagon of government dependency.

And that might be a very sobering experience that would teach the Greek people about the dangers of having too many people trying to ride in the wagon of government dependency.

That might not turn the Greeks into Nordics, but it presumably would help them understand that you can’t (at least in the long run) consume more than you produce.

That’s also a lesson that some American politicians need to learn!

P.S. I wonder if Paul Krugman will attack Latvia’s good reforms. When he went after Estonia for adopting similar policies, he wound up with egg on his face.

[mybooktable book=”global-tax-revolution-the-rise-of-tax-competition-and-the-battle-to-defend-it” display=”summary” buybutton_shadowbox=”true”]

Gee, what a surprise. With Uncle Sam picking up the tab,

Gee, what a surprise. With Uncle Sam picking up the tab,

The WSJ compares Obama’s six-year “expansion” with the growth of the economy after six years of expansion in the 1980s and 1990s.

The WSJ compares Obama’s six-year “expansion” with the growth of the economy after six years of expansion in the 1980s and 1990s.